The popular altcoin Solana has risen by 2% over the past 24 hours. This is a sign of recovery in the overall cryptocurrency market.

However, beyond the general market recovery, SOL's rise was triggered by an implied increase in institutional interest in the coin and its ecosystem.

Solana Rally Preparation? Momentum from Nasdaq Filing

According to the Form 40-F filed on June 18, Sol Strategies, a Canadian asset management company focused solely on the Solana ecosystem, submitted compliance documents to the U.S. Securities and Exchange Commission (SEC). This indicates their aim to be listed on Nasdaq.

While still awaiting approval, this filing is a bold step to provide institutional investors direct exposure to Solana-based assets through traditional markets. This development has triggered a new wave of cautious optimism among SOL holders, driving today's price increase.

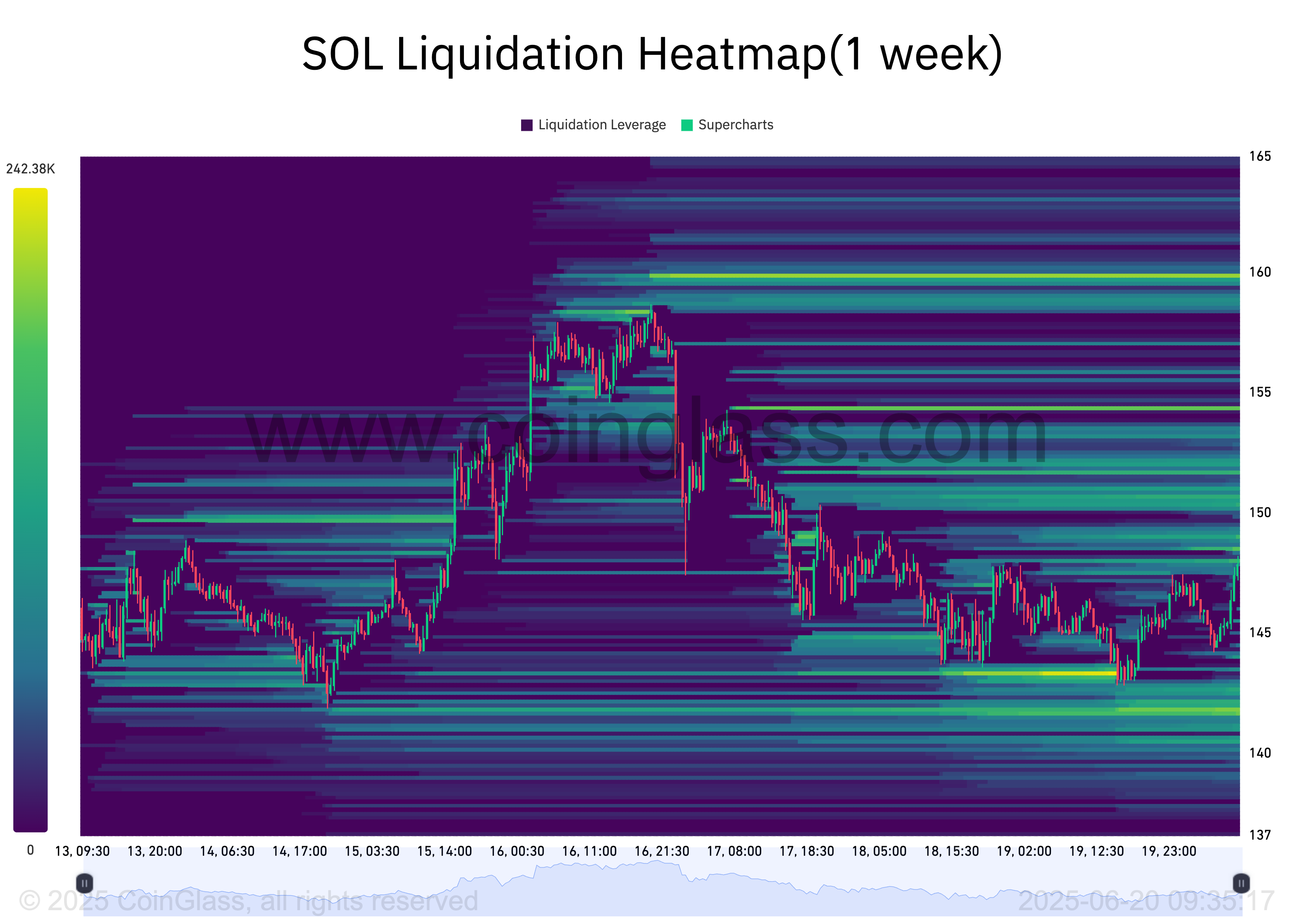

Additionally, the timing of this filing coincides with increasingly bullish on-chain signals, such as the coin's liquidation heatmap, which shows a liquidity cluster concentrated around the $160 level.

A liquidation heatmap is a visual tool used by traders to identify price levels with a high probability of leverage positions being liquidated. This map highlights high liquidity areas, often distinguished by color to indicate intensity. Brighter areas represent a higher likelihood of liquidation.

Typically, these price levels act as magnets for price movement. The market tends to move to these areas to trigger liquidations and open new positions.

For SOL, the concentrated liquidity cluster around the $160 level suggests strong trader interest in buying at that price or covering short positions. This sets the stage for a potential short-term rally to that area.

Moreover, SOL's open interest (OI) has increased by 3% over the past day, indicating increased leverage participation in SOL futures.

The increase in open interest suggests more capital is flowing into the coin's derivatives market, reflecting growing trader confidence in SOL's potential price increase.

New Demand, Potential to Break $160?

Since early June, SOL has been trading within a narrow range, facing resistance at $153.59 and support at $142.59. A potential rise to $160 would require definitively breaking this resistance, which is only possible with new market demand entering.

Without new buying pressure, the current momentum could stall. If buyers start showing signs of fatigue, SOL risks reversing recent gains and retesting support at $142.59.

A drop below this level could open the door for SOL coin to undergo a deeper correction to $134.68, potentially lasting until the end of the second quarter.