@0xSunNFT

On July 29, the "Altcoin Microstrategy" collectively plummeted, sparking discussions among traders about its sustainability. Currently, most traders remain optimistic about the "ETH Microstrategy" but are more cautious about other "Altcoin Microstrategies".

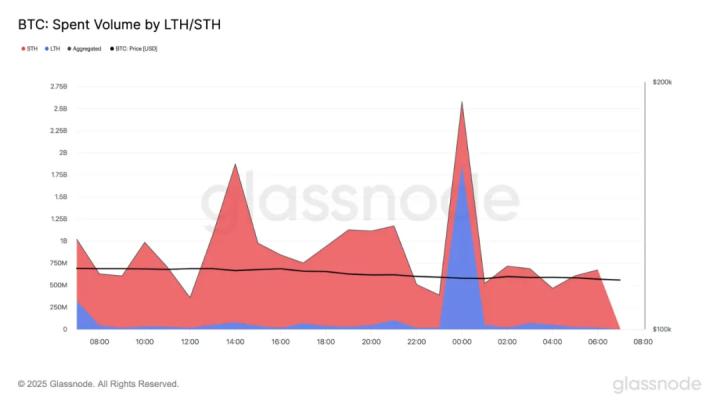

Trader @0xSunNFT pointed out that ETH has been the core engine of this round of price increase since late June, driven by two main forces: first, institutions imitating MicroStrategy are massively buying ETH through crypto-stock financing; second, the warming up of stablecoin narrative, with ETH being the core infrastructure and settlement layer.

Referencing the previous process of MicroStrategy driving BTC prices upward, most Altcoins ultimately failed to outperform Bitcoin. For the ETH Microstrategy, the funds invested by crypto-stocks and institutions are unlikely to spillover to other Altcoins. Data shows that according to CMC statistics, among the Top 200 tokens in the past 30 days, only 20 tokens have risen more than ETH, and these are mostly specific cases driven by favorable events like Bonk, Zora, CFX, and ENA.

In Altcoin selection, the strategy still follows the previous short logic: prioritizing targets with high market cap, non-leading positions, weak trends, and low presence, and adopting a diversified short approach with strict stop-loss to prevent sudden surges in single targets.

Looking ahead to the second half of the year, if the market continues its bull market pattern, ETH will likely lead the way; if it turns bearish, Altcoins may struggle, while ETH will at least have institutional buying providing some bottom support.

Click to learn about BlockBeats job openings

Welcome to join the BlockBeats official community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Twitter Official Account: https://twitter.com/BlockBeatsAsia