Recorded approximately 535.4 billion won in net inflow on the 18th

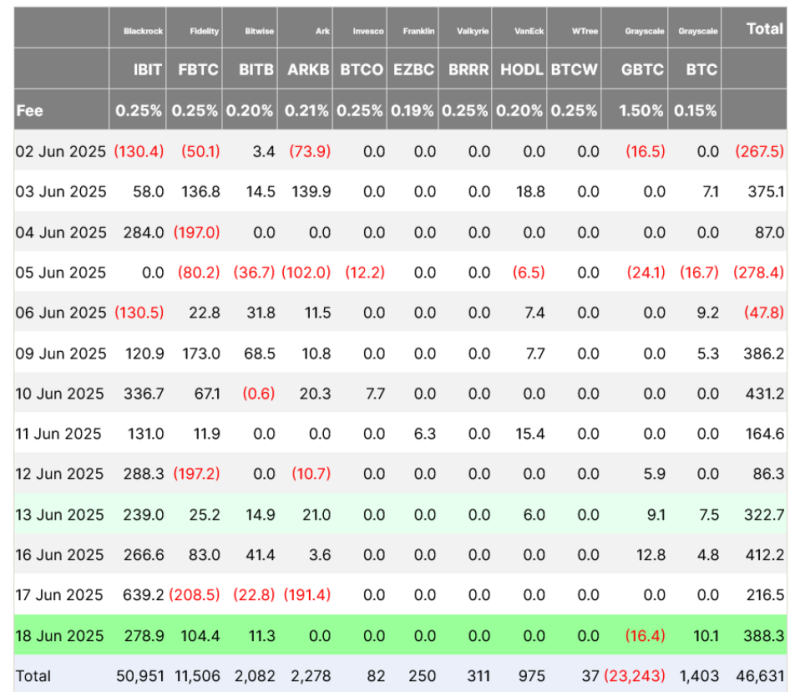

The Bitcoin (BTC) spot ETF in the United States achieved an 8-day consecutive net inflow despite tensions in the Middle East war, maintaining a solid Bitcoin price range.According to data from the financial data platform Farside Investors on the 19th, the U.S. Bitcoin spot ETF recorded a net inflow of approximately $388.3 million (about 535.4 billion won) on the 18th.

Earlier on the 18th, the White House held a National Security Council (NSC) meeting to discuss potential U.S. involvement in the current Middle East conflict. Even amid this, Bitcoin defended its price range of $104,000-$105,000. The continued institutional fund inflow through ETFs reflects Bitcoin's price stability.

BlackRock's 'IBIT' and Fidelity's 'FBTC' led the net inflow of U.S. Bitcoin spot ETFs, recording net inflows of approximately $278.9 million (about 384.6 billion won) and $104.4 million (about 144 billion won), respectively.

Meanwhile, while most U.S. Bitcoin spot ETFs achieved net inflows, Grayscale's 'GBTC' was the only one to record net outflows. GBTC's net outflow on the 18th was approximately $16.4 million (about 22.6 billion won).

Reporter Seung-won Kwon ksw@blockstreet.co.kr