Source: Token Dispatch

Original Title: The DIY Blockchain Trend

Compiled and Organized by: BitpushNews

Have you ever experienced this? Initially, you simply bought a few Philips Hue smart light bulbs out of pure intention, as they claimed to be the best. The application interface was cool, the colors were fantastic, and you felt like a tech wizard who could dim the lights with your phone, which was incredibly awesome.

Then, you thought thermostats should also be smart, and since Nest had the best AI, you bought it too. Different applications, different accounts, but no big deal, just one more.

Before you knew it, you were caught in chaos.

Your Ring doorbell doesn't talk to your Alexa speaker, the speaker can't control your Apple HomeKit garage door, and the garage door can't communicate with your Samsung SmartThings hub. You need four different applications to turn on lights, adjust temperature, and lock doors. Each company promises you a "seamless smart home experience".

But somehow, the house you live in has become more "stupid" than before, because of the many "applications".

Are Circle and Stripe about to do the same thing in the crypto world?

In August 2025, two heavyweight news stories broke.

First, the $50 billion payment giant Stripe announced a collaboration with crypto venture capital firm Paradigm to build a "high-performance, payment-centric" blockchain called Tempo.

A day later, Circle, which holds $67 billion in USDC stablecoin, also announced the Arc plan, a native Layer 1 blockchain designed specifically for stablecoin payments, foreign exchange, and capital markets.

[The rest of the translation follows the same professional and accurate approach, maintaining the specific blockchain and crypto terminology translations as specified in the initial instructions.]Reflecting on my smart home chaos, each company has reasonable technological choices. But the true driving force is often their unwillingness to rely on others' platforms or pay fees to competitors.

