Stablecoins are often considered capital that can fuel the rise of Bitcoin and altcoins in the cryptocurrency market. The total market capitalization of stablecoins in June continues to break records.

However, the inflow of stablecoins into centralized exchanges (CEX) is showing signs of decrease.

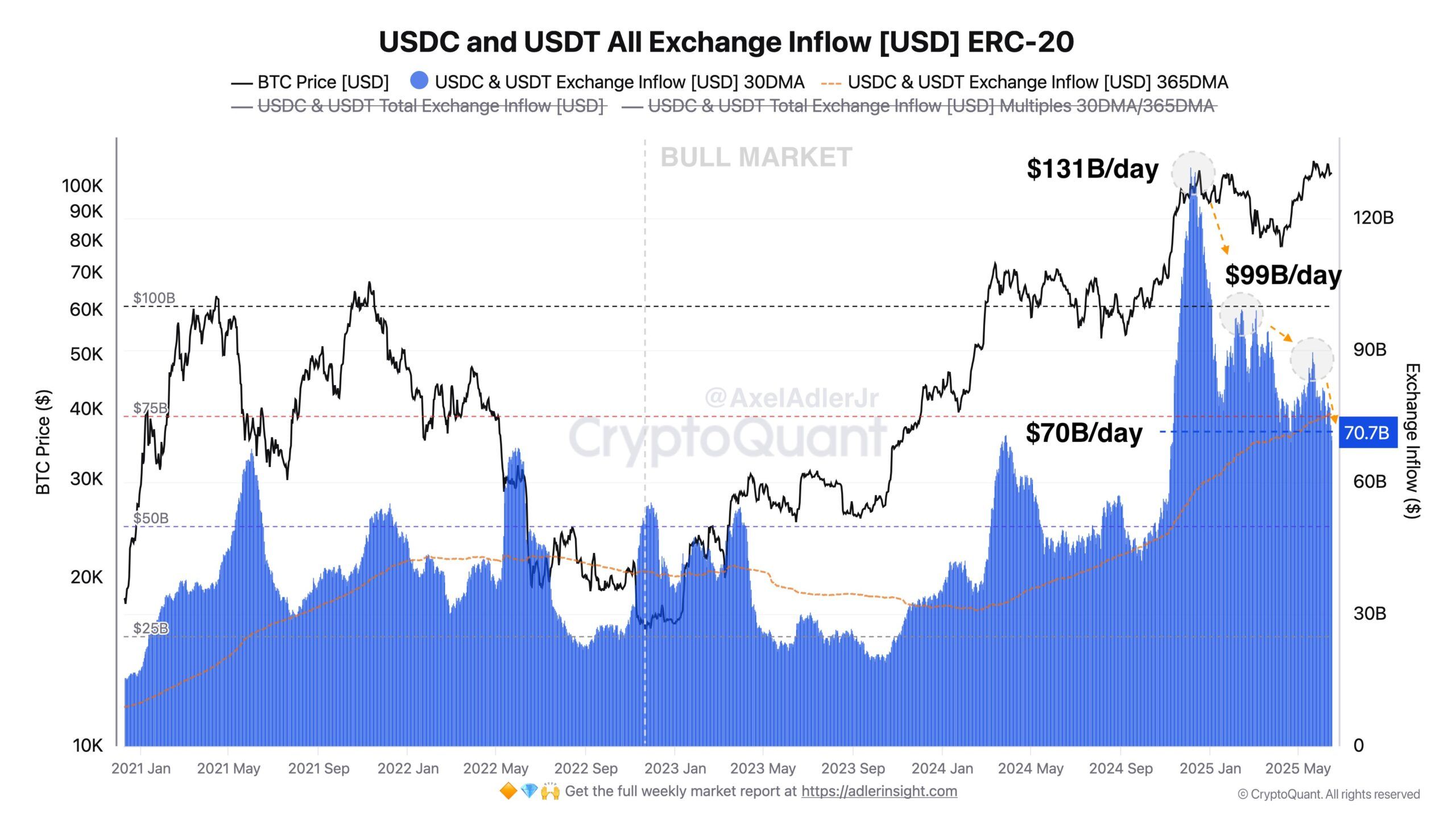

Daily $7 billion of USDT and USDC flowing into CEX

Analyst Axel Adler Jr. explained using Cryptoquant data that in December 2024, when Bitcoin was trading between $98,000 and $100,000, the daily exchange inflow of USDT and USDC reached a peak of $131 billion.

In June 2025, this figure dropped to $7 billion daily. While this represents a sharp 30% decrease, it is still much higher than the inflows from 2021 to 2024.

This change may reflect a more cautious investment sentiment. Bitcoin is trading near its all-time high, and global geopolitical tensions are increasing uncertainty. Nevertheless, the current stablecoin inflow remains substantial, suggesting that investors have not abandoned their optimistic expectations.

"This decline reflects a natural cooling of excessive bullish momentum, while BTC maintaining above $100,000 signals that market participants are willing to maintain positions and limit selling. We are currently witnessing a stage of consolidation and base building ahead of the next move," Axel Adler Jr. said.

Axel's perspective suggests Bitcoin is in a sideways phase while waiting for the next major movement.

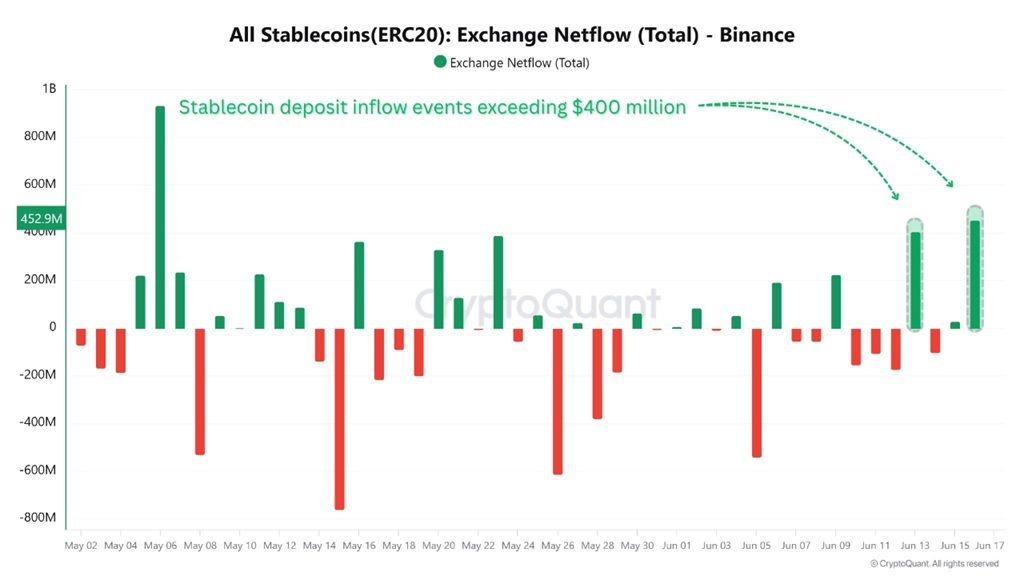

Short-term optimism due to Binance inflow surge

Looking at short-term trends, analyst Amr Taha notes that stablecoin inflows to Binance have been increasing again. He emphasizes that the net stablecoin inflow to Binance in the second week of June exceeded $400 million over several days, a significant increase compared to early May.

Additionally, on June 16, Binance recorded a large Bitcoin net outflow of approximately 4,500 BTC in a single day.

Combining these two signals, Amr suggests that Bitcoin may be on the verge of a potential breakout.

"The aggressive Bitcoin withdrawals concurrent with stablecoin deposits are creating an asymmetry of supply and demand. As the number of Bitcoins supplied to exchanges decreases and liquidity increases, the stage is set for a potential price breakout," Amr Taha predicted.

Stablecoin Market Cap Breaks June Record

According to defillama, the total stablecoin market cap in June surpassed $251 billion.

Tether (USDT) alone has exceeded a market cap of $155 billion. Recently, Tether has been issuing USDT at an accelerating pace. According to Cryptoquant analysis, in 2025 so far, there have been 17 issuances of over 1 billion USDT on TRON (TRC-20).

With stablecoin market cap rising and exchange inflows remaining robust, investors appear to be waiting for signals strong enough to alleviate current concerns and potentially trigger massive buying of Bitcoin and altcoins.