Written by: KarenZ, Foresight News

Financial technology giant Stripe is accelerating its layout in the stablecoin and payment domains.

A recently removed job posting revealed a secret collaboration with crypto venture capital firm Paradigm - the two parties are jointly building a high-performance blockchain dedicated to payments called Tempo.

This move is a key step in Stripe's continued layout in the stablecoin track, reflecting its ambition to reshape the global payment system and even the financial landscape.

Tempo: A Layer1 Blockchain Focused on Payments

According to a product marketing job posting archived on Fortune magazine and the Blockchain Association website (now taken down), Tempo is positioned as a "high-performance, payment-focused Layer1 blockchain" and is currently in a confidential phase. The team currently has 5 members and is recruiting its first product marketing personnel.

The position requires applicants to be familiar with fintech/payment or cryptocurrency fields, with "marketing experience targeting Fortune 500" required, suggesting its target customer group is large enterprises.

According to sources cited by Fortune magazine, Tempo is a Layer1 using an Ethereum-compatible programming language.

This technical choice ensures independence while leveraging the mature developer resources of the Ethereum ecosystem to lower application barriers.

Notably, Paradigm co-founder Matt Huang is both a Stripe board member and was an early investor in the crypto wallet company Privy, which Stripe acquired. Paradigm led Privy's $18 million Series A funding in November 2023, and Matt Huang also joined Privy's board at that time. In March 2025, Privy announced completing a $15 million funding round led by Ribbit Capital, with participation from Sequoia Capital, Paradigm, and Coinbase. This deep connection laid the foundation for collaboration between Paradigm and Stripe.

In fact, in February this year, Matt Huang stated that Paradigm is discussing with some of the world's largest enterprises to help them develop stablecoin strategies, such as faster global expansion or easier fund custody.

From Acquisition to Collaboration to Self-Development: Stripe's Stablecoin Strategy Advances

The development of Tempo is a continuation of Stripe's stablecoin strategy. From acquiring infrastructure to developing underlying technology, its layout logic is clear and progressive.

Step One: Acquiring the Core of Stablecoin Infrastructure - Bridge

In October 2024, Stripe acquired stablecoin infrastructure company Bridge for $1.1 billion, its largest acquisition to date.

Bridge allows enterprises and developers to seamlessly integrate stablecoin payments and supports convenient transfers between fiat currencies and stablecoins.

Bridge has attracted numerous customers, including SpaceX. For example, SpaceX uses Bridge to remit sales funds from Starlink in Argentina, Nigeria, and other markets. Mexican neobank DollarApp uses Bridge to help individuals receive USD payments from payroll services like Deel. Artim uses Bridge to pay employees across Latin America.

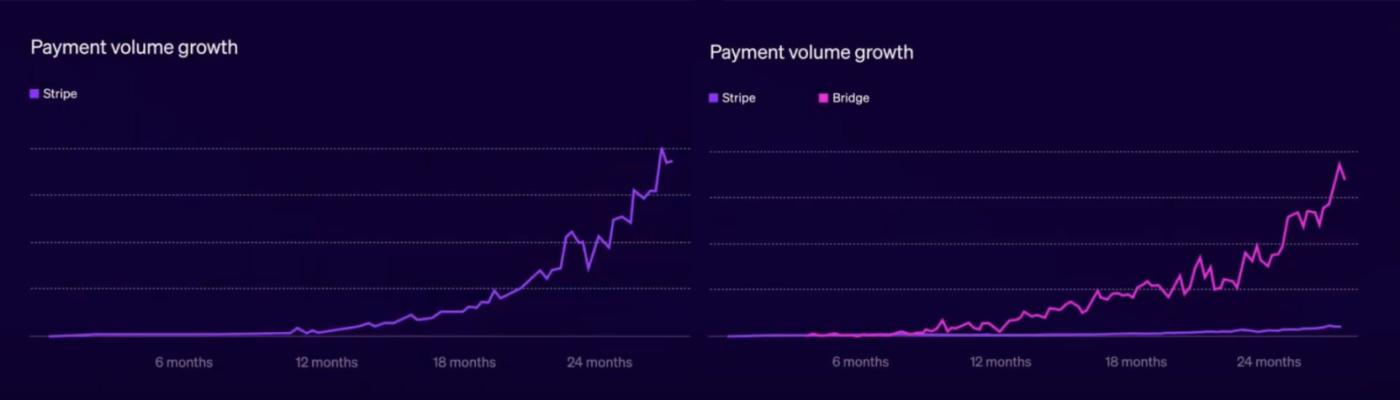

As Stripe co-founder John Collison stated in May at Stripe Sessions 2025, "Stablecoins can truly enable borderless finance. By comparing the payment transaction growth in Stripe's first two years with Bridge's first two years, we can see that Bridge shows a more significant exponential growth trend, which also indirectly confirms the huge potential of stablecoins."

