Deng Tong, Jinse Finance

According to data from defillama.com and artemisanalytics.com, as of August 11, the total value of the stablecoin market has exceeded $270 billion. In July this year, Trump signed the GENIUS Act, with the United States formally establishing a stablecoin regulatory framework for the first time. In fact, since the market began anticipating the GENIUS Act, stablecoins have become a battleground.

Fireblocks' "Stablecoin Status 2025" report indicates that 49% of institutions globally have already used stablecoins for payments, and 41% of institutions are piloting or planning to use stablecoins. In the race where giants are competing to layout the stablecoin track, which stablecoin chains are worth paying attention to? Why are giants laying out the stablecoin chain?

I. Which Stablecoin Chains Are Worth Noting?

Circle: Arc

On August 12, according to Circle's official blog, Circle announced the launch of Arc, an open Layer 1 blockchain designed specifically for stablecoin financial scenarios. Arc uses USDC as its native gas, supports low and predictable dollar-denominated fees, and has a built-in institutional-grade forex engine for 24/7 automatic settlement between stablecoins. Arc uses the Malachite high-performance consensus mechanism, supporting sub-second instant finality and optional privacy protection. The chain is EVM-compatible and oriented towards cross-border payments, stablecoin derivatives, on-chain credit, and capital market settlement. Developers can implement use cases including cross-border payments and remittances, stablecoin forex perpetual contracts, on-chain credit and off-chain trust, capital market settlement and tokenized collateral, agency business, and programmable payments. Public testing is expected to open this fall, with mainnet launch in 2026.

With the launch of Arc, Circle announced that its second-quarter total revenue and reserve income grew 53% year-on-year, reaching $658 million. Circle stated that its upcoming Arc is "built specifically for stablecoin finance," marking an important milestone in the company's mission to "provide a full-stack platform for the internet financial system." "Arc will be fully integrated into Circle's platform and services, and will maintain full availability and interoperability with dozens of other blockchain partners supported by Circle".

Circle CEO Jeremy Allaire previously stated in an interview that with the U.S. Congress passing the GENIUS Act, establishing a clear regulatory framework for stablecoin business, this field has become the most vibrant sector in the cryptocurrency market. Circle will explore the application of blockchain payment systems in traditional financial institutions. Stablecoin technology is gaining attention from traditional financial institutions and policymakers, and is expected to open up new application scenarios in payment and commercial domains in the future.

Stripe, Paradigm: Tempo

On August 11, it was reported that fintech giant Stripe and crypto venture capital firm Paradigm are collaborating to develop a high-performance, payment-focused Layer 1 blockchain called "Tempo".

Tempo uses the same programming language as Ethereum, allowing developers to directly migrate existing smart contracts and lower technical barriers. Its design goal is to support high-frequency, low-latency payment transactions, focusing particularly on real-time settlement of stablecoins and cross-border payment scenarios, aiming to bypass traditional intermediary institutions like Visa and Mastercard through blockchain technology, significantly reducing transaction costs and improving efficiency. The project is currently in a low-key development state, with a team of five. It is currently unclear whether the project will issue its own native token.

The launch of Tempo marks Stripe's official transition from a payment intermediary to a blockchain infrastructure builder. By controlling stablecoin issuance (Bridge), wallet entry (Privy), and transaction settlement (Tempo), Stripe will form a complete payment ecosystem, completely transforming traditional payment processes.

USDT: Plasma

In February this year, stablecoin company Plasma raised $24 million to develop a new blockchain for Tether's USDT.

Plasma is an EVM-compatible Proof of Stake (PoS) blockchain running on PlasmaBFT, an improved Fast HotStuff design specifically designed for high-throughput, low-latency stablecoin transfers, with an execution layer built on Reth, providing full EVM compatibility. It uses a dual validator architecture, with one validator cluster responsible for consensus security and another specifically handling gas-free USDT transfers.

Plasma provides zero-fee USDT transfer functionality, designed specifically for basic USDT payments, running on a parallel block layer to avoid mainnet congestion. Users can choose to wait slightly longer to obtain fee-free transfers. Additionally, users can pay transaction fees with authorized tokens (such as USDT or BTC) without needing to hold special gas tokens, with the off-chain system automatically converting them to Plasma's native gas token XPL at market price.

Plasma co-founder Paul Faecks previously revealed that the new blockchain will be built on the Bitcoin network and attract users by providing zero-fee USDT transactions. Plasma focuses on stablecoin transactions, meaning it will be able to process and settle transactions quickly.

Tether: Stable

Stable is an EVM-compatible Layer 1 blockchain launched by Tether, aiming to replace general public chains in cross-border payments and institutional settlements through zero-fee transactions, high throughput, and a compliant validator node network. Its core features include native USDT gas mechanism, sub-second confirmation, and compliance.

On July 2, the USDT-based Layer 1 network Stable released its roadmap: the first phase achieves the USDT base layer, using USDT as the native gas token, achieving sub-second block time and finality, and launching a stable wallet to enhance user experience; the second phase achieves the USDT experience layer, using optimistic parallel execution to improve transaction throughput, introducing USDT transfer aggregators and dedicated block space for enterprises to ensure efficient processing and consistent performance; the third phase achieves the USDT full-stack optimization layer, upgrading to a DAG-based consensus to improve speed and resilience, expanding developer tools and resources to promote dApp development.

