Original Author: TRACER

Compiled | Odaily

Translator | Ethan

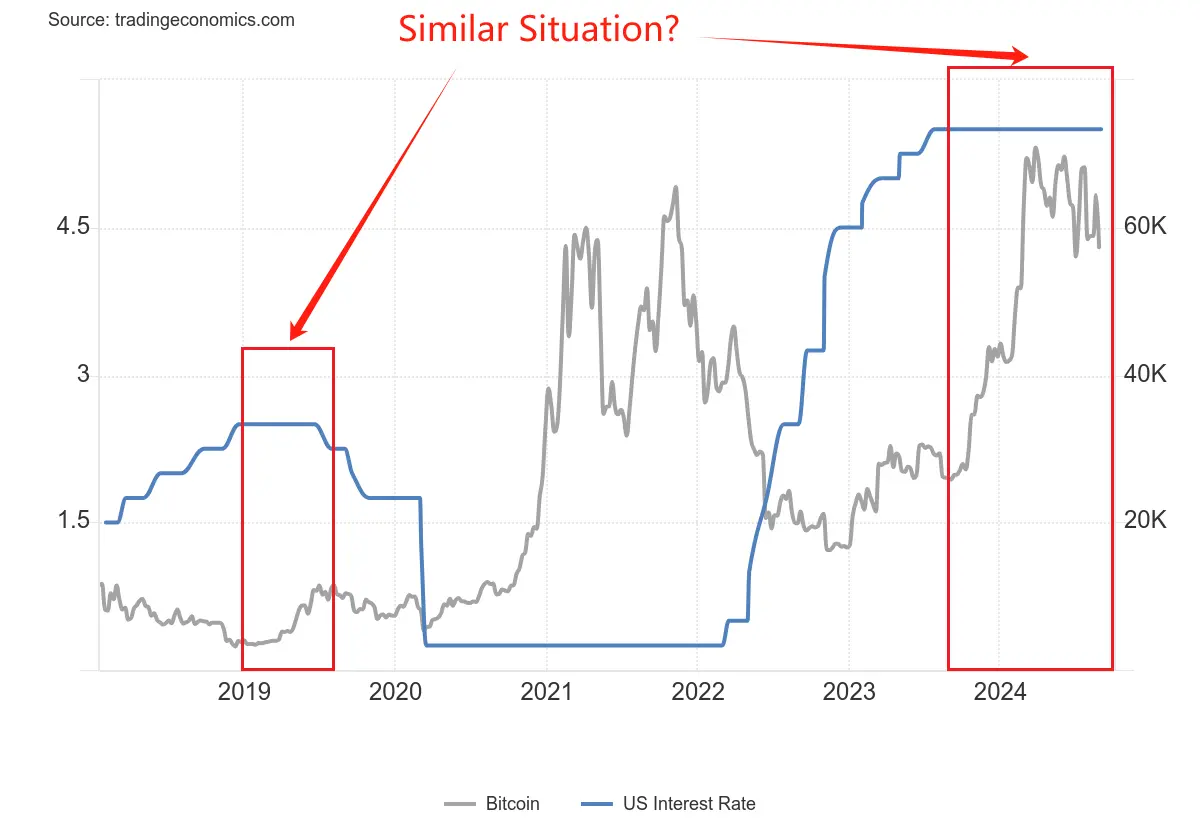

Original Title: Federal Reserve Countdown to Rate Cut, Has the Crypto Market Reached a "Golden Pit"?

Editor's Note: At the start of August, the crypto market once again experienced intense volatility: BTC weakened in the short term, Altcoins generally pulled back 20%-30%, with a single-day liquidation exceeding $1.5 billion. The main driver behind this is reportedly Trump. From new tariff policies and escalating geopolitical friction to macroeconomic data reversal and the Federal Reserve's inaction, the market is once again shrouded in FUD. Meanwhile, rumors of "Trump secretly selling crypto assets" have intensified market panic and triggered a new chain reaction. In this article, the author deconstructs macroeconomic data and capital flows, offering a different perspective: the short-term pullback might be an opportunity for long-term positioning, and the "second wave of bull market" may be brewing.

