Written by: Daniel Barabander

Translated by: AididiaoJP, Foresight News

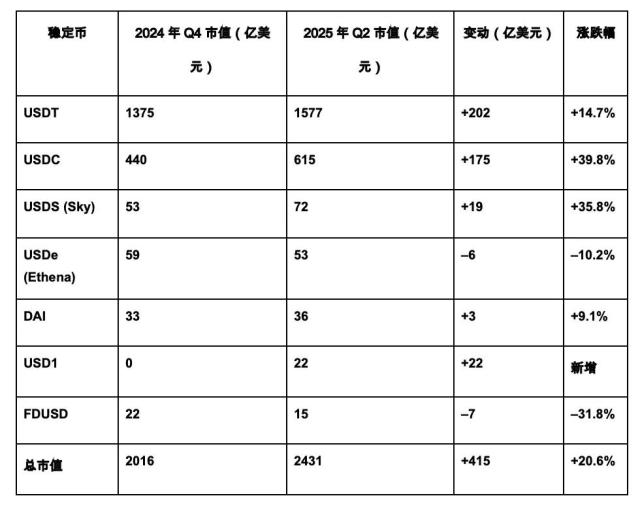

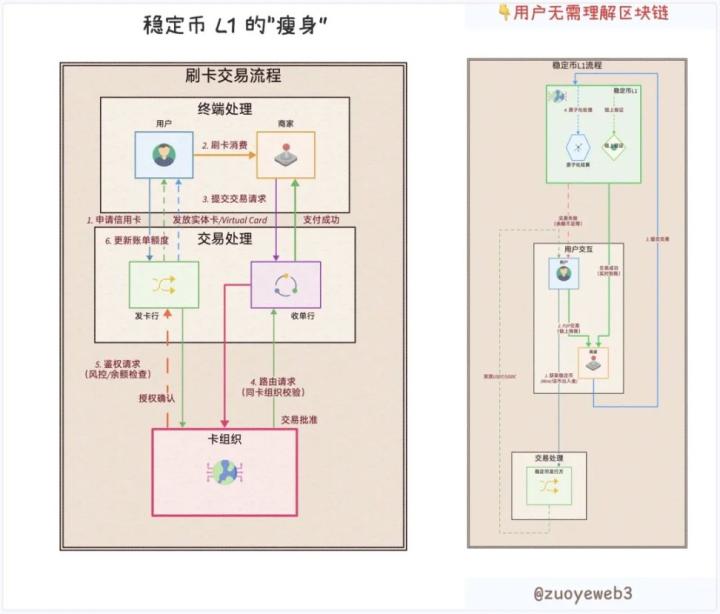

Currently, discussions about stablecoins in the US consumer payment sector are very heated. However, most people consider stablecoins a "sustaining technology" rather than a "disruptive technology". They believe that while financial institutions will use stablecoins for more efficient settlement, for most US consumers, the value provided by stablecoins is insufficient to make them abandon their current dominant and sticky payment method, which is credit cards.

This article argues how stablecoins can become a mainstream payment method in the United States, rather than just a settlement tool.

How Credit Cards Build Payment Networks

First, we must acknowledge that getting people to accept a new payment method is very difficult. A new payment method is only valuable when enough people use it in the network, and people only join when the network has value. Credit cards overcame the "cold start" problem through the following two steps and became the most widely used payment method for US consumers (accounting for 37%), surpassing cash, checks, and early cards limited to specific merchants or industries.

Step One: Utilizing Inherent Advantages That Do Not Require a Network

Credit cards initially expanded the market by solving pain points for a small group of consumers and merchants across three dimensions: convenience, incentives, and sales growth. Taking the first mass-market bank credit card BankAmericard launched by Bank of America in 1958 (which later developed into today's Visa credit card network) as an example:

Convenience: BankAmericard allowed consumers to pay back collectively at the end of the month without carrying cash or filling out checks at the cashier. Although merchants had previously offered similar delayed payment cards, these cards were limited to a single merchant or specific categories (such as travel and entertainment). BankAmericard could be used at any partner merchant, basically meeting everyone's consumption needs.

Incentives: Bank of America promoted credit card adoption by mailing 65,000 unsolicited BankAmericard credit cards to Fresno residents. Each card came with a pre-approved flexible credit limit, which was unprecedented at the time. Cash and checks could not provide similar incentives, and early charge cards, while offering short-term credit, were usually limited to high-income or existing customers and could only be used at specific merchants. BankAmericard's broad credit coverage was particularly attractive to low-income consumers who were previously excluded.

Sales Growth: BankAmericard helped merchants increase sales through credit consumption. Cash and checks could not expand consumers' purchasing power, and early charge cards could promote sales but required merchants to manage credit systems, customer access, collection, and risk control themselves, with extremely high operating costs that only large merchants or associations could afford. BankAmericard provided small merchants with opportunities for sales growth through credit consumption.

BankAmericard was successful in Fresno and gradually expanded to other California cities. However, due to regulations limiting Bank of America to operate only in California, it quickly realized that "to make credit cards truly useful, they must be accepted nationwide" and thus licensed the credit card to banks outside California for a franchise fee of $25,000 and royalties. Each authorized bank used this intellectual property to build its own consumer and merchant network locally.

Step Two: Expansion and Connection of Credit Card Payment Networks

At this point, BankAmericard had evolved into a series of decentralized "territories", with consumers and merchants in each region using the card based on its inherent advantages. Although it worked well within each territory, it could not be scaled overall.

[The rest of the translation follows the same professional and accurate approach]

Although permissioned stablecoins are structurally similar to prepaid reward programs, important differences indicate that permissioned stablecoins are more viable for merchants than traditional prepaid reward programs.

First, as the issuance of permissioned stablecoins becomes commoditized, the difficulty of launching such programs will approach zero. The GENIUS Act provides a framework for stablecoin issuance in the United States and establishes a new class of issuers (non-bank permissioned payment stablecoin issuers) with a lighter compliance burden than banks. As a result, an ecosystem around permissioned stablecoins will develop. Service providers will abstract user experience, consumer protection, and compliance functions. Merchants will be able to launch branded digital dollars at minimal marginal cost. For merchants with sufficient influence to temporarily "lock" value, the question is: why not launch their own reward program?

Second, these stablecoins differ from traditional reward programs in that they can be used outside the issuing merchant's ecosystem. Consumers will be more willing to temporarily lock value because they know they can convert it back to fiat, transfer it to others, and ultimately use it with other merchants. Although merchants can request non-transferable stablecoins, I believe they will realize that if stablecoins are transferable, their adoption likelihood will significantly increase; permanently locking value would be highly inconvenient for consumers, thereby reducing adoption willingness.

Consumer Incentives

Stablecoins offer a consumer rewards approach completely different from credit cards. Merchants can indirectly leverage earnings from permissioned stablecoins to provide targeted incentives, such as instant discounts, shipping fee credits, early access, or VIP queues. Although the GENIUS Act prohibits sharing revenue solely for holding stablecoins, I anticipate such loyalty rewards will be acceptable.

Because stablecoins have programmability that credit cards cannot match, they can natively access on-chain yield opportunities (specifically, I mean fiat-backed stablecoins accessing DeFi, not on-chain hedge funds disguised as stablecoins). Applications like Legend and YieldClub will encourage users to route idle funds to lending protocols like Morpho to earn yields. I believe this is key to stablecoins breaking through in rewards. Yields will attract users to convert fiat to stablecoins to participate in DeFi, and if spending is seamless in this experience, many will choose to transact directly with stablecoins.

If cryptocurrencies have an advantage, it's airdrops: incentivizing participation through instant global-scale value transfer. Stablecoin issuers can adopt a similar strategy by airdropping free stablecoins (or other tokens) to attract new users to the cryptocurrency space and incentivize them to spend stablecoins.

Sales Growth

Stablecoins are assets for holders, just like cash, and therefore do not inherently stimulate spending like credit cards. However, just as credit card companies built a credit concept on top of bank deposits, it's not difficult to imagine providers offering similar programs on top of stablecoins. Moreover, an increasing number of companies are disrupting credit models, believing DeFi incentives can drive a new sales growth paradigm: "buy now, never pay". In this model, spent stablecoins will be custodied, earn yields in DeFi, and partially use those yields to pay for purchases at month-end. Theoretically, this would encourage consumers to increase spending, which merchants hope to leverage.

How to Build a Stablecoin Network

We can summarize the intrinsic advantages of stablecoins as follows:

Stablecoins are currently neither convenient nor directly drive sales growth.

Stablecoins can provide meaningful incentives for merchants and consumers.

The question is how stablecoins can follow the credit card's "two-step" strategy to build a new payment method?