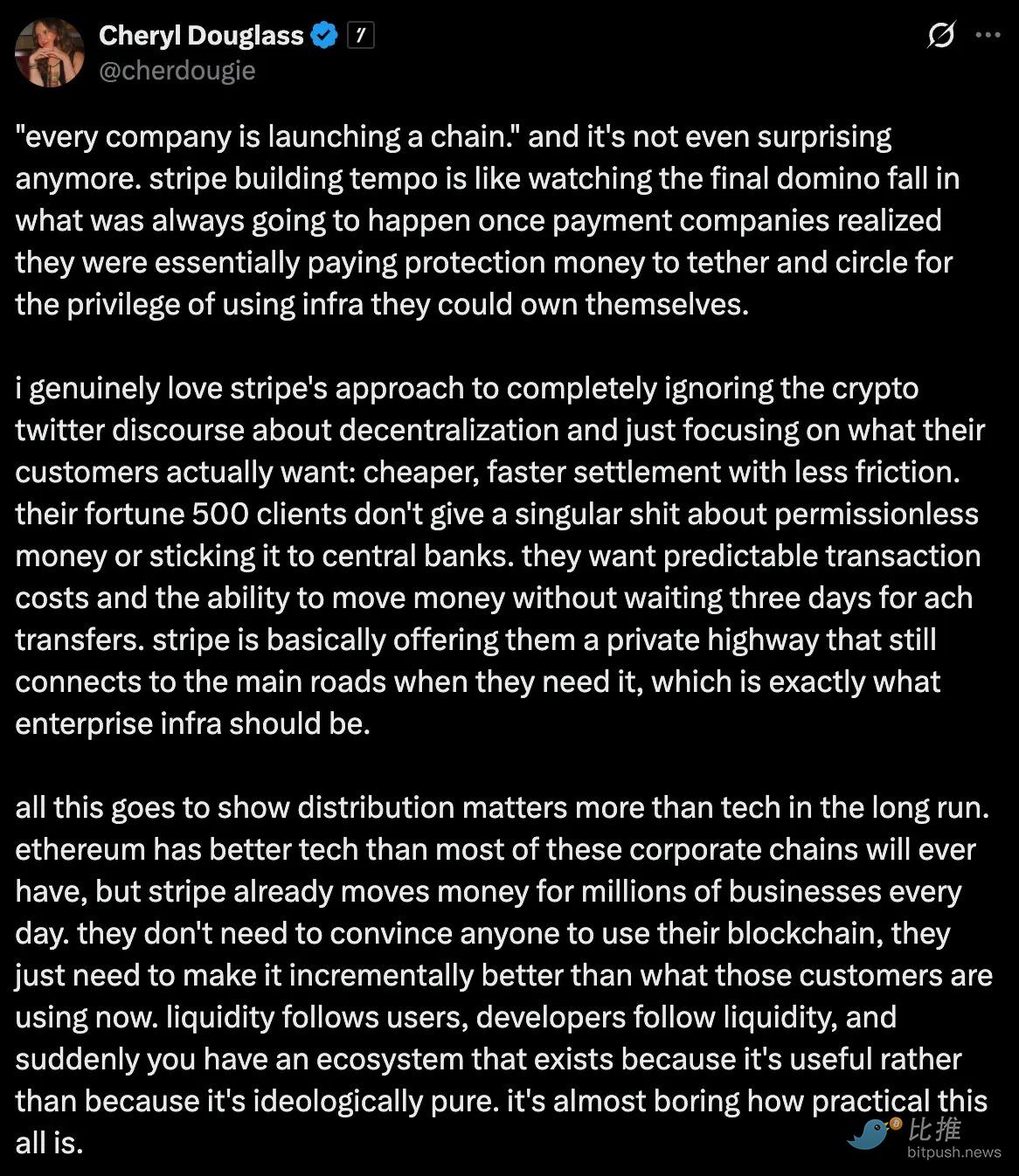

Perhaps this is what's really happening. Circle doesn't want to pay Ethereum's transaction fees, and Stripe doesn't want to build on infrastructure they can't control. That's fair. But we should be honest about it. This isn't about innovation or user experience, but about control and economic interests.

The king seems unconcerned

Ethereum appears unfazed by this, continuing to process over a million transactions daily, dominating most DeFi activity, and attracting massive institutional funds through its ETF. On a day in August, Ethereum ETF's net inflow reached $1 billion, more than Bitcoin ETF's total inflow the previous week.

The Ethereum community's reaction to these enterprise chains is also interesting. Some view it as an endorsement. After all, Arc and Tempo are both building EVM-compatible chains, essentially adopting Ethereum's development standards.

But a subtle threat exists. Every USDC transaction occurring on Arc instead of Ethereum is a fee income that Ethereum validators cannot capture. Every Stripe merchant payment processed on Tempo rather than Ethereum Layer 2 is an activity not contributing to Ethereum's network effect.

Solana might feel this competition more acutely. The network has positioned itself as Ethereum's high-performance alternative, especially for payments and consumer applications. When major payment companies choose to build their own chains instead of adopting Solana, it weakens Solana's long-touted argument that "everything can fit in a high-speed computer".

The graveyard of enterprise blockchains

History has not been kind to companies trying to build their own blockchains. As I mentioned earlier, Celo made a similar move in 2023.

Remember Facebook's Libra? This ambitious plan to create a global digital currency ultimately became Diem and disintegrated under regulatory pressure, being sold off. Don't forget that under today's regulatory environment, with the GENIUS Act clearly defining how stablecoin issuers should operate, Facebook's project might have actually succeeded.

JPMorgan's blockchain attempts might be the most relevant cautionary tale. The bank spent years building JPM Coin (a digital dollar), Quorum (their private blockchain network), and other blockchain projects. Despite having almost unlimited resources, regulatory relationships, and a massive existing customer base, these projects never gained meaningful adoption outside of JPMorgan's own business. JPM Coin processed billions of dollars in transactions but primarily only transferred funds between the bank's institutional clients.

Even major payment companies' attempts have not been inspiring. PayPal launched its own stablecoin PYUSD in 2023, becoming the first major US fintech to enter the stablecoin space. However, PayPal did not build custom infrastructure but chose to issue on existing networks like Ethereum. The result?

PYUSD's market cap is merely $1.102 billion, insignificant compared to USDC's $67 billion, and primarily limited to PayPal's own ecosystem.

This raises a question: If a company with PayPal's massive influence and payment expertise can't make a significant impact with just a stablecoin, what makes Circle and Stripe think they can do better by building an entire blockchain?

This pattern suggests that building a successful blockchain requires more than just technical capability and financial resources. You also need network effects, developer enthusiasm, and organic adoption - things notoriously difficult to create from scratch, even with big company endorsement.

Will this situation be different?

We have reason to believe that Circle and Stripe might succeed where others have failed.

First, regulatory clarity has significantly improved. The GENIUS Act passed in the US created a clear framework for stablecoin issuers, eliminating much of the uncertainty that plagued early enterprise blockchain attempts. When Circle launches Arc, they're not operating in a legal gray area but as a publicly traded company under established rules.

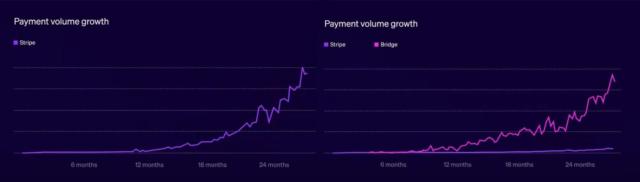

Second, both companies possess what JPMorgan lacked: a massive existing user base not primarily from the crypto-native community. Stripe processes over $1 trillion in transactions annually for millions of merchants worldwide and has systematically built its crypto infrastructure - acquiring Bridge (stablecoin infrastructure) for $1.1 billion and Privy (crypto wallet technology) to create an end-to-end payment stack. Circle's USDC is already integrated into hundreds of applications and trading platforms. They're not blindly building a chain but creating infrastructure for their existing user base with tools to seamlessly onboard them.

