Bitcoin (BTC) has recovered the psychological level of 116,000 USD, moving closer to the July peak.

This recovery occurred after a report that US President Donald Trump is preparing to sign an executive order allowing cryptocurrencies and other alternative assets into 401(k) retirement accounts.

Trump's Upcoming Executive Order Pushes Bitcoin Near 117,000 USD

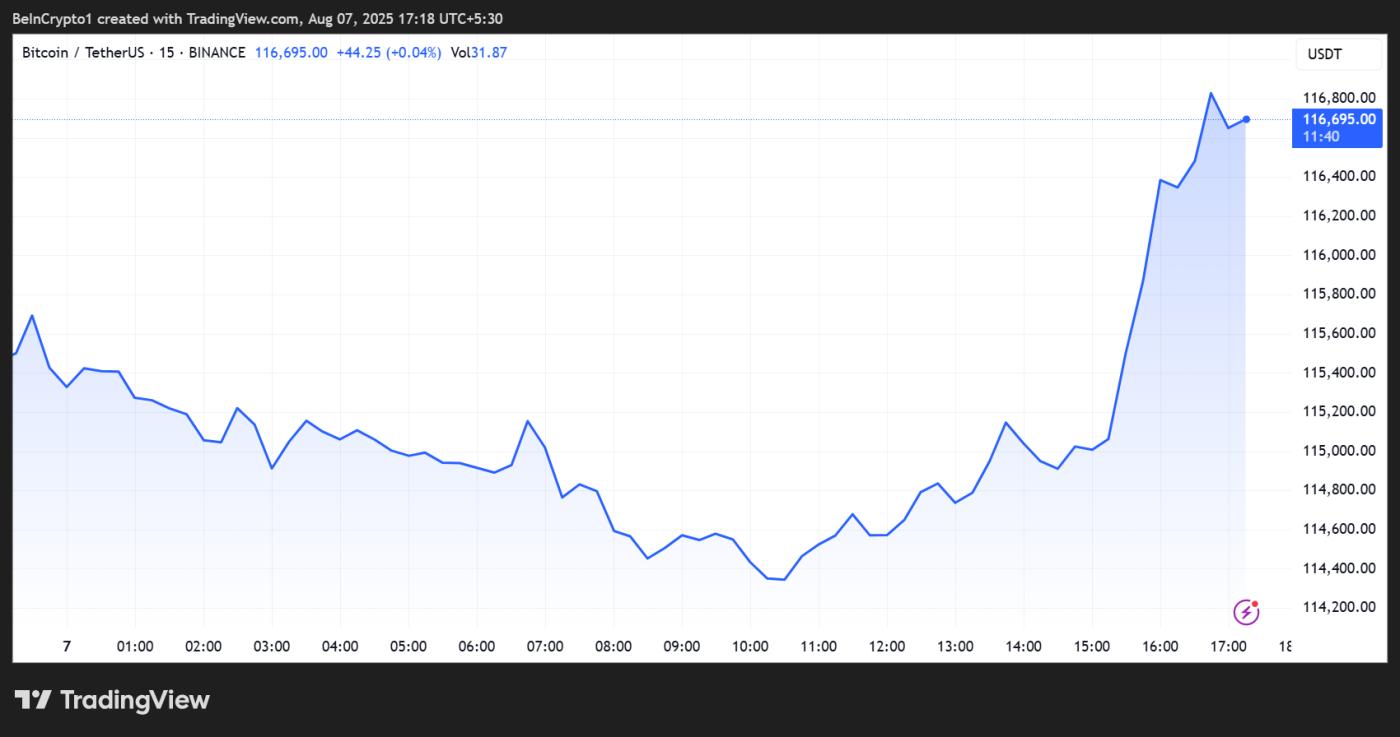

At the time of writing, Bitcoin is trading at 116,695 USD, a significant increase after opening Thursday's trading session around 114,000 USD.

Bitcoin Price Performance. Source: TradingView

Bitcoin Price Performance. Source: TradingViewThis price increase came after a report about an upcoming executive order directing the Department of Labor to reassess guidelines under the 1974 Employee Retirement Income Security Act (ERISA).

Notably, these guidelines traditionally exclude alternative assets like cryptocurrencies, real estate, and private capital from most workers' retirement plans.

Bloomberg reported that the order requires the Labor Secretary to coordinate with the Treasury Department, US Securities and Exchange Commission (SEC), and other regulatory agencies to explore rule changes.

The goal is to reduce legal barriers to introducing cryptocurrencies into defined contribution accounts.

"Very bullish for crypto!" said cryptocurrency analyst Lark Davis on X.

Davis's comment highlights the market's reaction to what could be a significant change in US retirement investment policy. With nearly 12.5 trillion USD held in 401(k) accounts, the potential capital flow into Bitcoin and other digital assets could be substantial.

Institutional investors like pension funds and endowments have long participated in private equity and alternative markets. However, the average US saver has been excluded until now.

This move reflects Trump's broader pro-cryptocurrency agenda for 2025. The order is expected to overturn Biden-era warnings about 401(k) cryptocurrencies.

However, allowing cryptocurrencies in retirement accounts will not be without challenges. Legal experts warn that 401(k) plan managers may face lawsuits related to cryptocurrency volatility and high fees or other illiquid assets.

Difficulties in pricing, custodial risks, limited participant understanding, and constantly changing regulatory oversight are also concerns. Based on this, fiduciary responsibility remains a core issue.

"In the early stages of cryptocurrency history, the Department has serious concerns about the prudence of trustee decisions in allowing plan participants to directly invest in cryptocurrencies or products with values directly tied to cryptocurrencies," the department noted.

Bitcoin's Expanding Role in US Finance

However, supporters argue that the modern financial system has evolved. The public market has significantly narrowed since the 1990s, while private capital has more than doubled in the decade ending in 2023.

As financial innovation accelerates, Trump's order could open up new diversification options for everyday investors. For cryptocurrencies, this move could inject new liquidity into the market, with this optimism driving Bitcoin's recovery.

Beyond 401(k) access, Bitcoin is making quiet but significant progress in another pillar of US finance, the housing market.

BeInCrypto has reported on a pilot initiative to provide Bitcoin-backed mortgages through a new US Housing Credit facility.

This approach allows cryptocurrency holders to use BTC as collateral to access home loans, potentially connecting decentralized finance (DeFi) with traditional credit markets.

However, this is not a complete transformation. Bitcoin mortgage recognition comes with regulatory conditions, including strict loan-to-value ratios, collateral asset liquidity checks, and higher risk disclosures.

US regulators are also concerned about volatility and counterparty risks in cryptocurrency-backed home lending, even as they cautiously approve innovation.