Table of Contents

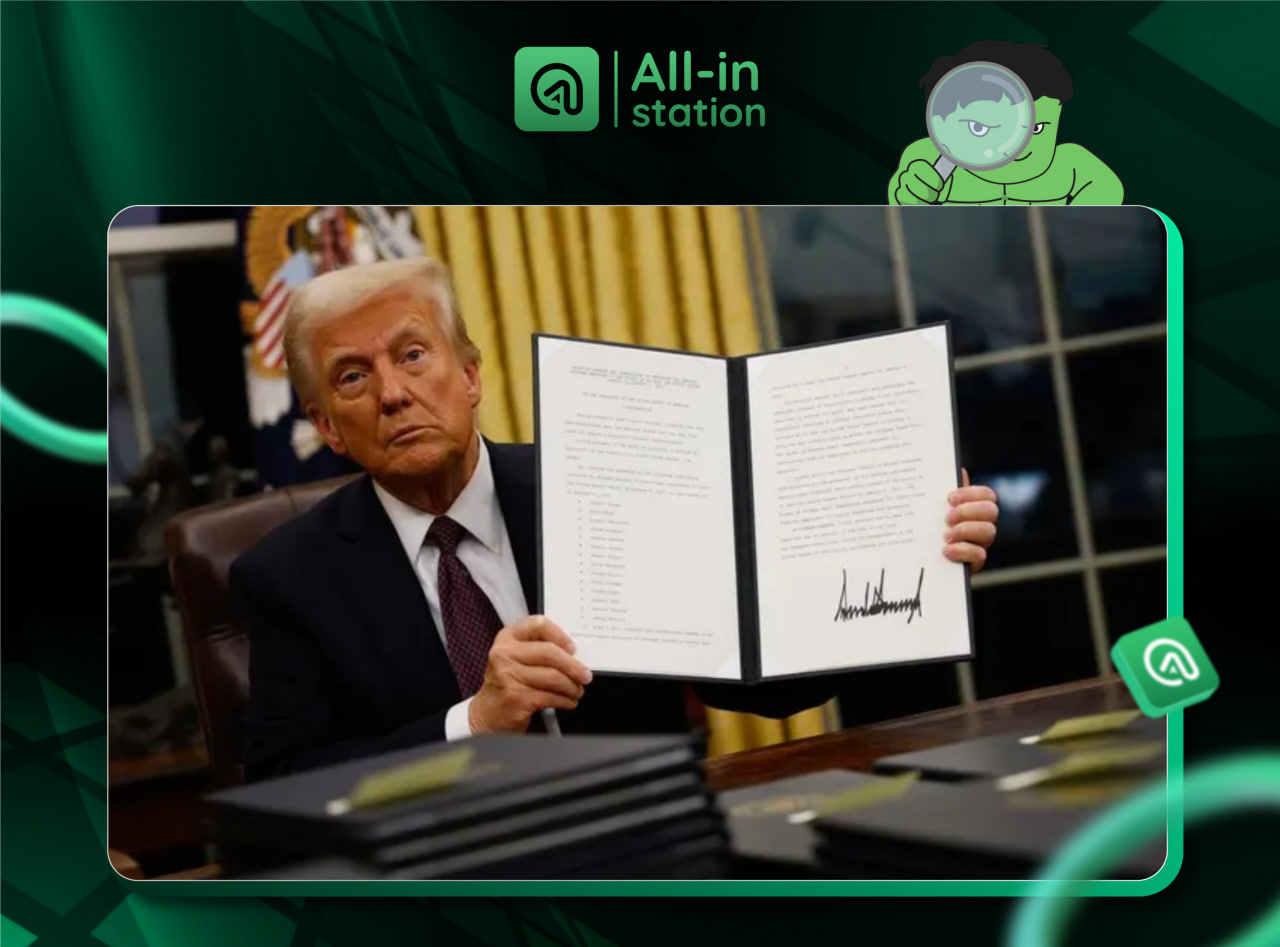

TogglePresident Trump officially signed an executive order allowing 401(k) retirement accounts to invest in digital assets.

On August 7, 2025, President Donald J. Trump – currently in office – signed a groundbreaking executive order: expanding investment scope in 401(k) retirement accounts to include alternative assets such as cryptocurrencies, real estate, and private equity. The order requires the Department of Labor, Securities and Exchange Commission (SEC), Treasury Department, and related agencies to quickly review and adjust current administrative regulations to facilitate this investment channel.

Main Features of the Executive Order and New Commitments of the Trump Administration

This order is considered an effort to "democratize alternative asset access for American workers", helping over 90 million retirement plan participants potentially benefit from higher profit potential and enhanced portfolio diversification. The Department of Labor is tasked with reviewing and potentially repealing previous restrictive guidelines within 180 days, and proposing safe harbor rules to minimize legal risks for 401(k) fund managers.

The SEC is also requested to collaborate with relevant agencies to modify or issue new guidelines, helping individuals access alternative investment funds more legally and safely.

Despite high profit potential, many opinions warn that alternative investment channels like private equity or crypto often have higher management fees, low liquidation, and lack transparency – factors that could increase risks, especially during economic stress. Organizations like Bankrate recommend that long-term savers prioritize traditional index funds as a simple, low-cost, and proven effective solution.

Reactions from the Market and Asset Management Sector

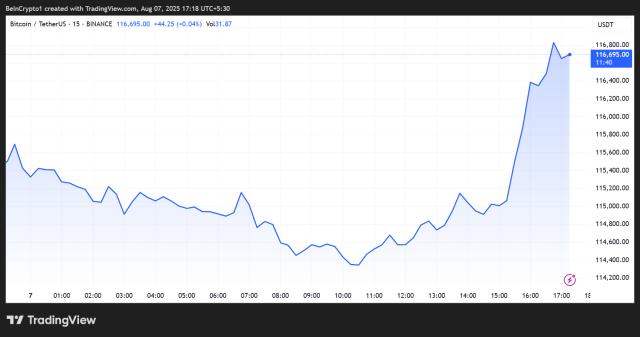

This news created a positive effect on the cryptocurrency market immediately: Bitcoin price increased nearly 2% to over $117,300 – its highest level since late July – Ethereum also rose over 5% crossing $3,870. Large pension funds like BlackRock are preparing to launch new funds in 2026, allocating 5-20% to alternative assets, while Empower plans to implement private asset investment options by the end of this year.

Broader Context: Trump Administration's "Crypto-Friendly" Strategy

This is not the first time the Trump administration has strongly supported the cryptocurrency industry. Previously, in late March 2025, he signed an executive order establishing a "Strategic Bitcoin Reserve" and another digital asset reserve – a move aimed at officially positioning Bitcoin and Ethereum as national reserve assets.

All these actions indicate that President Trump continues to pursue the goal of making the US the "global crypto capital", promoting the digital asset sector and creating an increasingly open investment environment for long-term savers.