Bitcoin trading volume has generally decreased across major time zones in Asia, Europe, and the United States, while the Bitcoin balance in exchanges increased slightly over a day. With the simultaneous decrease in trading volume and inflow of balances, market participants continue to maintain a short-term wait-and-see attitude.

According to CoinGlass as of the 16th, the total Bitcoin balance of major global exchanges was approximately 2,084,419.18 BTC.

A net inflow of +389.62 BTC occurred over a day, while a net outflow of -8,399.08 BTC was recorded over the past week, and a net outflow of -80,974.82 BTC over the past month.

Coinbase Pro holds 637,848 BTC, still maintaining the largest Bitcoin balance. A net inflow of +122.97 BTC was recorded daily, but weekly -7,798.20 BTC and monthly -32,272.33 BTC show a continued long-term outflow trend.

Binance holds 547,788 BTC. Daily -577.09 BTC and weekly -5,828.97 BTC show a continuing outflow trend. In contrast, a monthly net inflow of +10,106.84 BTC was observed.

Bitfinex holds 378,388 BTC, maintaining a daily net inflow of +335.66 BTC and weekly +4,904.39 BTC. A monthly net outflow of -21,679.09 BTC was recorded.

Largest Daily Net Inflow ▲Bitfinex (+336 BTC) ▲Bybit (+221 BTC) ▲Gate (+180 BTC)

Largest Daily Net Outflow ▲Binance (-577 BTC) ▲Kraken (-68 BTC) ▲Gemini (-45 BTC)

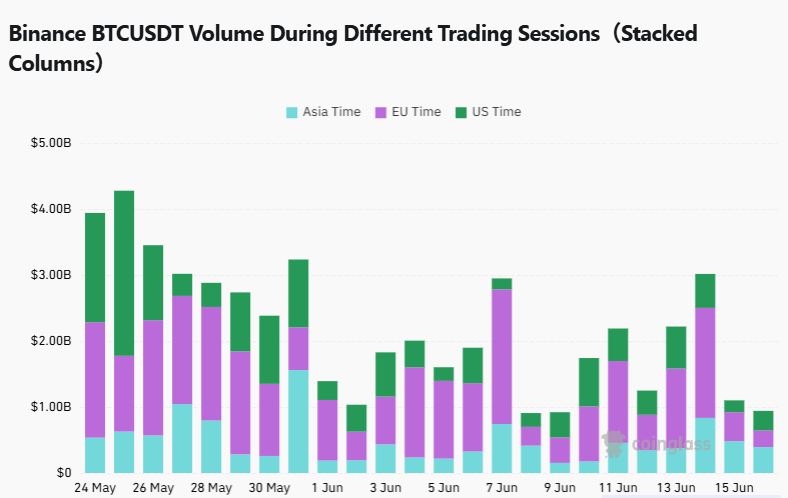

According to CoinGlass, Binance BTCUSDT trading volume on June 15th was $392.55 million in the Asian time zone, $252.57 million in the European time zone, and $296.23 million in the US time zone.

Compared to the previous day (June 14th), Asian (-18.7%) and European (-42.4%) markets saw significant volume decreases, while the US market (+64.9%) showed an increase.

Especially when compared to two days ago on the 13th, all regions - Asia (-52.9%), Europe (-84.9%), and the US (-42.4%) - showed a clear trading contraction, reflecting the overall market's wait-and-see sentiment. After a short-term rebound on the 14th, liquidity decreased again on the 15th, raising caution about price recovery.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>