Step Two: Connecting Offline Payment Scenarios and Launching Stablecoin Financial Accounts

Additionally, on April 30, Stripe's Bridge collaborated with Visa to launch a stablecoin card issuance product, allowing developers using Bridge to programmatically integrate stablecoin-related Visa card issuance across multiple countries/regions through a single API.

Enterprises and individuals can use their stablecoin balances for daily shopping anywhere Visa is accepted. When a cardholder shops, Bridge deducts funds from their stablecoin balance and converts it to fiat currency, while merchants continue to receive payment in local currency.

After acquiring Bridge, Stripe officially announced the launch of stablecoin financial accounts on May 8, aimed at providing more efficient and convenient cross-border payment and fund management solutions for global enterprises.

According to Stripe's official documentation, stablecoin financial accounts allow users to hold USDC and USDB stablecoin balances and send and receive funds through stablecoins and traditional financial channels (such as ACH, SEPA, and wire transfers), meaning stablecoin balance funds can be transferred to external bank accounts or crypto wallets. If the recipient is an external bank account, the received amount will be automatically converted based on the current exchange rate, greatly enhancing the convenience and flexibility of fund circulation. The technical support for this service also comes from Stripe's acquired Bridge platform.

Step Three: Completing User-Side Entry - Privy

In June 2025, Stripe acquired embedded crypto wallet developer Privy.

Privy's identity verification and wallet infrastructure allows developers, projects, or companies to register wallets for users, launch self-custodial wallets, and securely sign transactions through app security. Privy simplifies cryptocurrency use by embedding wallets in applications.

At the underlying level, Privy combines Trusted Execution Environment (TEE) with distributed key sharding to provide a seamless, secure, and scalable wallet.

Data published by Privy in June shows it has over 75 million accounts in more than 180 countries/regions, with monthly transaction volumes exceeding 85 million and total RPC calls over 500 million. Privy's customers include mainstream crypto projects like Hyperliquid, Farcaster, Jupiter, Zora, pump.fun, and Blackbird.

Step Four: Self-Developed Underlying Blockchain - Tempo Closes the Loop

The development of Tempo is now an important piece of Stripe's stablecoin layout.

By developing its own Layer1 blockchain, Stripe can control the core processing stage of stablecoin transactions, forming a complete closed loop with its previous layout: Bridge focuses on stablecoin infrastructure construction and enterprise integration, responsible for enterprise stablecoin integration and issuance; Privy provides user wallet entry; stablecoin financial accounts and Visa cards connect fund circulation scenarios; Tempo carries the underlying transaction processing.

Stripe's ultimate goal is to completely control the entire process of stablecoin payments through the Tempo blockchain.

Stripe's Deeper Ambitions

Stripe's vast customer network provides a natural landing scenario for its stablecoin ecosystem.

According to the 2024 annual letter by Stripe CEO Patrick Collison and co-founder John Collison in February, the total enterprise payment amount on the Stripe platform in 2024 reached $1.4 trillion, a year-on-year growth of 38%, equivalent to 1.3% of global GDP. Stripe firmly believes that technologies like stablecoins and artificial intelligence will inevitably reshape the economic landscape. The Stripe ecosystem covers every dimension of the economic landscape, from industry giants (half of the Fortune 100 use Stripe) to high-growth enterprises (80% of Forbes Cloud Computing Top 100 and 78% of Forbes AI 50 are Stripe customers), to emerging startups (one in six newly registered Delaware companies completes registration through Stripe Atlas).

Stripe previously stated that it is becoming the preferred platform for building stablecoin applications and has been in dialogue with multiple top global enterprises to help them develop stablecoin strategies, such as accelerating global expansion or simplifying fund custody.

If Stripe's stablecoin ecosystem fully takes shape, it may become a key hub for the fusion of Web2 and Web3 finance, further consolidating its trillion-dollar payment empire.

Stripe's ambition goes beyond improving payment efficiency. In its 2024 annual letter, it mentioned that stablecoins could become an "upgraded Eurodollar" - just as the Eurodollar system provided offshore dollar services for non-US enterprises, stablecoins achieve global dollar circulation with a lower threshold. Additionally, stablecoin issuers may become important buyers of US Treasury bonds, which will further promote the dollar's strong position.

Click to learn about ChainCatcher's job openings

Recommended Reading: