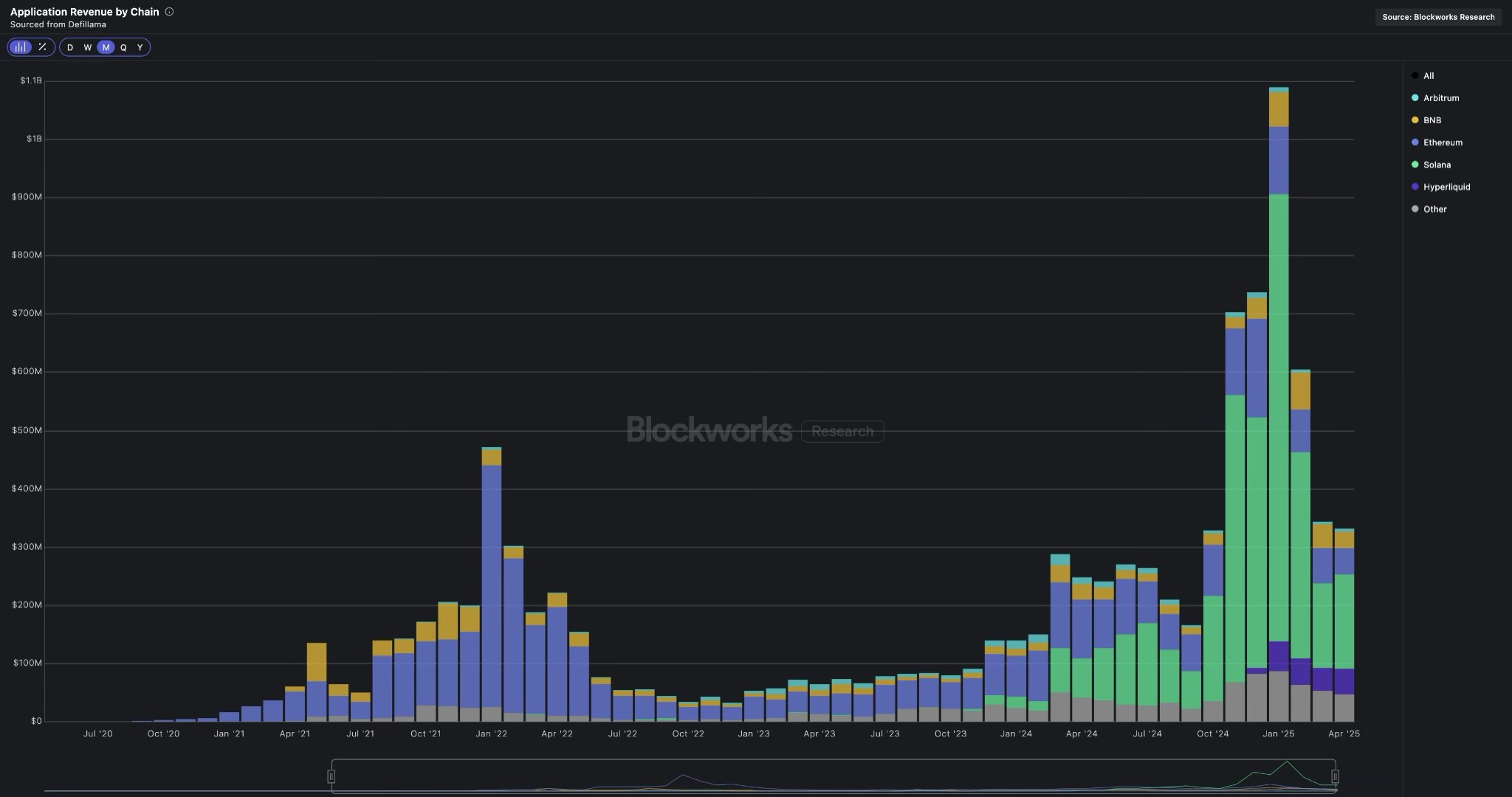

Solana continues to build momentum in 2025, with the blockchain exceeding $1 billion in application revenue for two consecutive quarters.

The latest network health report from the Solana Foundation was released on June 20th, highlighting the blockchain's accelerated economic performance. According to the report, improvements in protocol efficiency, developer engagement, and validator incentives support this growth.

