At the end of July, when macro signals were densely released over consecutive days, the crypto market is at the crossroads of policy gaming and regulatory reconstruction. In this column, HTX Research Chloe (@ChloeTalk1) interprets and analyzes the unexpected weakening of US non-farm employment, the re-pricing of Federal Reserve policy, and the regulatory paradigm shift triggered by SEC's "Project Crypto", pointing out that core assets like Bitcoin are receiving dual support from macro and institutional dividends.

Non-farm Shift, Policy Expectations Dramatically Changed

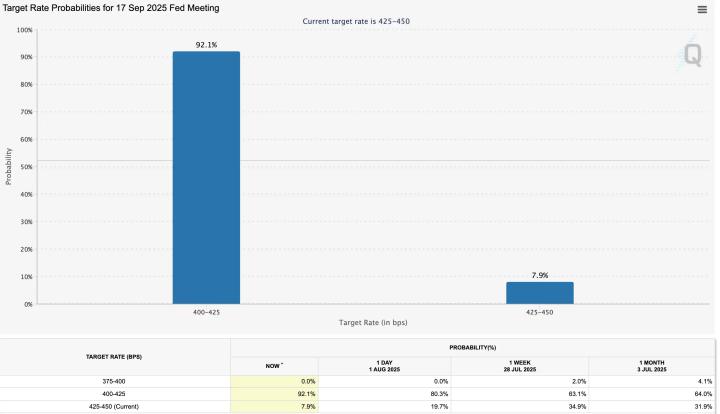

After the July FOMC meeting, the Federal Reserve maintained the interest rate target range of 5.25%-5.50% and refused to provide a rate cut timeline, momentarily causing market concerns about "long-term high interest rates". Consequently, the 10-year US Treasury yield surged to 4.24%, the US dollar index returned above 100, gold dropped below $3,270, and Bitcoin subsequently explored down to the $116,000 range, with on-chain activity simultaneously declining. However, the unexpectedly "collapsed" July non-farm employment report released three days later: new employment only added 73,000 jobs, far below the consensus expectation of 180,000; meanwhile, employment for May-June was collectively revised down by about 90% (129,000), instantly revealing a "systematically overestimated" labor market. The sudden cooling of macro fundamentals triggered a violent re-pricing of the interest rate market: CME FedWatch rate cut probability soared from 38% to 82%, with bets on two rate cuts before year-end rising to 64%. The 10-year yield subsequently fell below 4.10%, gold rebounded $40 in a single day to $3,363, while Bitcoin dropped to a low of 112,000 due to panic from economic recession narratives.

However, in terms of overall economic resilience, multiple structural data indicate that the US is still in the "slowdown" rather than "systemic recession" range: as of the second quarter of 2025, household debt only accounts for 98% of disposable income, significantly lower than the 133% peak during the 2008 crisis; credit card default rates have slightly decreased from 2.7% to 2.5% within the year, with residents' leverage safety cushion still substantial. Retail sales remain stable at 2.8%-3.1% year-on-year, with consumption underpinned by the wealthiest 10% of households—this group controls 72% of the nation's wealth and contributes nearly half of the expenditure. The corporate side remains equally stable, with JPMorgan Chase and Bank of America's latest financial reports showing commercial loans maintaining a 5%-7% year-on-year growth, with no significant increase in bad debt provisions, indicating no systemic credit contraction. Historical experience suggests that such combinations of "marginal employment decline + sticky inflation" often herald a monetary policy transition from tight to loose, with risk assets entering a "high volatility, liquidity gaming" window; core assets like BTC and gold are favored by funds for their hedging value, while Altcoins are constrained by valuation compression and leverage de-risking.

Regulatory Breakthrough, On-chain Finance Benefits

An even more disruptive change comes from the regulatory side. On July 31, the new SEC Chairman Paul Atkins launched "Project Crypto", declaring to make US finance "fully on-chain" and rewriting compliance norms through regulatory relaxation, innovation exemption, and safe harbor mechanisms. He explicitly stated that most crypto assets should not be automatically defined as securities, and that automated market-making and on-chain lending are "non-intermediated financial activities" that should receive institutional recognition. This move releases massive policy dividends for DeFi protocols: Uniswap, Aave, Lido and other highly autonomous protocols gain legalization expectations, with token valuation logic long suppressed by "securities shadows" receiving a repair window.

Atkins simultaneously proposed a "Super-App" license blueprint—allowing operators to integrate traditional securities, crypto assets, staking, and lending services under one license, giving full-stack platforms like Coinbase and Robinhood a first-mover advantage; Robinhood has already launched ERC-20 tokenized stock trading through Bitstamp acquisition, while Coinbase is laying the groundwork for "one-stop on-chain Charles Schwab" through the Base chain. The regulatory draft also specifically names ERC-3643 as a reference template for RWA tokenization, with a standard that natively embeds ONCHAINID identity and permission management, capable of integrating KYC/AML rules, paving the way for trillion-dollar assets like real estate and private equity to safely go on-chain.

More critically, the SEC plans to revise the decades-old Howey test, establishing disclosure exemptions and safe harbors for on-chain native economic activities like airdrops, ICOs, and Staking, truly writing "token issuance does not equal securities" into regulatory guidelines. This means startup teams no longer need to "detour through Cayman" or block US users, with primary capital expected to flow back domestically, and the on-chain venture capital cycle potentially restarting from the United States.

Triple Resonance, Valuation Logic Reshaped

Combining macro loosening re-pricing and regulatory paradigm shift, Bitcoin's role as a "global anti-inflation anchor + policy gaming tool" is further consolidated. From a strategic perspective, BTC and ETH remain the core assets of current market focus, with the market continuously observing BTC market dominance trends and stablecoin exchange rate deviations to determine potential capital allocation directions. For Altcoins and high-leverage strategies, market volatility may intensify when the US dollar temporarily strengthens or long-end interest rates return above 4.4%. Simultaneously, DeFi protocol tokens with clear compliance and real yield models, as well as RWA theme assets around the ERC-3643 standard, may enter a new valuation reshaping cycle driven by policy dividends and actual implementation, becoming a medium-term focus for market participants. Overall, the global crypto market stands at the starting point of "macro slowdown + liquidity loosening + regulatory upgrade" triple resonance—the valuation anchor of core assets is moving upward, and the institutional dividends of on-chain finance are opening the next structural opportunity.

Note: This content is not investment advice and does not constitute any offer, solicitation of offer, or recommendation for any investment product.

About HTX DeepThink

HTX DeepThink is a crypto market insight column meticulously crafted by HTX, focusing on global macro trends, core economic data, and crypto industry hotspots, injecting new thinking power into the market, helping readers "find order in chaos" in the ever-changing crypto world.

About HTX Research

HTX Research is the dedicated research department under HTX, responsible for in-depth analysis of cryptocurrencies, blockchain technology, and emerging market trends, writing comprehensive reports and providing professional assessments. HTX Research is committed to offering data-driven insights and strategic foresight, playing a crucial role in shaping industry perspectives and supporting wise decisions in the digital asset domain. With rigorous research methods and cutting-edge data analysis, HTX Research consistently stands at the forefront of innovation, leading industry thought development and promoting deep understanding of constantly changing market dynamics.