Globally, an increasing number of listed companies are rushing to buy cryptocurrencies (mainly BTC and ETH). Companies like sharpLink Gaming, Upexi, and GameStop have announced the inclusion of Bitcoin or Ethereum in their corporate treasury, successfully driving significant stock price increases and bringing the term "crypto reserves" back to media headlines.

Operating Mode: The Hidden Channel of Crypto Stock Swaps

In fact, after the Bitcoin spot ETF was listed last year, institutions can directly buy crypto assets, and theoretically, companies should not need to take risks by writing coins into their books. However, the latest round of announcements shows demand is not decreasing but increasing.

A recent Forbes article warns that on the surface, companies claim to spend billions of dollars buying cryptocurrencies, but the actual operation often has different arrangements... Crypto analyst Ran Neuner describes this type of transaction process:

Imagine someone comes to ask you, "Do you have ETH?" You tell me, yes, you have 10 ETH.

I say, why don't you give me those 10 ETH, which are now worth $35,000, and I'll give you $35,000 worth of stock in my new company... Once we announce to the market that this is an ETH-funded company, the stock you receive will be valued at three times the net asset value.

The key lies in the "funding source": In most cases, companies do not use cash to buy in the market, but instead allow internal executives, early investors, or related parties to "contribute" their held coins through over-the-counter transactions. The company thus obtains crypto assets and issues a grand press release.

Contributors receive publicly traded stocks in exchange, waiting to cash out after market speculation is ignited.

Neuner provides a concrete example: Upexi claims to have accumulated 1.9 million Solana tokens, but a large part may have come from purchasing locked Solana at a discount below market price, or direct contributions from crypto investors, rather than open market purchases.

When you look at the investor lists of these treasury management companies, you'll find they are filled with native crypto funds like Arrington Capital, Electric Capital, and Pantera.

"They all hold ETH. So what they do is put ETH into investment tools, then buy shares at net asset value, with these shares opening at 20 times net asset value, and then they cash out their original investment."

Risks: Leverage and Premium Resonance

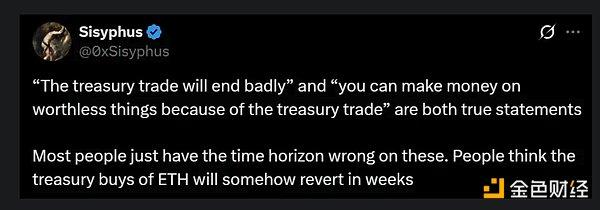

When stocks become "wrapping paper" for crypto assets, prices are no longer influenced only by company fundamentals, but also by cryptocurrency price fluctuations and market sentiment.

Recently, the stock prices of companies announcing crypto purchases are priced at 2 to 4 times the net value of an equivalent amount of Bitcoin or Ethereum. In other words, retail investors are paying $3 for stocks for every $1 of cryptocurrency. This gap might be temporarily ignored in a bull market, but once crypto prices retreat, stocks will face a double impact of "premium contraction" and "cryptocurrency price decline".

Looking back at the 2017 ICO craze and the 2021 Luna and FTX collapses, excessive leverage always reveals itself when capital recedes. Although this wave does not involve complex derivatives, the stock × crypto structure already has inherent leverage attributes, with amplification effects immediately apparent with even slight price fluctuations.

How Retail Investors Should View This Wave

History repeatedly shows that when insiders cash out at high prices, the last to pay are the latest investors. Standing at the 2025 point, facing a stock that has risen due to the "buying crypto" narrative, first answer a simple question: Why should I pay three times the price for the same crypto assets? If you can't find a compelling reason, perhaps take a deep breath before pressing the buy button.

Investors should first confirm the funding sources and purchase methods of these enterprises, observing whether announcements include audit proof or are vague. If you find that primary assets come from internal "contributions", recognize this might be a price difference transaction of transferring coins to the market.

Enthusiasm will always dissipate, and numbers will eventually align. Maintaining skepticism and patience is key to navigating the next bull and bear market cycle.