Solana, a High-Revenue Blockchain Thanks to Meme Coins

According to the report, Solana app revenue peaked in January 2025. It generated over $806 million in a single month.

In February, it recorded $376 million, surpassing $1 billion in total app revenue for that quarter.

The primary factor for this surge is that the blockchain network has become a hub for meme coin trading. The meme coin launchpad platform Pump.fun has emerged as a dominant force within the ecosystem.

Additionally, the launch of viral political tokens like Trump and Melania meme coins increased user activity and fees across the network.

According to the report, these tokens not only followed social trends but also generated actual fees, significantly contributing to the network's GDP-style app revenue indicator.

Considering this, fees from decentralized exchanges and other on-chain services have become key indicators of Solana's economic activity.

This increasing revenue encourages developers to stay on Solana. It also allows the network to reinvest in critical infrastructure, enabling the ecosystem to evolve to meet user demands.

Solana Exceeds Ethereum by 70x in TPS

The report also highlighted the blockchain's advantage in developer acquisition.

In 2024, it was the top blockchain for new developers, maintaining over 3,200 active contributors monthly and recording 83% growth in developer engagement compared to the previous year.

Solana's stability played a crucial role in driving this trend. The network maintained 100% uptime for 16 consecutive months, including a period when it set daily transaction volume records, reaching $39 billion in January 2025.

Meanwhile, the network's key technical improvements reduced the average relay time to below 400 milliseconds, a significant leap compared to the previous year.

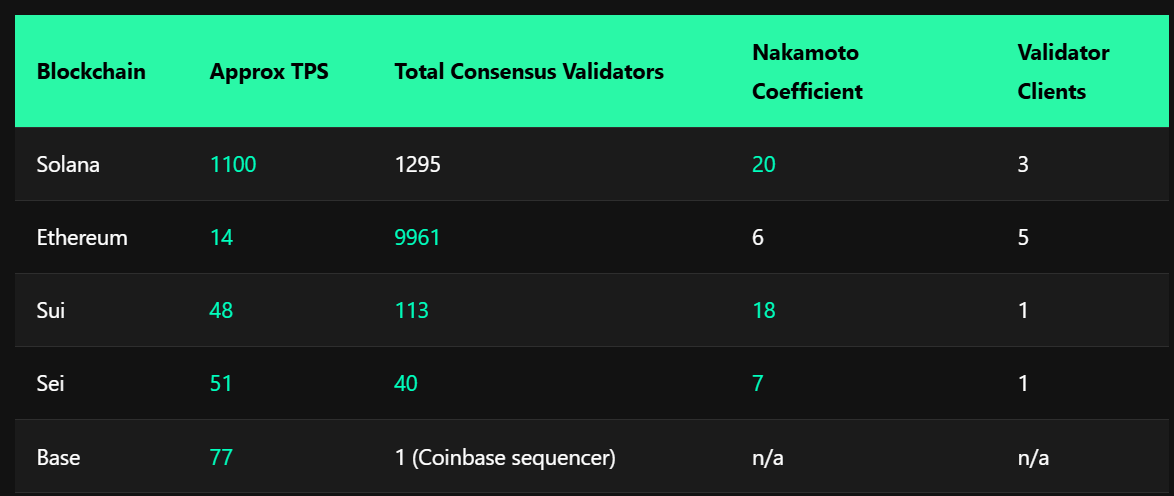

Transaction throughput remains a standout metric, with Solana processing about 1,100 transactions per second. This far surpasses Ethereum's average of 14 TPS.

Validator rewards accordingly set a record for Real Economic Value (REV) at $56.9 million on January 19th.

The average quarterly REV is now around $800 million, and the staking breakeven point has decreased from 50,000 SOL in 2022 to 16,000 SOL this year.

Solana validators are thriving. REV hit an all-time high of $56.9M on January 19, 2025, with quarterly REV now averaging ~$800M.

— Solana (@solana) June 20, 2025

In three years, breakeven stake has dropped from ~50k SOL (2022) to just 16k SOL (2025). pic.twitter.com/advfI9r9ej

Overall, Solana's steady growth in performance, developer retention, and revenue generation indicates a rising network. These improvements suggest that Solana is developing into one of the most sustainable ecosystems in the industry.