Welcome to the US Cryptocurrency Morning Briefing. We'll briefly summarize today's key cryptocurrency developments.

Prepare a cup of coffee to learn what's happening in the market today, especially regarding Bitcoin (BTC). Amid ongoing geopolitical tensions, the pioneering cryptocurrency is withstanding uncertainty, and recent developments are expected to cause volatility.

Iran Strikes Israel's $47.5 Billion Market…TA-125 Rebounds

In previous US cryptocurrency news, we highlighted the S&P 500's resilience despite escalating geopolitical tensions.

In recent developments, Iran attacked the Tel Aviv Stock Exchange building in retaliation for Israel's $47.5 billion capital market.

"The Israeli Stock Exchange building in Ramat Gan, east of Tel Aviv, was hit during Iran's recent missile attack," as reported.

Yesterday, a cyber attack related to Israel impacted Iran's banking system, destroying digital assets worth tens of millions of dollars.

BeInCrypto reported that in the Israel-Iran war, financial markets have become a new battlefield, and blockchain is one of them.

"And the market's response? It was not natural. It was a manipulated calm. Liquidity was supported. AI algorithms were adjusted. Panic was suppressed. Because this is not just a war. It is a controlled dismantling. A financial power shift packaged in a missile and speech theater. Look at the money, not the headlines. The market knows what's coming," a user mentioned.

Surprisingly, the market rebounded, with TA-125 hitting a 52-week high on the same day. As an immediate result, TA-125 surged over 0.53%, which is remarkable amid political uncertainty.

TA-125 is Israel's stock market index, tracking the performance of the 35 largest and most actively traded companies listed on the exchange.

Meanwhile, Ray Yossef, CEO of NoOnes and former CEO of Paxful, tells BeInCrypto that Bitcoin remains trapped in a narrow range near $105,000 despite geopolitical tensions. The cryptocurrency executive says daily volatility is below 2.1%, with no panic selling.

"Bitcoin no longer seems to function as a hedge asset. Instead, it behaves like a high-beta tech stock, getting caught in macro winds but not actually steering its own ship. The connection between BTC and Nasdaq 100 remains strong at 0.68," Yossef added in a statement shared with BeInCrypto.

Bitcoin's Current Strength is Technical and Structural, Say Analysts

Bitcoin has maintained a critical level above $100,000 for over 40 days. The pioneering cryptocurrency demonstrates impressive resilience amid increasing geopolitical tensions and cautious central bank signals.

In this context, analysts say macroeconomic and institutional forces now support Bitcoin's position as a long-term financial asset.

This aligns with Robert Kiyosaki's recent US cryptocurrency news publication advocating for Bitcoin alongside other assets.

"Despite the ongoing conflict between Israel and Iran, Bitcoin has shown remarkable resilience over the past week. BTC's recent strength demonstrates not just its recovery or increasing appeal as a safe asset, but also its growing importance as an alternative to the declining US dollar," said Elliot Johnson, CEO of Bitcoin Treasury Corporation (BTCT), to BeInCrypto.

Johnson also pointed out the impact of institutional demand, noting that it's not surprising BTC is firmly maintaining above $100,000, given that corporations and governments are pouring billions into Bitcoin treasury, including Michael Saylor's recent $1.05 billion purchase.

Nic Puckrin, founder of The Coin Bureau, agreed, saying the $100,000 level has become a base price in investors' minds.

"Retail investors panic selling right now are becoming exit liquidity for institutional buyers," Puckrin mentioned.

From a macro perspective, the market was reassured by the Fed's latest dot plot anticipating two rate cuts in 2025. According to Puckrin, liquidity is coming, and when it flows in, Bitcoin will be the biggest beneficiary.

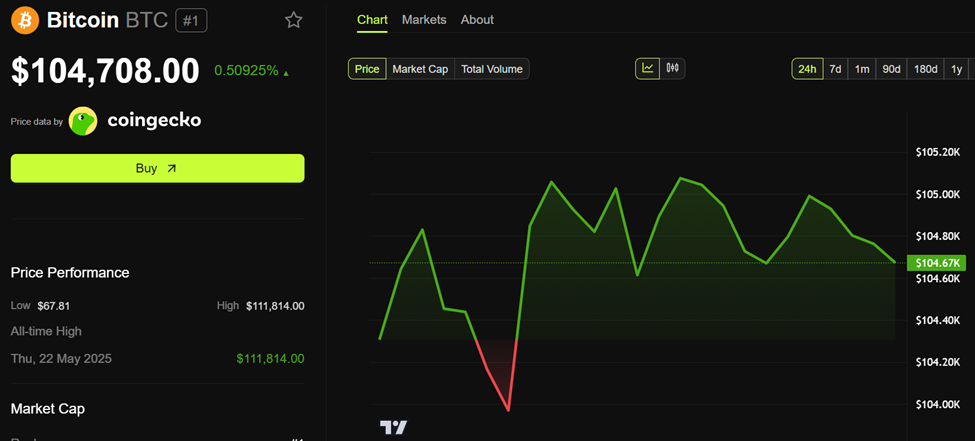

At the time of writing, Bitcoin is trading at $104,708, slightly up 0.5% in the last 24 hours.

Today's Chart

Byte Size Alpha

Summary of today's notable US cryptocurrency news:

- Changpeng Zhao (CZ) supports Binance's new cryptocurrency inheritance tool for posthumous heirs.

- Israel-Iran tensions impact cryptocurrency. The $81 million hack of Iranian cryptocurrency exchange Nobitex indicates that blockchain has emerged as a geopolitical battleground in the Israel-Iran conflict.

- Three reasons why the altcoin winter could extend. Over 17 million altcoins disperse the market, spreading capital too thinly and putting a brake on growth for all projects except top ones.

- Is the altcoin season on hold? The ETH/BTC ratio consolidation indicates market caution.

- Solana (SOL) faces weak market conditions but continues accumulation, showing strong investor confidence and potential for recovery.

- Geopolitical tensions between Israel and Iran have increased Bitcoin's volatility, contributing to price stagnation despite institutional demand.

- Pie Network introduces a new feature to synchronize KYC and resolve discrepancies.

- Ohio House of Representatives passed House Bill 116, the Blockchain Basics Act, with bipartisan support. The bill exempts cryptocurrency transactions under $200 from capital gains tax.

- FET outperforms top AI tokens following Fetch.ai CEO Humayun Sheikh's announcement of a $50 million buyback.

Cryptocurrency Stock Market Pre-Opening Overview

| Company | Closing on June 18 | Pre-Market Overview |

| MicroStrategy (MSTR) | $369.03 | $370.50 (0.40%) |

| Coinbase Global (COIN) | $295.29 | $293.45 (-0.62%) |

| Galaxy Digital Holdings (GLXY) | $26.12 | $27.05 (+3.57%) |

| Marathon Holdings (MARA) | $14.49 | $14.61 (+0.83%) |

| Riot Platforms (RIOT) | $9.94 | $9.96 (+0.20%) |

| Core Scientific (CORZ) | $11.90 | $11.97 (+0.59%) |