As geopolitical tensions escalate and investor sentiment deteriorates, downward pressure continues to spread in the Bitcoin spot and derivatives markets.

Due to uncertainty about global macroeconomic stability, many market participants are taking a risk-averse approach, and coins are showing vulnerability as the second quarter comes to a close.

Bitcoin Futures Turning Bearish

As Bitcoin struggles to gain an upward momentum at the price of $103,000, Bitcoin futures traders are increasingly taking positions against the coin.

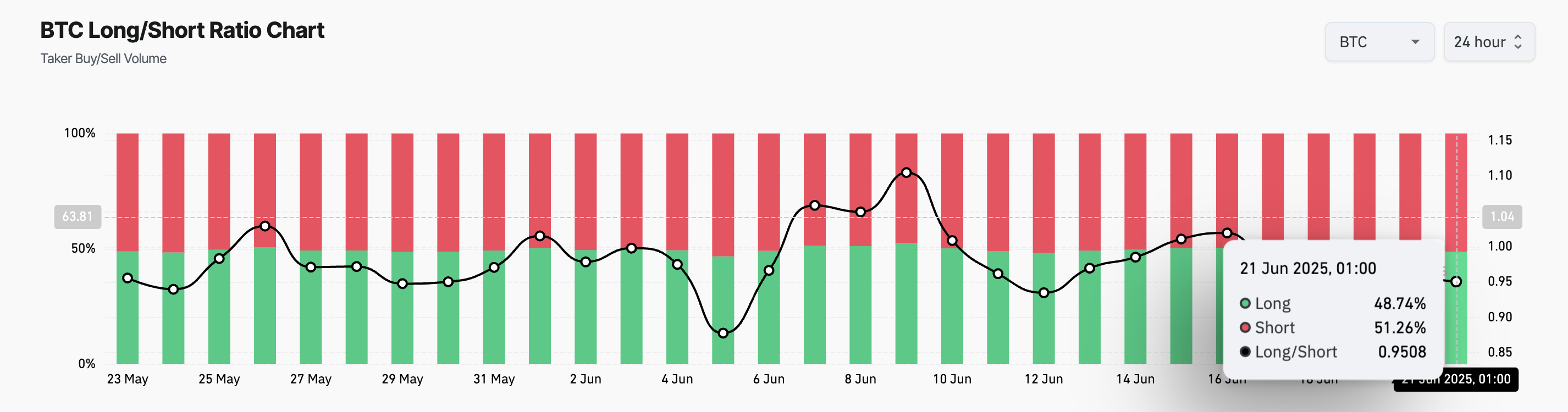

According to Coinglass, the coin's Longing/Short ratio — a key indicator of trader sentiment — has been significantly tilting towards Short since June 17, indicating a growing belief that BTC's recent upward trend is losing momentum. At the time of reporting, the ratio is 0.95, showing that more traders are betting on a decline in altcoins.

This ratio compares the number of Longing and Short positions in the market. When the Longing/Short ratio is above 1, it indicates that Longing positions outnumber Short positions, meaning traders are primarily betting on price increases.

Conversely, as seen in BTC, when the ratio is below 1, it indicates that most traders are anticipating price declines and taking positions accordingly. This reflects a heightened bearish sentiment in the short term and growing expectations of continued downward movement.

Moreover, the daily chart reading of BTC's BBTrend indicator reinforces the bearish outlook. As BTC's price momentum weakens, the green histogram bars of the indicator gradually decrease, signaling reduced buying pressure and loss of upward strength.

BBTrend is used to measure the strength and direction of price trends. It is represented by histogram bars, with green bars indicating an upward trend and red bars indicating a downward trend.

When BBTrend turns negative or green bars decrease, the upward momentum weakens, and the asset may be consolidating or experiencing a reversal.

A consistently negative BBTrend suggests that selling pressure is dominant, increasing the likelihood of an extended price correction for BTC.

BTC Drops to Two-Week Low… Will $102,000 Support Hold?

Yesterday, BTC's price fell to a 15-day low of $102,345. After rebounding and closing at $103,297, downward pressure remains, with the coin down 2% over the past 24 hours.

If new demand continues to be limited, BTC's price could drop to $101,520. If buying pressure fails to defend this critical support level, the asset could further decline to $97,658.

On the other hand, if buying pressure strengthens, BTC may rebound and attempt to break through $103,952. Successfully crossing this level could open the door to an increase to $106,295.