Step One: Leveraging Intrinsic Advantages Demonstrable Without a Network

Stablecoins can focus on the following niche scenarios:

(1) Stablecoins are more convenient for consumers than existing payment methods, thereby driving sales growth;

(2) Merchants are motivated to offer stablecoins to consumers willing to sacrifice convenience for rewards.

Niche One: Relative Convenience and Sales Growth

Although stablecoins are currently not convenient for most people, they may be a better option for consumers not served by existing payment methods. These consumers are willing to overcome barriers to entering the stablecoin world, and merchants will accept stablecoins to reach previously unreachable customers.

A typical example is transactions between US merchants and non-US consumers. Consumers in certain regions (especially Latin America) find it extremely difficult or expensive to obtain US dollars to purchase goods and services from US merchants. In Mexico, only those living within 20 kilometers of the US border can open a dollar account; in Colombia and Brazil, dollar banking services are completely prohibited; in Argentina, while dollar accounts exist, they are strictly controlled, with limited quotas, and usually offered at an official exchange rate far below the market rate. This means US merchants lose these sales opportunities.

Stablecoins provide non-US consumers with an unprecedented channel to obtain dollars, enabling them to purchase these goods and services. For these consumers, stablecoins are actually relatively convenient because they typically have no other reasonable way to obtain dollars for spending. For merchants, stablecoins represent a new sales channel because these consumers were previously unreachable. Many US merchants (such as AI service companies) have significant demand from non-US consumers and will therefore accept stablecoins to acquire these customers.

Niche Two: Incentive-Driven

Customers in many industries are willing to sacrifice convenience for rewards. My favorite restaurant offers a 3% cash payment discount, for which I specifically go to the bank to withdraw cash, despite it being very inconvenient.

Merchants will be motivated to launch branded white-label stablecoins as a way to fund loyalty programs, providing consumers with discounts and privileges to drive sales growth. Some consumers will be willing to endure the cumbersome process of entering the cryptocurrency world and converting value to white-label stablecoins, especially when incentives are strong and the product is something they are passionate about or frequently use. The logic is simple: if I love a product, know I will use the balance, and can receive meaningful rewards, I'm willing to tolerate a poor experience and even hold funds.

Ideal merchants for white-label stablecoins include those with at least one of the following characteristics:

Passionate fan base. For example, if Taylor Swift asked fans to purchase concert tickets with "TaylorUSD", fans would still comply. She could incentivize fans to retain TaylorUSD by offering priority access to future tickets or merchandise discounts. Other merchants might also accept TaylorUSD for promotions.

High-frequency platform usage. For instance, the second-hand marketplace Poshmark had 48% of sellers using part of their income for platform purchases in 2019. If Poshmark sellers start accepting "PoshUSD", many would retain this stablecoin to transact with other sellers.

Step Two: Connecting the Stablecoin Payment Network

Since the above scenarios are niche markets, stablecoin usage will be temporary and fragmented. Parties in the ecosystem will define their own rules and standards. Moreover, stablecoins will be issued on multiple chains, increasing technical acceptance difficulties. Many stablecoins will be white-label and accepted by limited merchants. The result will be a decentralized payment network, where each network can be sustainable in local niches but lacks standardization and interoperability.

They need a completely neutral and open network for connection. This network will establish rules, compliance and consumer protection standards, and technical interoperability. The open and permissionless nature of stablecoins makes aggregating these decentralized supply and demand possible. To solve coordination problems, the network needs to be open and collectively owned by participants, rather than vertically integrated with other parts of the payment stack. Turning users into owners will enable the network to scale massively.

By aggregating these isolated supply and demand relationships, the stablecoin payment network will solve the "cold start" problem of new payment methods. Just as consumers today are willing to endure the one-time inconvenience of registering a credit card, the value of joining the stablecoin network will ultimately outweigh the inconvenience of entering the stablecoin world. At this point, stablecoins will enter mainstream adoption among US consumers.

Conclusion

Stablecoins will not directly compete with and replace credit cards in the mainstream market, but will instead penetrate from the margins. By solving real pain points in niche scenarios, stablecoins can create sustainable adoption based on relative convenience or better incentives. The key breakthrough lies in aggregating these fragmented use cases into an open, standardized network co-owned by participants, coordinating supply and demand to achieve scalable development. If this is achieved, the rise of stablecoins in US consumer payments will be unstoppable.