Cosmos: Noble

Noble is a native asset issuance chain built on the Cosmos SDK. It aims to become a "world-class issuance center for interoperable digital assets", supporting not only stablecoin issuance but also tokenization and issuance of real-world assets.

In September 2023, Circle chose Noble as the launch platform for native USDC in the Cosmos ecosystem, supporting cross-chain transfer to ecosystem application chains via IBC protocol. In December 2024, the Noble blockchain launched a USD-denominated stablecoin USDN, which uses an M^0 "permissioned minting" mechanism backed by short-term U.S. Treasury bonds, with USDN holders expected to earn a 4.2% annual yield. Additionally, fintech company Monerium also launched the euro stablecoin EURe on the Noble blockchain, the first native euro stablecoin in the Cosmos ecosystem.

II. Why Are Giants Laying Out Stablecoin Chains?

Global banks and traditional financial giants are actively integrating blockchain technology and stablecoins into their products, and the stablecoin arms race has begun. With the U.S. Senate passing the GENIUS Act to regulate stablecoins, this trend is accelerating.

1. Favorable Regulatory Environment

2025 has become a watershed for stablecoin policy. The U.S. GENIUS Act and Hong Kong's Stablecoin Regulation have established clear frameworks for stablecoin regulation, directly driving the market from "wild growth" to "compliant competition".

Trump once pointed out: stablecoins are a revolution in financial technology, and the stablecoin bill is a major recognition of cryptocurrencies; Federal Reserve Governor Waller stated: stablecoins bring competition to the payment system but do not pose a threat; Fed's Musalam believes: stablecoins are an interesting innovation in the payment field, and establishing a regulatory framework is a good thing, and stablecoins may become an important part of payments; U.S. Vice President Vance stated: once the GENIUS Act is implemented, it is expected to significantly expand the application of stablecoins as a digital payment system, providing convenience for millions of Americans. At the same time, this will protect coin holders and enhance market transparency.

2. Growing Market Demand

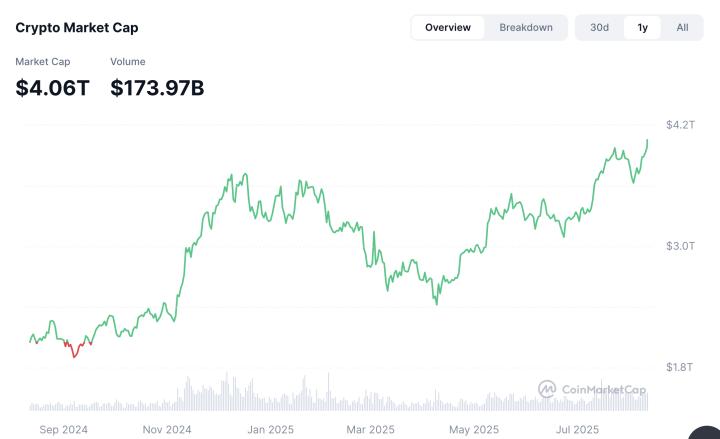

Standard Chartered Bank once predicted: currently, stablecoins account for 40% of all blockchain transaction fees, with Ethereum occupying more than half of all stablecoins. By the end of 2028, the stablecoin industry is expected to grow approximately 8 times.

Coinbase's latest research shows that stablecoins are becoming the core driving force of the financial future. In December 2024 and April 2025, they set historical monthly trading volume records of $719 billion and $717.1 billion respectively. The total annual stablecoin trading volume in 2024 reached $27.6 trillion, surpassing Visa and Mastercard's total transaction volume by 7.68%. The rise of on-chain activity and global application acceleration marks a fundamental transformation in monetary evolution, with stablecoins becoming the primary catalyst driving real-world use cases.

3. Seizing Industry Discourse

According to GLG Research data, nearly one-fifth of Fortune 500 executives view on-chain projects as a critical part of their company strategy, a year-on-year increase of 47%. The layout of stablecoin chains is essentially a competition for "accounting rights" and "coinage rights". By deploying stablecoin chains, giants can upgrade from "crypto market participants" to "crypto rule makers", ultimately occupying a core position in the reshuffled financial system.

Circle's Arc, through the "Malachite consensus mechanism" and "USDC native Gas design", has established technical standards for stablecoin "low-friction settlement", with other institutions needing to follow Arc's cross-chain interface and fee rules to access the USDC ecosystem; Tether's Stable, with "USDT as native Gas" and "zero-fee transfers" as core features, indirectly forces other stablecoin chains to adopt similar mechanisms to remain competitive, thereby embedding USDT usage habits into industry standards; Cosmos' Noble, leveraging the IBC protocol, has become a "hub node" for stablecoin cross-chain flow, with its "cross-chain asset verification rules" already adopted by 20+ application chains in the Cosmos ecosystem, thus dominating the ecosystem's stablecoin cross-chain standards.

Conclusion

As regulatory signals continue to clarify and market demand grows, giants' exploration of the crypto realm extends beyond stablecoin issuance to more ambitious ideals—developing stablecoin chains. This competition around stablecoin chains is not only a battle for future financial discourse among giants but also a grand experiment guiding deeper integration between crypto technology and traditional finance.