While the leading cryptocurrency Bitcoin (BTC) continues to trade in a narrow range, the FED's interest rate decision to be announced next week is expected to trigger the rise.

While it is considered certain that the FED will cut interest rates in September, a 25 basis point rate cut is priced in at 91.8%, and a 50 basis point cut is priced in at 8.2%.

While some experts state that the FED's interest rate cut has already been priced in, others argue that the FED's interest rate cut will trigger the expected rise.

While the FED's decision was eagerly awaited, data on the US Producer Price Index (PPI), one of the data the FED follows in its decisions, was announced.

The data disclosed is as follows:

Core Producer Price Index (Monthly): Announced -0.1% – Expected 0.3% – Previous 0.9%

Core Producer Price Index (Annual): Announced 2.8% – Expected 3.5% – Previous 3.7%

Producer Price Index (Monthly): Announced -0.1% – Expected 0.3% – Previous 0.9%

Producer Price Index (Annual): Announced 2.6% – Expected 3.3% – Previous 3.3%

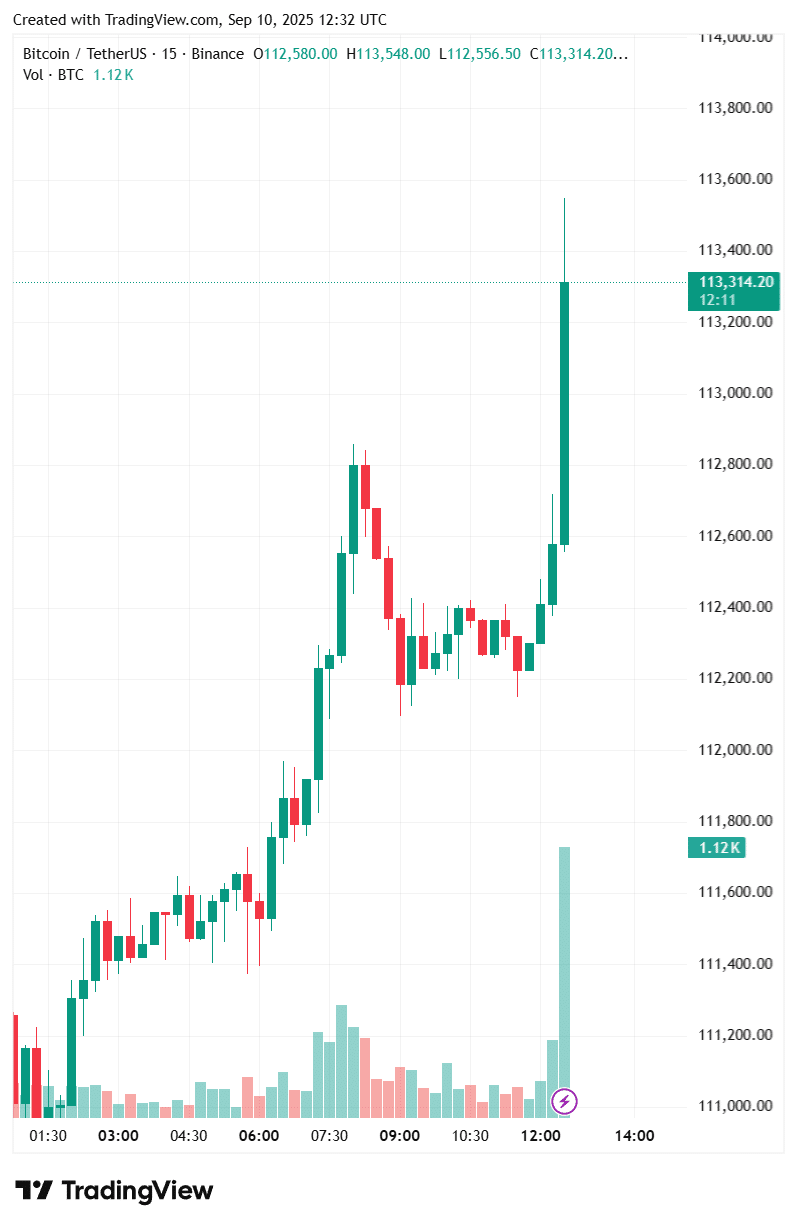

Bitcoin's first reaction after the incoming PPI data was as follows:

*This is not investment advice.