Note: The views in this article represent a clear stance and are not investment advice. Odaily reminds readers to rationally reference the analysis and make prudent decisions based on their individual circumstances.

Original Content

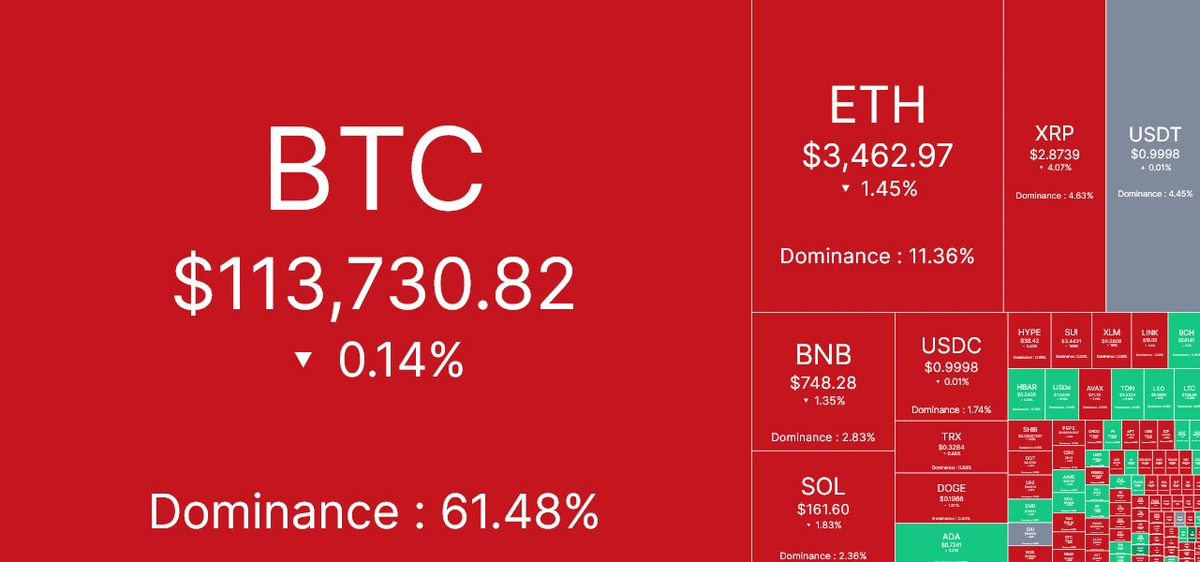

Market optimism has dissipated, and adjustment has quietly arrived, with BTC falling 9% from its historical high and Altcoins generally pulling back 20%-30%.

In early August, the market was suddenly hit by massive selling pressure, with a single-day liquidation scale exceeding $1.5 billion. The core question is: Are the causes of this decline severe? How should we respond?

The core trigger for this pullback lies in the latest developments of US President Trump:

New tariff policy proposals;

Escalating geopolitical uncertainty;

Contradictory macroeconomic data.

First, focusing on the exhausting "new tariff proposal". Over 66 countries are on the potential tariff list - the same old routine. It seems like an "old script repeating" and even gives the impression of "market manipulation".

However, the US government clearly won't risk economic recession merely for these tariffs.

We've seen market pullbacks caused by such operations countless times. Retail investors often view such news as major negative signals and overreact.

Recall how many times such tariff threats have been announced? And how many times has the market subsequently reached new highs?

Therefore, there's no need to be overly concerned; this is an old story.

