Binance joins hands with Franklin Templeton, BNB price sets new ATH

Binance joins hands with Franklin Templeton, BNB price sets new ATH

Binance – the world's largest cryptocurrency exchange, has just announced a partnership with Franklin Templeton – a traditional asset management group worth 1.6 trillion USD .

The two parties will develop products related to digital assets and Tokenize securities , aiming to bring more transparent, efficient and accessible investment opportunities to both institutional and individual investors.

#Binance is partnering with #FranklinTempleton @FTI_Global @FTDA_US to build tailored digital asset initiatives and institutional-grade solutions for a broad range of investors.

— Binance (@binance)September 10, 2025

We are committed to making digital finance more accessible and reliable in TradFi while bridging… pic.twitter.com/V9YR7Kk6ip

Why is this news important?

Marking a major step forward in the collaboration between traditional finance (TradFi) and crypto.

Franklin Templeton is a global asset management giant, while Binance owns trading infrastructure and more than 280 million users.

Combining the strengths of both sides could open up a new standard for digital financial products.

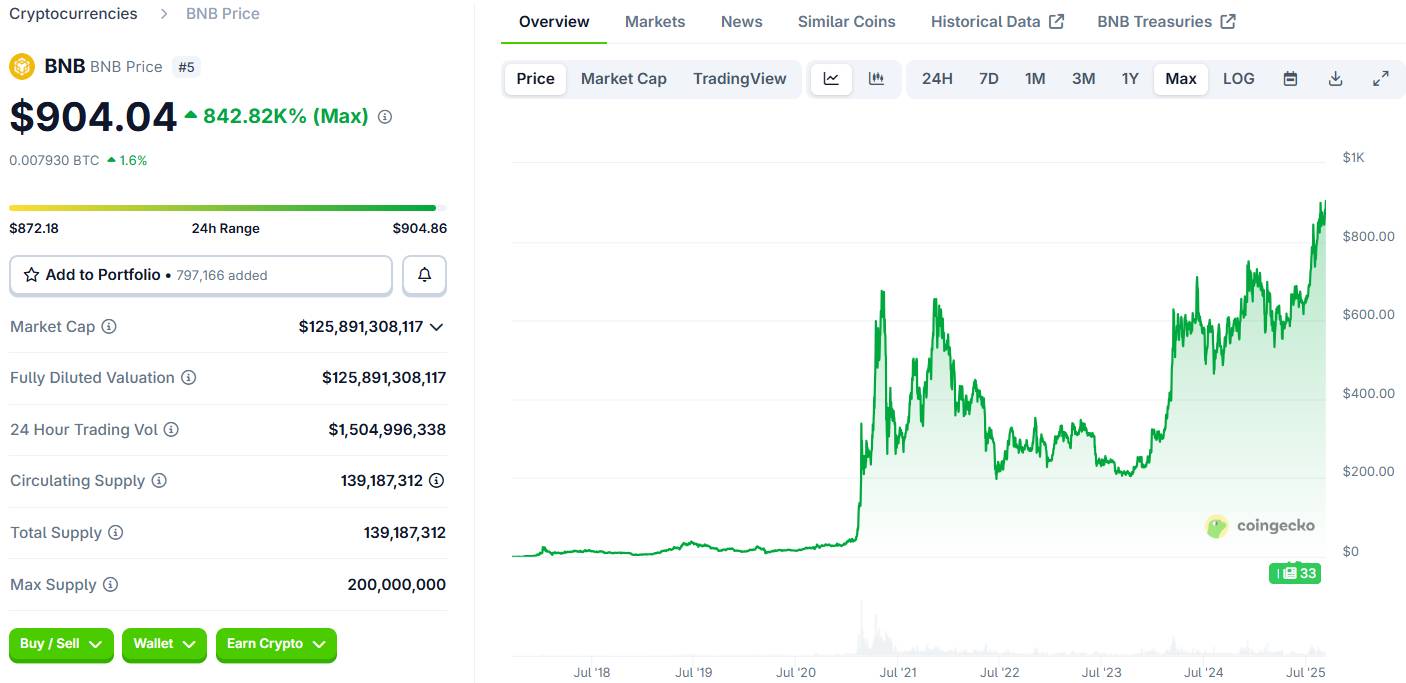

This information appeared at the same time BNB – the Governance Token of Binance and the BNB Chain ecosystem – set a new All-Time-High (ATH) at $907.3, with a market capitalization approaching $126 billion.

Background and related events

Franklin Templeton developed the Benji platform for Tokenize funds and brought Franklin OnChain US Government Money Fund (FOBXX) to multiple blockchains including Ethereum , Solana , Base ,...

Launched in 2021, FOBXX is the first money market fund (MMF) to use a public blockchain to record transactions and asset ownership.

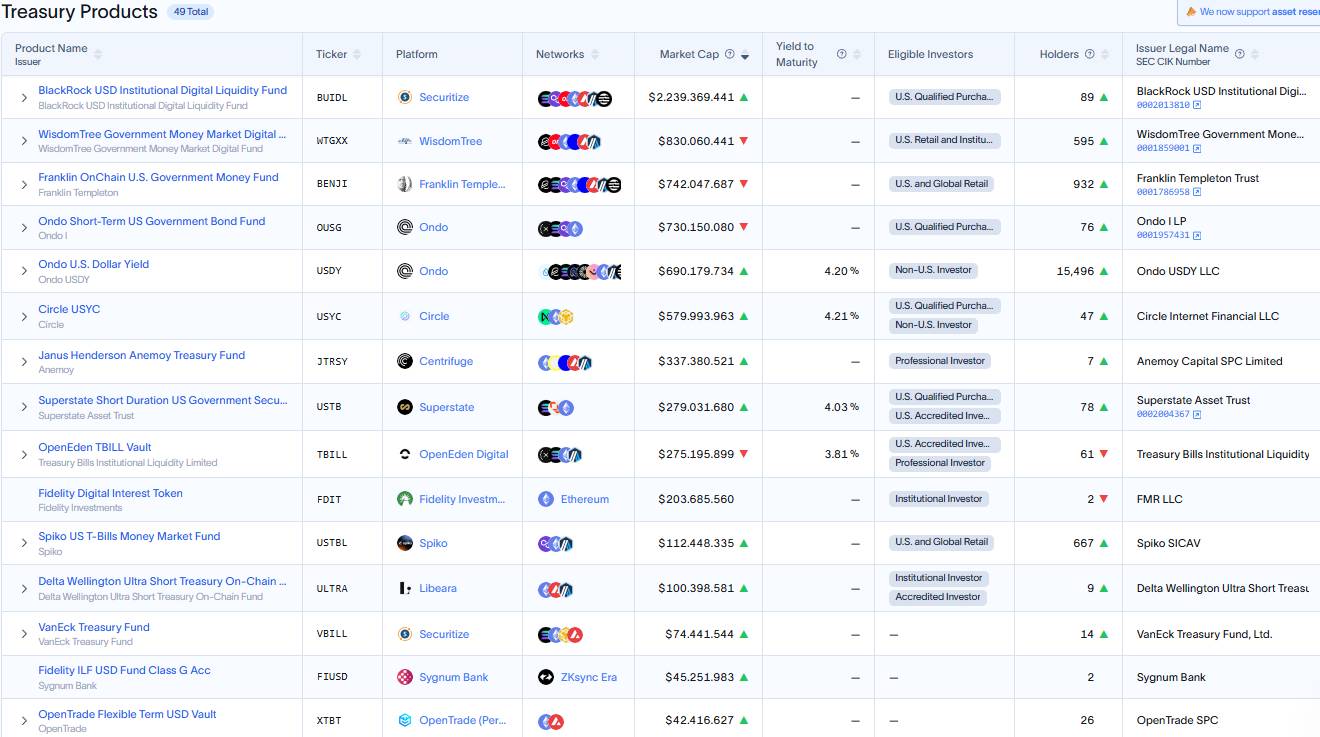

- FOBXX currently has a Capital cap of $742 million — the third largest in the RWA market — topped by BlackRock’s Tokenize BUIDL fund partnered by Securitize at $2.23 billion.

Binance is continuously expanding its services towards the intersection of TradFi and DeFi, with the ambition of becoming a global Capital bridge.

The trend of Tokenize real assets ( RWA ) is being XEM as the next booming segment in crypto, when recently Ant Digital - the blockchain unit of Ant Group under billionaire Jack Ma's Alibaba Group - said it is Tokenize $8.4 billion in energy assets in China. In addition, Ondo Finance combined with Pantera Capital poured $250 million into RWA projects.

McKinsey & Co analysts predict the value of Token assets (RWA) could reach $2 trillion by 2030 .

Expert opinion

Sandy Kaul (Franklin Templeton): “Blockchain is not a threat, but an opportunity to reshape the financial system.”

Roger Bayston (Franklin Templeton): “Our goal is to take Tokenize from concept to reality, optimizing asset management, escrow, and portfolio construction.”

Catherine Chen (Binance): “This partnership demonstrates Binance’s commitment to connecting crypto with traditional markets, opening up more opportunities for global investors.”

Conclude

The Binance – Franklin Templeton partnership is a clear demonstration of TradFi’s move into Web3.

Specific products will be announced later this year, promising to give a big boost to the Tokenize wave.

BNB price reacted instantly to positive news, setting new ATHs and consolidating its position in the crypto ecosystem.

Evidence

Binance BNB Token real-time price movement captured at 09:00 PM on 09/10/2025 on CoinGecko

Binance BNB Token real-time price movement captured at 09:00 PM on 09/10/2025 on CoinGecko

Statistics of the 15 largest RWA funds at present. Source: rwa.xyz (September 10, 2025)

Statistics of the 15 largest RWA funds at present. Source: rwa.xyz (September 10, 2025)

Coin68 synthesis