In the past 24 hours, a large-scale liquidation of leveraged positions occurred in the cryptocurrency market. According to recent 4-hour data, approximately $87 million (about 12.7 billion won) worth of positions were liquidated.

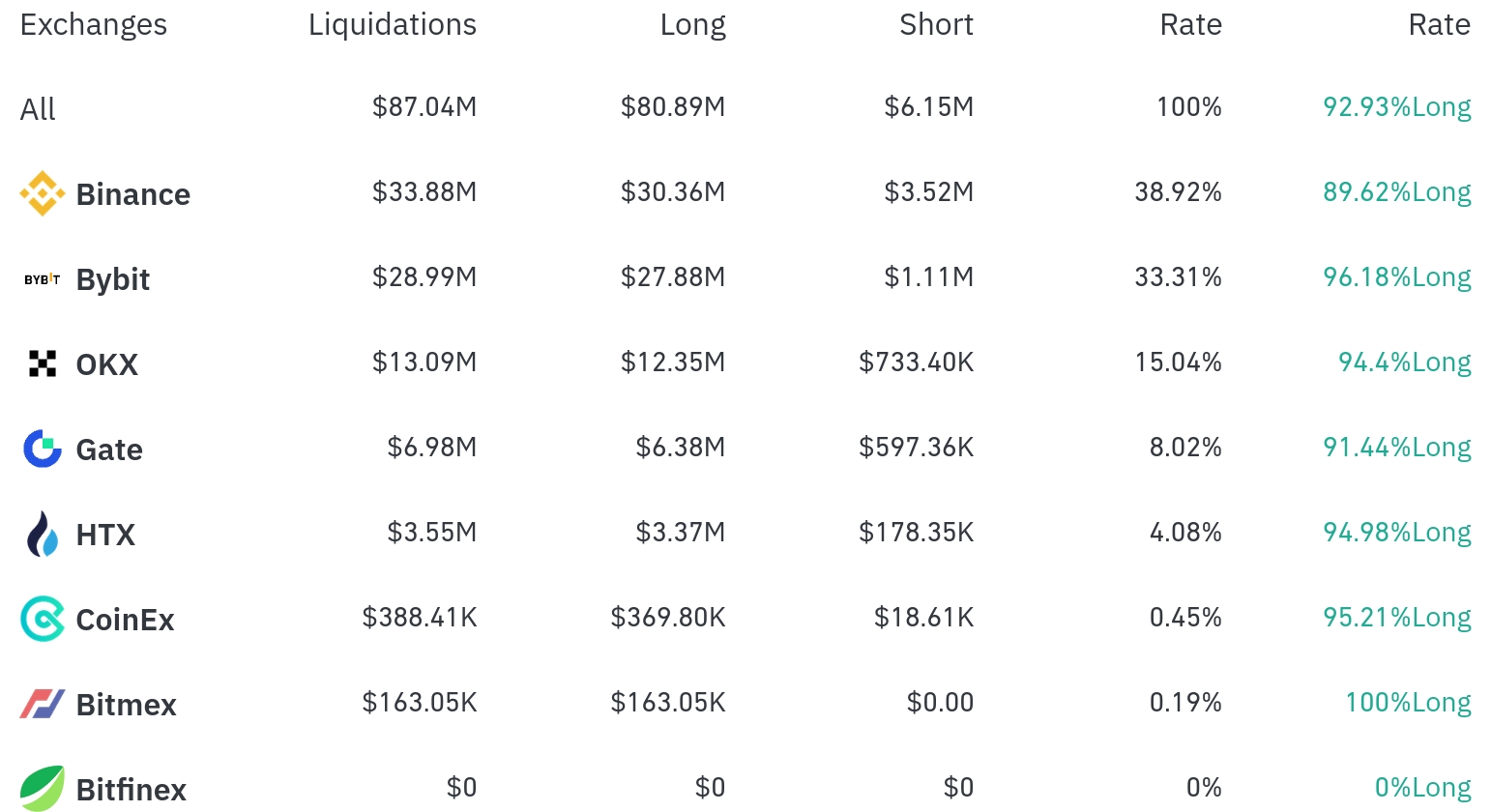

Exchange-specific liquidation data shows that Binance had the highest liquidation at $33.88 million (38.92% of the total), with long positions accounting for $30.36 million or 89.62%. The second-highest liquidation occurred on Bybit, with $28.99 million (33.31%) of positions liquidated, of which long positions were 96.18%.

OKX saw approximately $13.09 million (15.04%) in liquidations, with long positions at 94.4%. Gate experienced $6.98 million (8.02%), and HTX had $3.55 million (4.08%) in liquidations.

Notably, all liquidations on BitMEX were long positions (100%). Meanwhile, most exchanges recorded long position liquidation rates of over 90%, indicating strong downward market pressure.

By coin, Bitcoin (BTC) had approximately $21.20 million in long positions liquidated in the past hour, and $27.23 million in long positions and $2.79 million in short positions liquidated over 4 hours. Bitcoin's price is currently trading at $102,780, down 0.84% in 24 hours.

Ethereum (ETH) saw about $17.52 million in long positions liquidated in one hour, with $42.57 million in long positions and $8.95 million in short positions liquidated over 4 hours. In total, $51.52 million was liquidated in 24 hours, the highest liquidation amount. Ethereum is currently trading at $2,404, down 0.88%.

A notable altcoin is FARTCO, which experienced an 8.10% price drop and liquidations of $4.25 million in long positions and $6.02 million in short positions over 4 hours. Solana (SOL) is trading at $138.49, down 1.70%, with $6.41 million in long positions liquidated over 4 hours.

Doge (DOGE) is trading at $0.158, down 3.04%, with $3.77 million in long positions liquidated over 4 hours. The TRUMP Token is trading at $9.091, down 2.55%, with approximately $7.15 million in long positions liquidated over 4 hours.

This large-scale liquidation signals increased volatility in the cryptocurrency market, with the overwhelmingly high rate of long position liquidations suggesting that market participants' optimistic outlook is being adjusted. Investors need to pay more attention to risk management when trading with leverage.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>