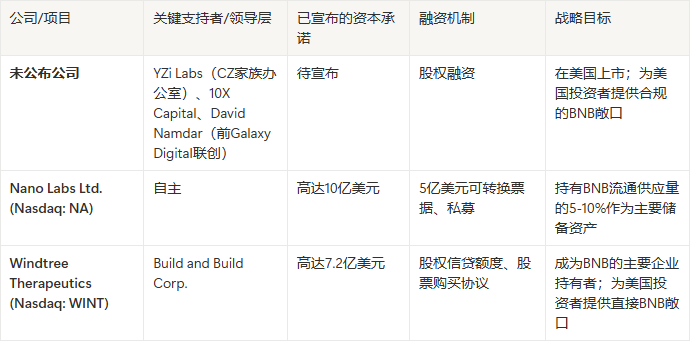

Meanwhile, a market rumor sparked widespread discussion: "CZ established a listed company, holding 28% of shares, and raised funds for a BNB micro-strategy". The rumor quickly spread, suggesting CZ was directly involved behind the scenes. Facing market speculation, CZ himself briefly responded on social media X (formerly Twitter) with a single word: "scam / fake". This response initially confused the market, but soon, more detailed analysis clarified the facts: CZ's response was not denying the entire BNB reserve strategy, but precisely refuting the inaccurate information that "he personally established a listed company and raised funds". A more accurate interpretation is: There is indeed a new company with BNB as a strategic reserve, with David Namdar as CEO, 10X Capital as asset manager, and CZ's family office YZi Labs as one of its investors, not a direct operator. This distancing both aligns with CZ's current legal status and explains why he defined rumors directly attributed to him as "fake".

Beyond this main storyline, a "pioneer fleet" composed of trailblazers has set sail, demonstrating impressive capital firepower. Nasdaq-listed Chinese chip design company Nano Labs announced a BNB acquisition plan of up to $1 billion, funded by a $500 million convertible note issuance, with the goal of long-term holding of 5% to 10% of BNB circulating supply. Recently, the company has purchased 120,000 BNB through over-the-counter (OTC) trading, with a total value of approximately $90 million. Another Nasdaq-listed company, biotechnology firm Windtree Therapeutics, also announced a transformation, securing financing commitments of up to $720 million through equity credit lines, most of which will be used to purchase and hold BNB.

What truly reveals the scale of ambition is information CZ revealed on another occasion: "Over 30 teams" are exploring the establishment of listed companies with BNB reserve assets. This indicates that what we are seeing is no longer isolated cases, but an emerging, coordinated capital movement.

Compared to TRON's single-point breakthrough approach, BNB's "constellation" strategy is clearly more advanced. By cultivating a decentralized network of listed companies, it builds a more resilient and scalable capital bridge. This structure disperses risks, avoids dependence on a single entity, and creates continuous demand for BNB from multiple dimensions, representing a profound practice of applying Web3 decentralization thinking to solving traditional financial interface problems.

Multi-Party Win-Win: Building a Value Flywheel

Behind this strategic shift lies a precise, multi-party win-win value model. It cleverly combines BNB assets, core stakeholders, and traditional capital market needs, forming a powerful positive cycle.

First, for the BNB asset itself, this strategy creates an unprecedented "permanent demand pool". When BNB is written into multiple listed companies' balance sheets, its identity transforms from a simple, chain-activity-dependent functional token to a digital commodity or strategic reserve asset endorsed by institutions. These purchases by listed companies, typically driven by capital market tools like stock or convertible bond issuances, are structural and long-term, not short-term speculative actions. This provides solid bottom support for BNB's price and introduces a grand narrative based on institutional asset allocation to its valuation model.

Second, for CZ and the entire ecosystem, this is an extremely wise layout in the post-regulatory and settlement era. By investing and supporting through his family office YZi Labs, he can maintain legal and operational distance from the Binance exchange where he has resigned as CEO, thereby continuing to promote the BNB ecosystem development while complying with legal agreements. As one of the largest BNB holders, this strategy allows the value of his core assets to rise with the success of the entire "BNB reserve constellation" without directly selling tokens in the open market, perfectly balancing personal legal constraints with maximizing ecosystem economic influence.

Finally, for traditional capital markets, this model solves the core "access" challenge. Many institutions and individual investors cannot directly invest in crypto assets due to compliance and custody issues. However, purchasing a stock traded on Nasdaq, such as Nano Labs (NA) or Windtree (WINT), is a simple, mature, and fully compliant operation. These listed companies act like a "converter", encapsulating the complexity of the crypto world and providing a seamless interface for traditional capital, potentially guiding trillions of global stock market funds into the BNB ecosystem.

Dawn of a New Paradigm

In summary, BNB's recent price breakthrough is not without source or foundation. It is an external signal of BNB's profound transformation: from a compliance-constrained exchange functional token to an institutional-grade reserve asset supported by public market capital. This transformation path is not through traditional direct IPO, but by borrowing and surpassing TRON's financial techniques, innovatively building a "reserve asset constellation" composed of multiple listed companies.

This model is poised to form a powerful value flywheel: listed companies buy BNB, driving price increases; BNB price increases enhance these companies' asset values, thereby boosting their stock prices; higher stock prices make it easier to raise capital in the market; newly raised funds can then be used to buy more BNB. Once this self-reinforcing cycle forms, it will provide continuous growth momentum for BNB.

More profoundly, BNB's practice may signal the birth of a new paradigm - "Asset-Backed Network". In this model, the value of a mature decentralized network is no longer defined solely by its on-chain economic activity, but more by the asset value anchored behind it and flowing in compliant capital markets. This perhaps points to a new direction for how mainstream crypto ecosystems can deeply integrate with the global financial system and draw strength from it. Therefore, the BNB historical high we see may not be the endpoint of this market trend, but the beginning of a more grand narrative.