When Paradigm's Matt Huang described Stripe's approach, he emphasized how blockchain technology could "recede into the background", imperceptible to ordinary users.

Imagine making an online payment with instant settlement, lower fees, and programmable features, but the merchant's checkout interface looks exactly like the existing Stripe checkout process. This is entirely different from demanding people download MetaMask and manage a seed phrase. It's a Web2 user experience with a Web3 underlying architecture. Users won't even feel anything "blockchain-like".

Third, the technology itself has matured. When JPMorgan attempted blockchain in 2017-2018, the infrastructure was indeed very primitive. Today, building a high-performance blockchain with institutional-grade capabilities is challenging but not unprecedented. Circle acquired the team behind the Malachite consensus engine, bringing battle-tested technology capable of sub-second finality. Stripe's collaboration with Paradigm supplements its payment expertise with deep crypto knowledge.

Cost dynamics have also changed dramatically. In 2017, launching a new blockchain typically required $1-5 million with a 1-2 year (or longer) development cycle. By 2025, due to improved developer tools, consensus engines, and blockchain-as-a-service platforms, launching a functional blockchain application costs an average of $40,000-$200,000, with a typical timeline of 3-6 months. Due to efficiency improvements and infrastructure expansion, some modern deployments are even 43% cheaper than centralized applications.

Payment companies realize they've been paying for infrastructure they could have built themselves. Instead of paying Circle's USDC transaction fees or relying on Ethereum's fee structure, companies like Stripe can now build their own infrastructure at a fraction of the cost, much lower than the long-term fees paid to third parties.

This is a classic "build vs. buy" decision, with the "build" option's cost dropping from millions to tens of thousands.

The Coexistence Question

So where will all this lead us? Are we heading towards a fragmented future where every big company runs its own blockchain? Or will market forces drive consolidation and interoperability?

Early signs suggest pragmatic coexistence rather than winner-takes-all competition. Circle has clearly stated that Arc will complement, not replace, its multi-chain strategy. USDC will continue running on Ethereum, Solana, and dozens of other networks. Arc is positioned as an additional option for users needing its specific features like institutional privacy, guaranteed settlement times, or built-in forex capabilities.

Stripe's approach seems similar. Tempo is not intended to completely replace existing payment rails but to provide alternative solutions for use cases where blockchain features offer clear advantages. Cross-border payments, programmable money, and merchant settlements are areas where blockchain technology can truly surpass traditional systems.

Ultimately, user experience will determine whether this fragmentation becomes an advantage or a problem. If "chain abstraction" technology develops as promised, users might interact with all these different blockchains without knowing or caring. Your payment app might automatically choose the network offering the best speed and cost for a specific transaction.

My prediction (if I can be optimistic): We'll see two outcomes happening simultaneously but existing in different market segments.

For institutional and enterprise users, multiple specialized blockchains may flourish. When a multinational company transfers $100 million between subsidiaries, they care about compliance functions, settlement guarantees, and integration with existing financial systems. They do not care about gas price fluctuations, whether their blockchain has the coolest Non-Fungible Token projects, or the most active DeFi protocols. A chain that allows enterprises to directly withdraw to traditional banking systems, provides built-in compliance reports, or guarantees settlement time will be more favored than Ethereum's general infrastructure.

Arc may indeed be better able to serve these users than Ethereum.

Stable fees, instant settlement, and built-in compliance functions may be more important to CFOs than accessing the latest DeFi protocols.

For retail users and developers, network effects will continue to be crucial. Blockchains with the most applications, strongest liquidity, and most active developers will continue to attract more people. Today, this is still Ethereum, and these enterprise chains do not seem to have any direct intention of challenging its dominance.

The biggest uncertainty is whether these enterprise blockchains will always remain focused on enterprises. If Stripe enables merchants to make payments faster and cheaper, and customers do not realize they are using a blockchain, it may grow beyond enterprise use cases.

But the essence of infrastructure is: the best things are invisible. When you turn on a light switch, you do not think about power plants or transmission lines. When these blockchain experiments succeed, it will be because they have made the underlying technology completely disappear.

Whether this will really happen remains to be seen. For now, we are in a land grab phase, with everyone wanting to secure a place in the future financial infrastructure.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Community:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush