The cryptocurrency market is a high-volatility environment where highs and lows change rapidly within a day. By tracking tokens that have set new ATH (all-time high) or ATL (all-time low), one can detect bullish and bearish trends early. Based on tokens with a market capitalization of over $10 million, this article summarizes the main tokens that have set new highs or lows within a day and analyzes the market recovery potential and trends by examining the adjustment rates of top market cap tokens and real-time domestic popular assets. [Editor's Note]

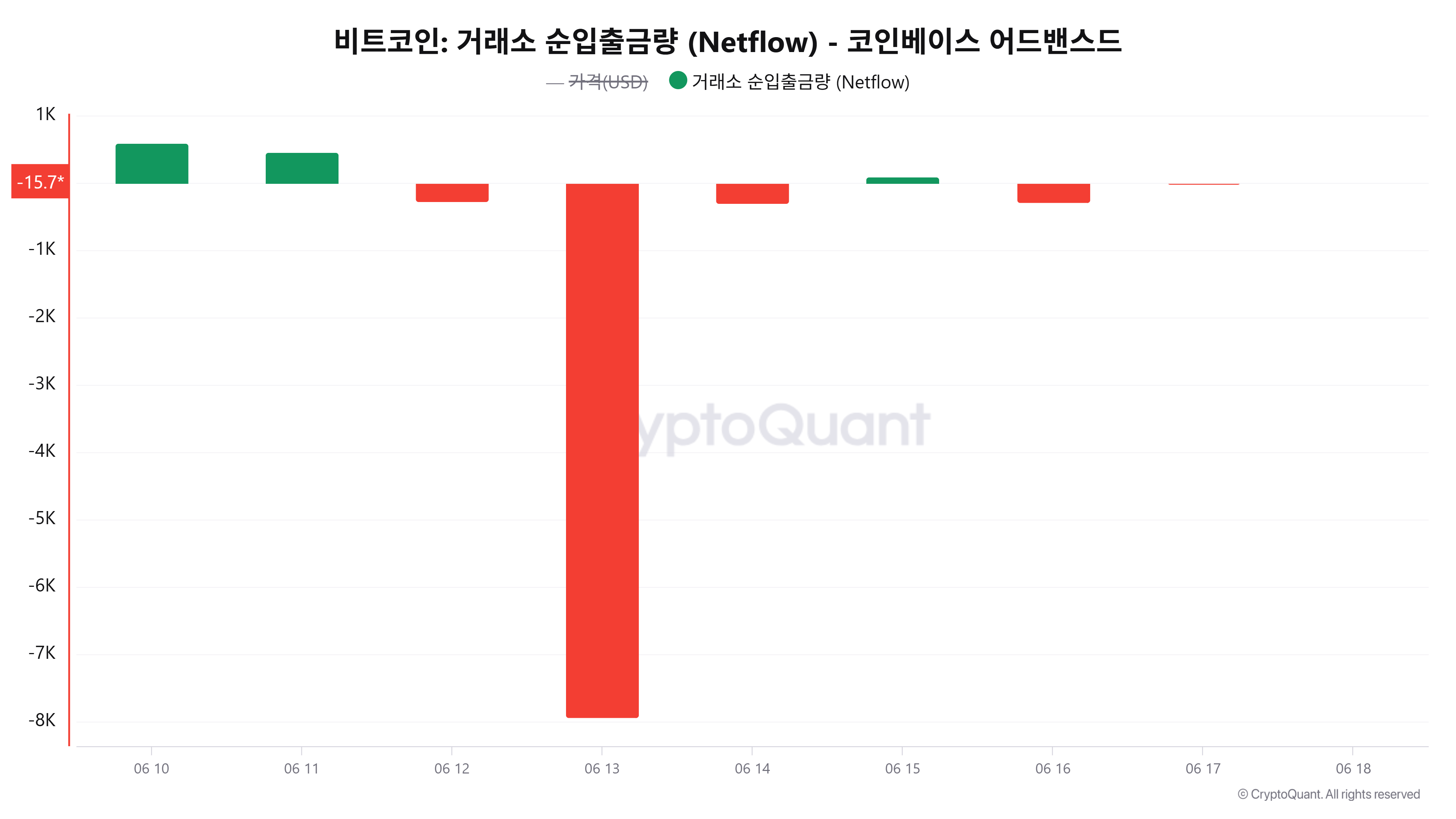

According to CryptoQuant data, Coinbase's Bitcoin netflow on June 17 was -15.79 BTC, significantly reducing the outflow scale compared to the previous day (-286.30 BTC). This suggests that the long-term holding movement to external wallets has somewhat slowed down.

Looking at the trend over the past week, ▲13th -7932.73 BTC ▲14th -298.08 BTC ▲15th +92.76 BTC ▲16th -286.30 BTC ▲17th -15.79 BTC, showing a mixed flow of significant outflows and temporary inflows, reflecting complex holding and profit-taking sentiments.

