In Arc's plan, cryptographic technologies such as TEE/ZK/FHE/MPC will be integrated. It can be said that today's technological diffusion makes the launch cost of public chains almost constant. What's difficult is ecological expansion, building distribution channels and terminal networks. Visa took 50 years, the USDT/Tron alliance took 8 years, and Tether has been creating USDT for 11 years.

Time is the biggest enemy of stablecoin Layer 1, so stablecoins have chosen a strategy of separating talking and doing:

• Doing: Retail use → Distribution channels → Institutional adoption

• Saying: Institutional compliance → Public popularization

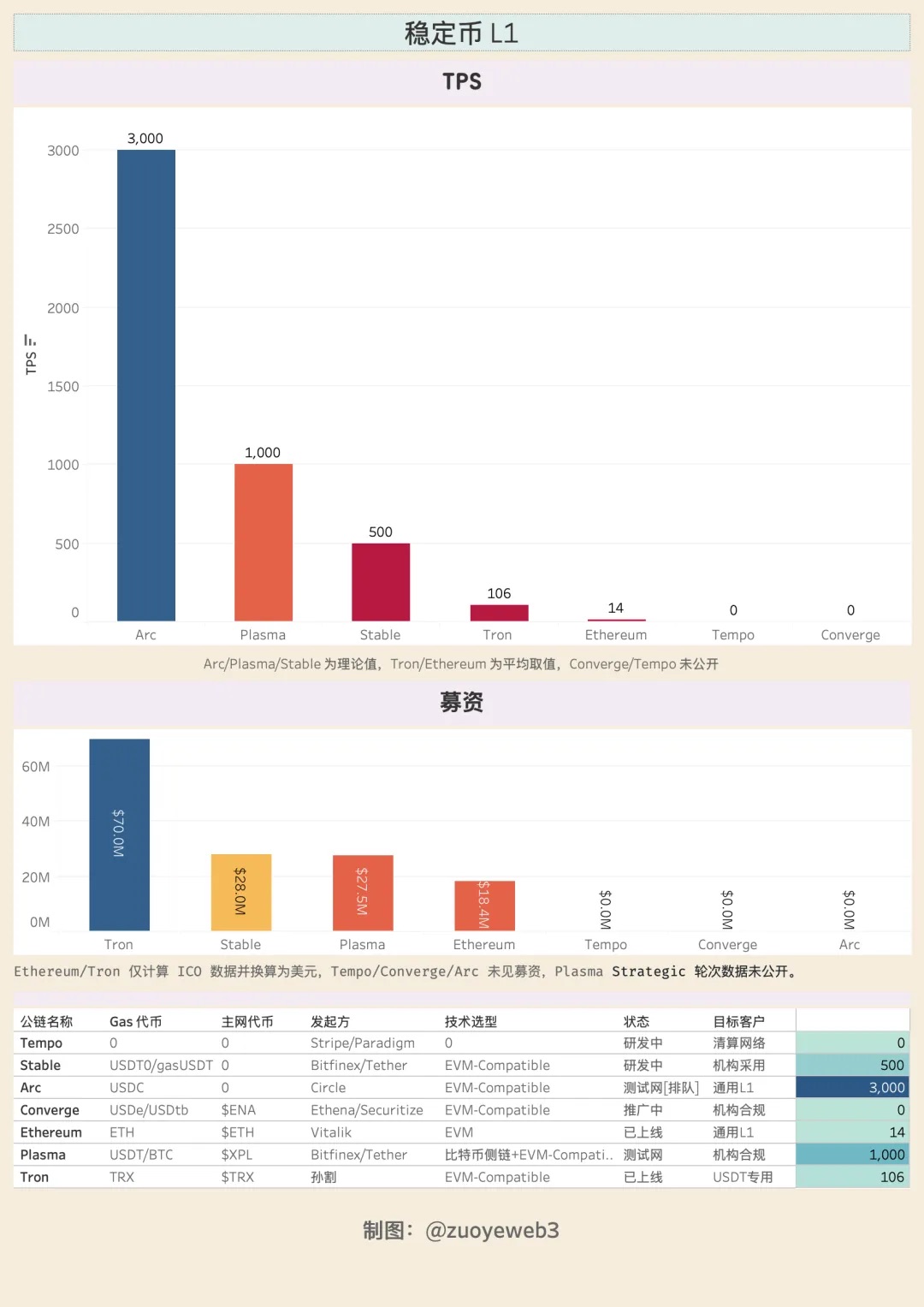

Whether Tempo or Converge, both target institutional adoption. Arc is more focused on the global compliance path. Compliance + institutions is the Go-to-Market strategy given by stablecoin Layer 1, but this is not the whole story. Stablecoin Layer 1 will promote using a more "Crypto" approach.

Plasma and Converge are going to collaborate with Pendle. Circle is subtly pushing 24/7 conversion of yield stablecoins USYC and USDC. Tempo, with Paradigm founder Matt Huang as CEO, is also core to being more blockchain-oriented, rather than more Fintech-oriented.

Institutional adoption has always been a compliance measure, just as Meta claims to protect user privacy. But in real business, users must come first before driving institutional adoption. Don't forget that USDT's earliest and largest user group has always been ordinary people in Asia, Africa, and Latin America, and now it has also entered the institutional perspective.

Distribution channels have never been an institutional strength. Ground marketing armies are the underlying color of the internet.

Image description: Stablecoin Layer 1 Comparison

Image source: @zuoyeweb3

Emerging stablecoin Layer 1 projects either have raised significant funds or are backed by big players. Under Genius Act and MiCA regulations, they basically cannot pay interest to users or acquire customers this way. However, USDe has reached the $10 billion mark within a month by relying on circular lending.

The gap between on-chain yield distribution and user conversion leaves market space for interest-bearing stablecoins. USDe manages on-chain, while USDtb becomes a compliant stablecoin under Genius Act with Anchorage's cooperation.

Yield can greatly promote user adoption, which is a fatal temptation. Beyond the boundaries set by rules is a great arena for each player to show their skills.

Conclusion

Before stablecoin Layer 1, TRC-20 USDT was the de facto global USDT clearing network. USDT is the only stablecoin with real users, so Tether doesn't need to share profits with exchanges. USDC is just its compliant substitute, like Coinbase is Binance's Nasdaq mapping.

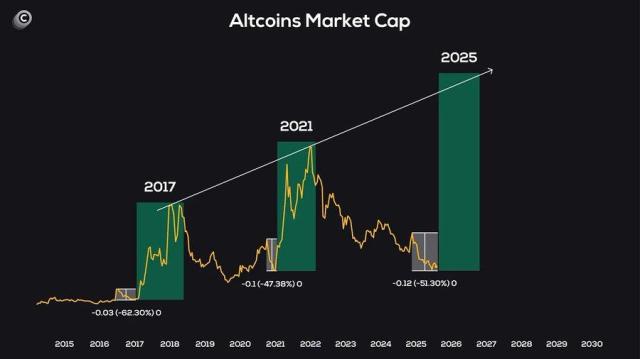

Stablecoin Layer 1 is challenging Visa and Ethereum. The global monetary circulation system is fundamentally being reshaped. Global US dollar adoption rate is declining, but stablecoin Layer 1 has already targeted forex trading. The market is always right, and stablecoins are thirsty to do more.

More than 10 years after blockchain's birth, seeing innovation in the public chain field is already enough to be delightful. Perhaps the most fortunate thing is that Web3 is not Fintech 2.0, DeFi is changing CeFi|TradiFi, and stablecoins are changing banks (deposits/cross-border payments).

Hope that stablecoin Layer 1 remains the heir to blockchain's core principles.