Global exchange Bitcoin balance slightly decreased on a daily basis, with a clear net inflow on Coinbase. In the European trading time zone, a signal of liquidity recovery was detected due to a surge in trading volume.

As of the 18th, according to CoinGlass, the total Bitcoin balance of major global exchanges was approximately 2,077,605.38 BTC.

Over the past day, a net outflow of –262.12 BTC was recorded, with a net outflow of –13,667.76 BTC over the past week and –89,335.48 BTC over the past month.

Coinbase Pro holds 638,882 BTC, still maintaining the largest Bitcoin holdings. A net inflow of +1,313 BTC was observed on a daily basis, though outflow trends continue on a weekly and monthly basis.

Binance holds 539,764 BTC. The outflow expanded to –1,944 BTC on a daily basis. Bitfinex holds 378,956 BTC, with a net inflow of +360 BTC on a daily basis.

Largest Daily Net Inflow ▲Coinbase Pro (+1,313 BTC) ▲Gate (+709 BTC) ▲Bitfinex (+360 BTC)

Largest Daily Net Outflow ▲Binance (–1,944 BTC) ▲Bybit (–486 BTC) ▲Kraken (–450 BTC)

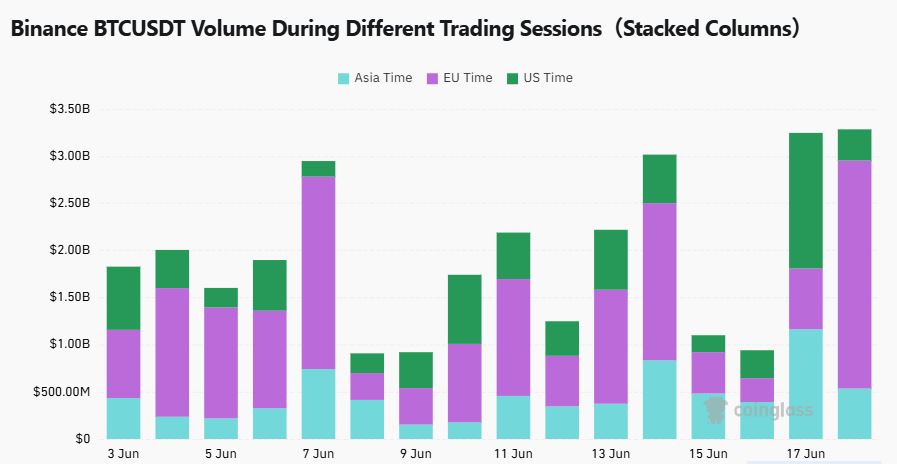

According to CoinGlass, the Binance BTCUSDT trading volume on June 17th was $535.22 million in the Asian time zone, $2.42 billion in the European time zone, and $330.51 million in the US time zone.

Compared to the previous day (June 16th), the Asian (–53.9%) and US (–77.0%) markets saw significant trading volume decreases, while the European market (+275.1%) showed a notable increase.

Particularly in the European market, a two-day consecutive trading increase signaled liquidity recovery, while the Asian and US markets showed a strengthened wait-and-see sentiment due to sharp trading reductions. The potential change in trading dominance is drawing attention alongside the recent trend of reduced price volatility.

Get news in real-time... Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>