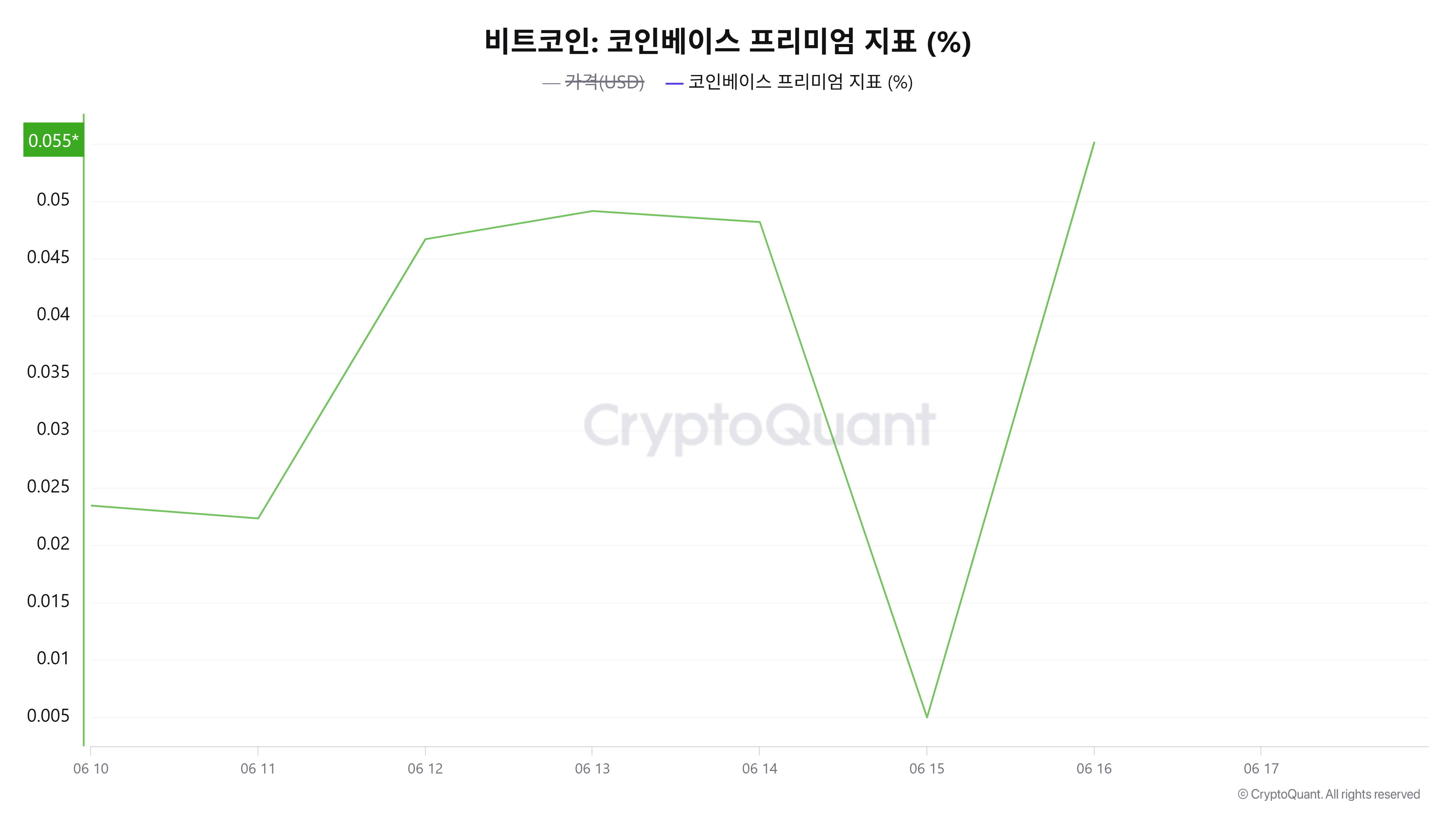

The Coinbase Premium was 0.0551% as of June 16. Rising from 0.0049% the previous day (15th), it showed a somewhat recovered buying sentiment among US investors.

This indicator represents the price difference between the US-based exchange Coinbase and the global exchange Binance for Bitcoin, and a positive value is interpreted as a signal of relatively strong buying pressure in the US.

This rebound is a gradual expansion since recording 0.0223% on the 11th, supporting the scenario of short-term price recovery and renewed US demand. However, the increase is still limited, and further assessment is needed based on its sustainability.

As of June 16, Coinbase Prime's Bitcoin trading volume was approximately 5952.98 BTC. This is about a 245.5% increase from the previous day (15th) of 1722.81 BTC. In dollar terms, it expanded from $196.33 million on the 15th to $676.96 million on the 16th, approximately 3.45 times.

The significant one-day surge in trading volume in the institutional OTC market suggests strong buying pressure. It represents a resumption of large trades after a week of wait-and-see attitude, particularly interpreted as strategic buying related to structured products or ETF-linked demand.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>