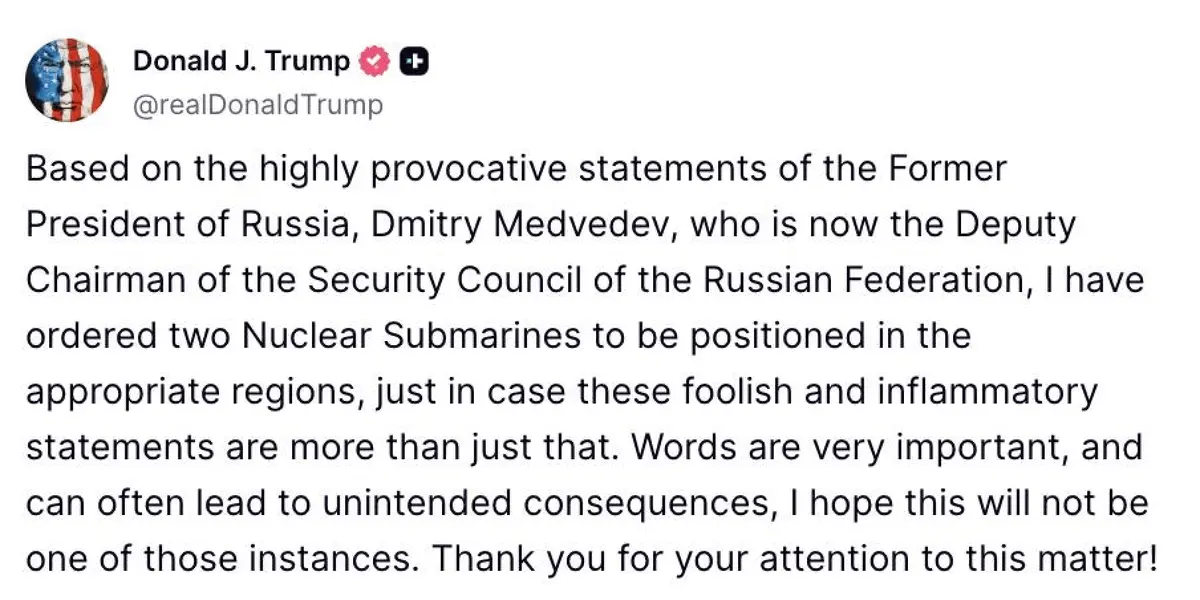

Besides tariffs, recently increased geopolitical risks have also intensified unease. The trigger: the US announced deploying two nuclear submarines near Russia. Is this worrying? Indeed.

But thinking calmly: Does anyone really believe a nuclear war will break out in 2025? This is more likely a "pressure tactic" aimed at pushing forward negotiations.

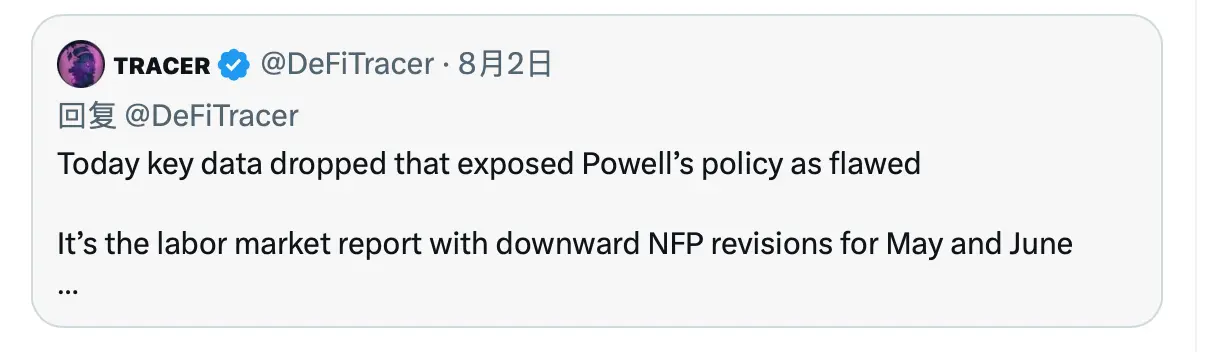

What truly troubles US economic decision-makers (like the Federal Reserve) is the chaotic labor market macroeconomic data.

The market's previous expectation of a "Federal Reserve policy shift" (rate cut) has fallen through.

More critically, the non-farm payroll (NFP) data for May-June was drastically revised down by nearly 10 times, severely shaking market confidence in the overall macroeconomic data reliability.

