According to the latest CoinShares report, cryptocurrency inflows reached $1.9 billion last week, showing investors' strong confidence even amid heightened geopolitical risks.

This marks the ninth consecutive week of inflows, setting a new annual (YTD) record of $13.2 billion.

Cryptocurrency Inflows of $1.9 Billion Recorded Amid Escalating Middle East Tensions

Despite escalating tensions in the Middle East, including Israel's retaliatory attack on Iran and North Korea's promise of military support, the cryptocurrency market is showing a surprising recovery.

James Butterfill, Research Head at CoinShares, wrote, "Digital assets recorded an additional $1.9 billion in inflows, ignoring geopolitical tensions."

This recovery is particularly noteworthy considering the volatility at the beginning of the week. Just three days ago, BeInCrypto reported that the cryptocurrency market lost over $1 billion due to Israel's strike on Iranian military targets.

During the same period, investors seeking safe assets amid uncertainty saw gold rising at a higher rate than Bitcoin.

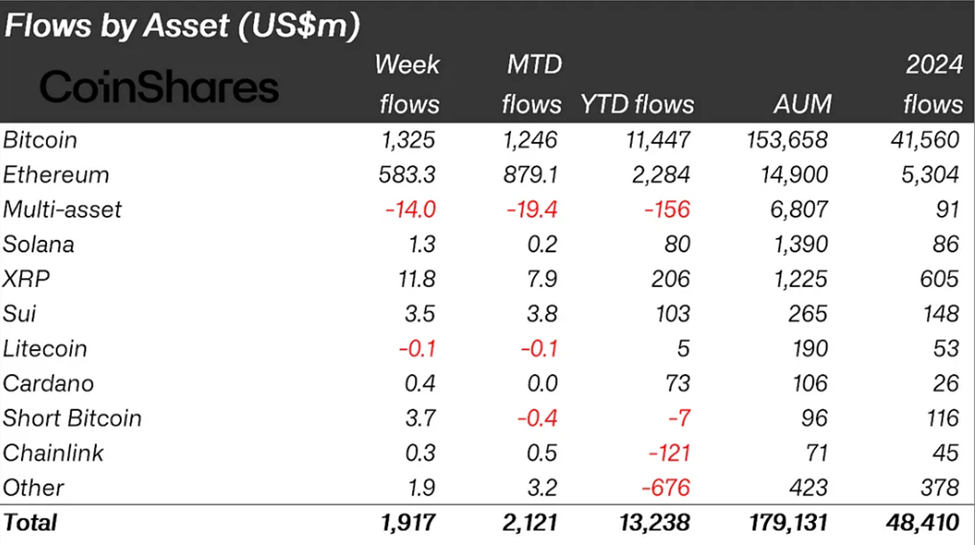

Nevertheless, the overall cryptocurrency trend appears unshaken. Bitcoin recorded inflows of $1.3 billion after two weeks of slight outflows, suggesting investors are buying the dip amid war-related volatility.

Ethereum also showed strength with inflows of $583 million, its largest weekly increase since February. The current inflows amount to $2 billion, or 14% of AUM.

The chart shows investors' enthusiasm has also extended to altcoins. Ripple received $11.8 million in inflows, ending three consecutive weeks of capital outflows. Sui attracted $3.5 million in new funds.

Regionally, the United States led with $1.9 billion in inflows, followed by Germany ($39.2 million), Switzerland ($20.7 million), and Canada ($12.1 million).

However, outflows were recorded in Hong Kong ($56.8 million) and Brazil ($8.5 million), indicating ongoing regional uncertainties.

Last week's cryptocurrency inflows continue the positive trend of capital inflows into digital asset investment products. In the previous three weeks, cryptocurrency inflows were $224 million, $286 million, and $3.3 billion respectively.

Bitcoin and Ethereum Take the Lead Despite Inflation and War Risks

The steady inflow of funds during global tensions shows cryptocurrency investors are showing resilience. Despite fear trading, institutions are returning to cryptocurrencies, especially Bitcoin and Ethereum.

However, the background remains unstable. Oil price increases due to Middle East conflicts could trigger inflation. JP Morgan recently warned that if Israel launches a full-scale attack on Iran, US Consumer Price Index (CPI) inflation could surge to 5%, with oil prices potentially reaching $120 per barrel.

JP Morgan said an attack on Iran could spike oil prices to $120, driving US CPI to 5%

— Cheddar Flow (@CheddarFlow) June 13, 2025

Crude is sitting in the mid-70's right now

This could threaten the current market expectation that the Federal Reserve will begin rate cuts by September.

Generally, rate increases unfavorable to Bitcoin strengthen liquidity and increase borrowing costs, weakening the value of risky assets.

These inflation concerns are adding complexity to recent cryptocurrency price movements. While Bitcoin prices briefly dropped on war news, the subsequent inflows suggest many investors view digital assets as a long-term hedge against inflation and geopolitical instability.

The data of nine consecutive weeks of inflows, totaling $13.2 billion annually, shows that while the cryptocurrency market is not free from macro risks, it is increasingly recognized as part of a global flight to hard assets alongside gold during crises.