As geopolitical tensions escalate in the Middle East, the cryptocurrency market experienced significant volatility this week.

However, large holders, often referred to as crypto whales, remain actively engaged and are carefully accumulating specific tokens with strong upside potential. Their choices include Ethereum (ETH), Bitcoin Cash (BCH), and Dogecoin (DOGE).

Ethereum (ETH)

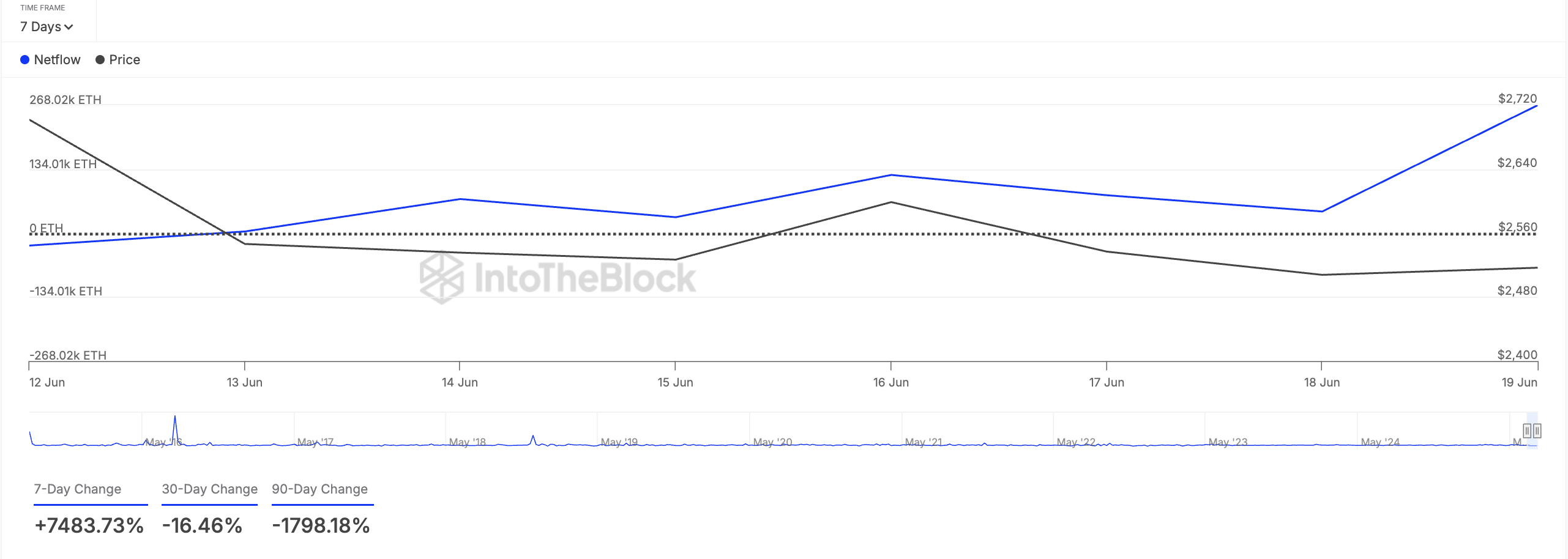

Despite minimal price performance this week, ETH is one of the primary assets purchased by crypto whales as the market navigates intense volatility. According to IntoTheBlock data, this is highly convincing, as whale investor net inflows increased by over 7,000% in the past 7 days.

IntoTheBlock's whale investor net inflow measures the difference between tokens bought and sold by large holders during a specific period. An increase in this figure indicates strong accumulation by whales, suggesting increased confidence in the asset or an upward outlook.

If this trend continues, the altcoin could initiate a new upward phase, potentially breaking through the $2,500 price range.

Bitcoin Cash (BCH)

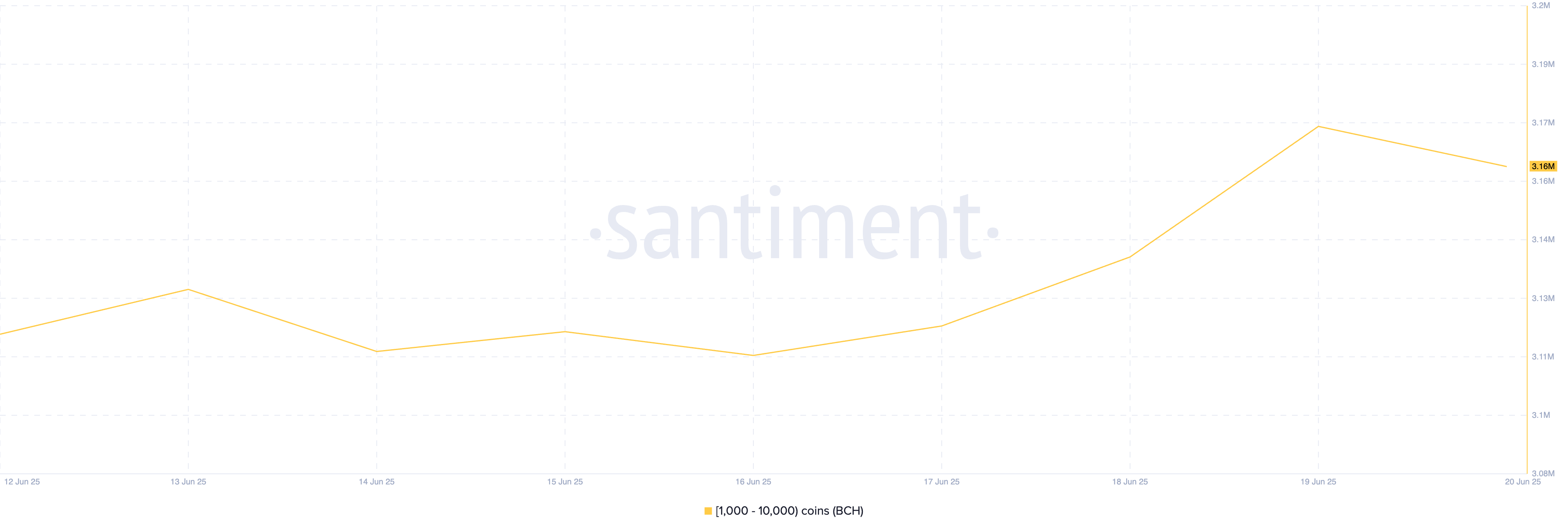

BCH is another asset being accumulated by crypto whales amidst geopolitical uncertainty in the Middle East.

According to data from Santiment, an online cryptocurrency data platform, wallet addresses holding 1,000 to 10,000 BCH tokens have increased their coin holdings. During this week, this group of BCH holders purchased 40,000 tokens, valued at over $19 million at current market prices.

This altcoin is currently trading at $485.76 and has risen 5% in the past day amid an overall bullish sentiment in the cryptocurrency market.

Dogecoin (DOGE)

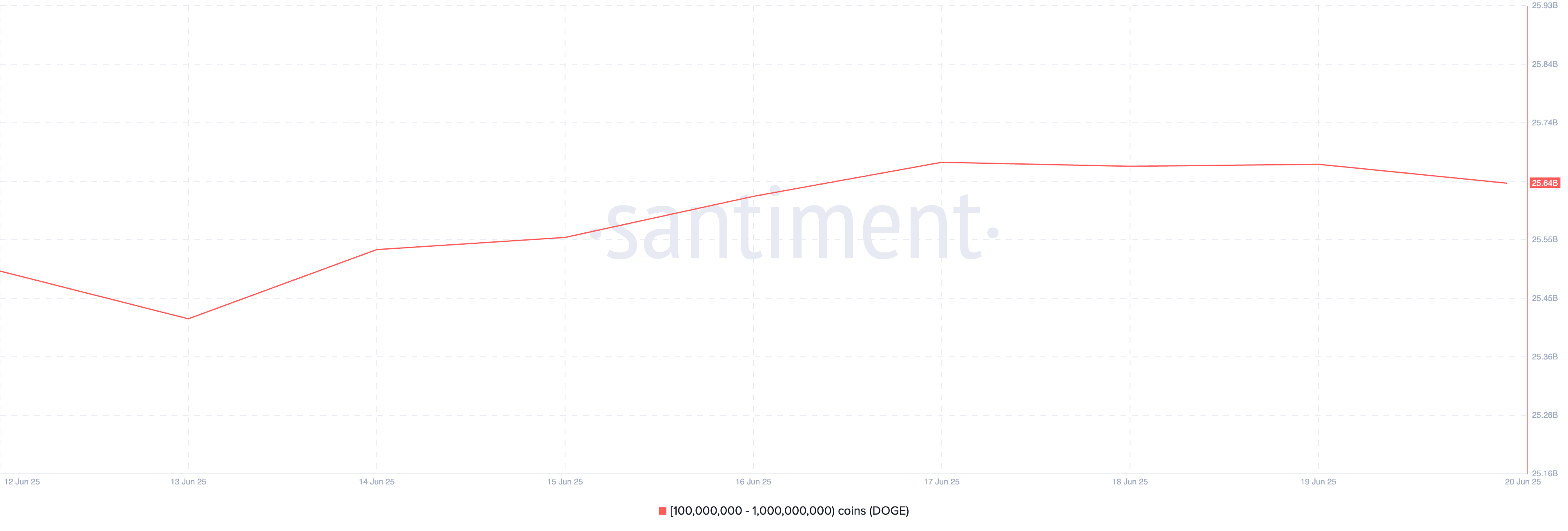

Dogecoin (DOGE), a major meme coin, is also receiving increased attention from crypto whales this week. According to Santiment's on-chain data, large holders with 100 million to 1 billion DOGE have seen a surge in accumulation.

Over the past week, this group purchased a total of 140 million DOGE, with a total purchase value exceeding $24 million.

This surge in whale accumulation is a positive signal for DOGE's short-term outlook. As momentum builds, this wave of accumulation could lay the groundwork for a short-term recovery or breakthrough at current price levels.