Ultimately, multiple factors formed a powerful "combination punch":

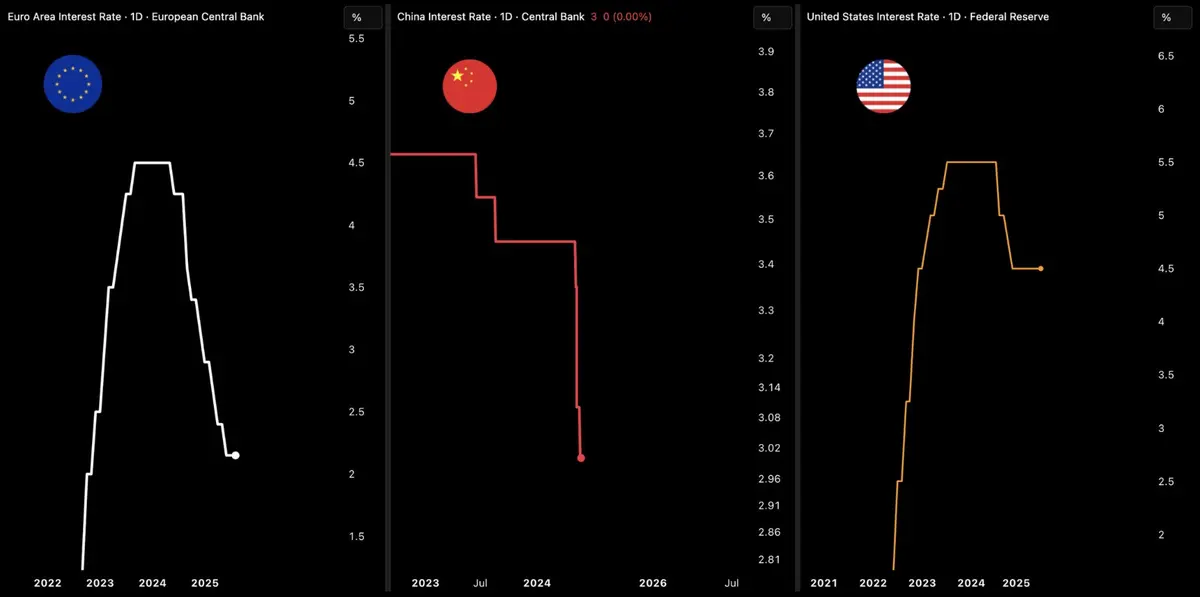

Persistently high interest rates;

Increasing signs of economic cooling.

These factors combined have led to a significant decline in institutional investor demand this week. BTC spot ETF even recorded its first net outflow.

So, what is my judgment on the future market?

My current view is based on the recognition of continuously accumulating macroeconomic pressure. Currently, no major economic entity can create sufficient credit growth to support continuous GDP expansion.

My key support levels are: BTC at $110,000, ETH at $3,200.

I anticipate that by September, the Federal Reserve will have no choice but to initiate rate cuts to restimulate the market:

Inflation data has significantly declined;

The job market is under pressure;

Powell seems intent on delaying the rate cut decision.

As the time point approaches, the market is expected to restart an upward trend.

Historical patterns show that after each such FUD (Fear, Uncertainty, Doubt), the market typically experiences a strong rebound.

Referencing the correlation chart between M2 money supply and BTC price, the conclusion is clear: market trends follow liquidity, and the global liquidity environment remains generally loose.

Therefore, the current volatility is essentially a global market game superimposed with FUD.

Looking towards autumn, with the rate cut cycle beginning, I predict major funds will massively flow back, thereby launching a true "Altcoin season".

At that time, it will be a critical window for actively locking in profits.

This is my current positioning strategy.

In this adjustment, I'm focused on continuously accumulating three assets: BTC, SOL, and ETH.

I'm particularly optimistic about ETH's technical potential and fundamentals, and have noticed increasing institutional interest. On August 3rd, a wallet related to Shraplink again added $36 million worth of ETH, which is one example of proof.

In summary, the strategy is clear: view the current volatility as an opportunity to accumulate positions.

The market landscape is evolving, and such a low-price buying window may not last long. Now is the time to build positions step by step, reserve chips, and await the market from October to December.