The Bank of Korea's Central Bank Digital Currency (CBDC) experiment 'Project Han River' is approaching the end of its first test. This experiment involved converting bank deposits into digital tokens and using them for actual payments, applying blockchain-based smart contract technology. Through Project Han River, the potential for administrative innovation such as digital vouchers and conditional payments was confirmed, but complex authentication procedures were noted as a drawback. Additionally, integration with local currencies remains a challenge.

■More Than 70,000 Digital Wallets Opened

As of the morning of the 19th, about ten days before the end of the first CBDC Project Han River test, wallet creators reached 75,000. Although this falls short of the initial 100,000 target, it is considered a positive outcome for an experimental stage. Total transaction volume was around 86,000, with approximately 45,000 payments made at offline stores. However, some participants opened wallets but did not engage in payments.

The test, which began on April 1st, will run for about two months until June 30th. Follow-up tests are expected after incorporating improvements. The next experiment may consider diversifying voucher programs and peer-to-peer transfer functions. The Bank of Korea plans to determine specific implementation timing and scope through consultations with the Financial Services Commission, Financial Supervisory Service, and participating banks.

■Complex Authentication, Simple Payment

Users can download a wallet app from participating bank apps, tokenize their deposits, generate a QR code, and pay when purchasing items.

The payment process itself is as simple as other payment systems. However, CBDC-based deposit token payments involve cumbersome procedures like password entry, and the QR code's time limitation makes unmanned payment machines challenging.

The Bank of Korea explains that CBDC differs from general systems by enabling complex administrative functions like conditional payments, automatic settlement, and smart vouchers. For instance, processes like manual discount and point issuance, expense settlement, and youth lunch vouchers can be automated through smart contracts.

These experiments are also connecting to actual projects. For example, Busan City, Busan Bank, and Silla University are collaborating on a student voucher experiment, with potential for developing a policy support payment platform for youth and students.

■Designing Usage Incentives Remains a Challenge

Deposit token-based payments can be very attractive for merchants, as funds are immediately deposited with no transaction fees. Seven Eleven, participating in Project Han River, offered a 10% discount on all items to encourage usage.

However, in an environment where easy payment and card services are already established, consumers find it difficult to perceive the necessity of deposit tokens. Some Busan citizens responded that they would not use it unless integrated with the local currency Dongbaek.

A CBDC representative from Busan Bank, the only local bank participating in the experiment, stated that CBDC deposit tokens and Dongbaek have different legal characteristics and payment network structures, making simple integration challenging.

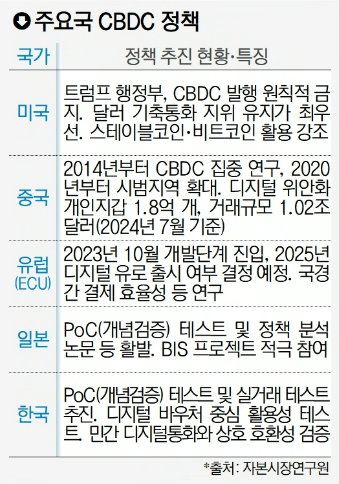

■What About Major Countries?

Major global countries are accelerating experiments with next-generation payment systems using CBDC. Singapore, Hong Kong, and China are demonstrating various models in collaboration with the Bank for International Settlements (BIS), including cross-border payments, large-value settlements, and physical asset digitization. China is particularly advanced, with digital yuan (e-CNY) already recording 180 million personal wallets and over $1 trillion in cumulative transactions.

In contrast, the United States has officially opposed CBDC since Donald Trump's potential return, effectively withdrawing from related projects. Trump has opposed CBDC since his candidacy, concerned it might weaken the US dollar's status.