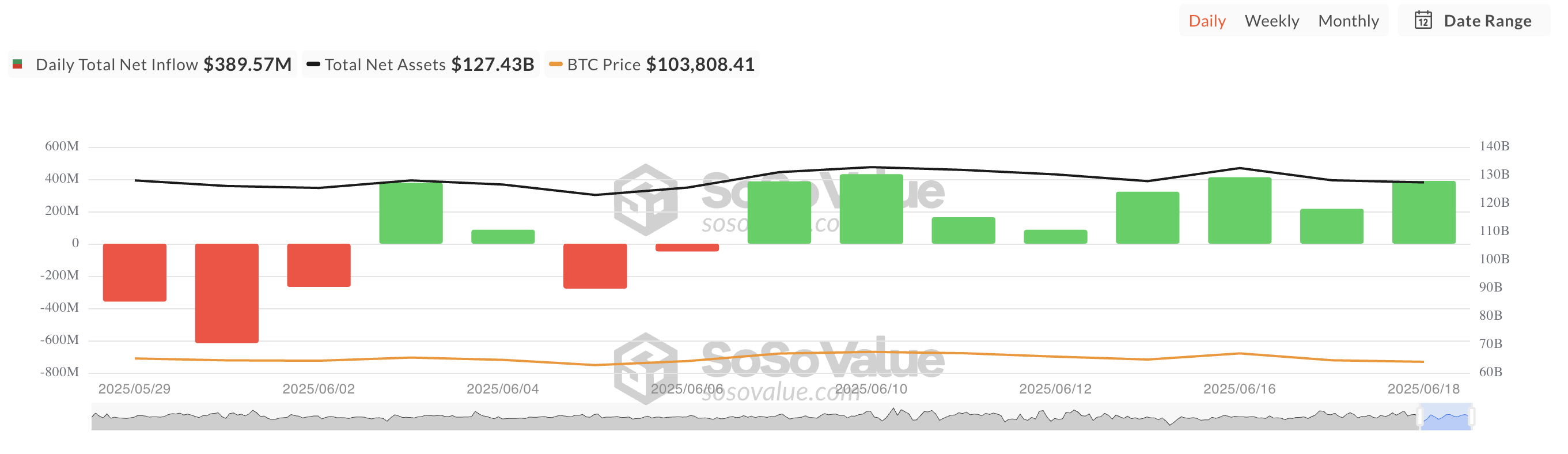

This week, the Bitcoin spot ETF net inflow has exceeded $1 billion in just 3 days. This fund has been recording a positive trend for 8 consecutive days.

However, capital inflow has occurred even with minimal BTC price movements this week. Amid escalating geopolitical tensions in the Middle East, the contrast between continuous institutional buying and weak spot price performance raises important questions. Are sentiments quietly shifting favorably for long-term accumulation?

Bitcoin ETF Breaks $1 Billion Despite Price Weakness

According to SosoValue, the BTC-backed fund recorded an inflow of $1.02 billion this week. This demonstrates institutional investor confidence despite the coin's poor performance amid escalating geopolitical tensions in the Middle East.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

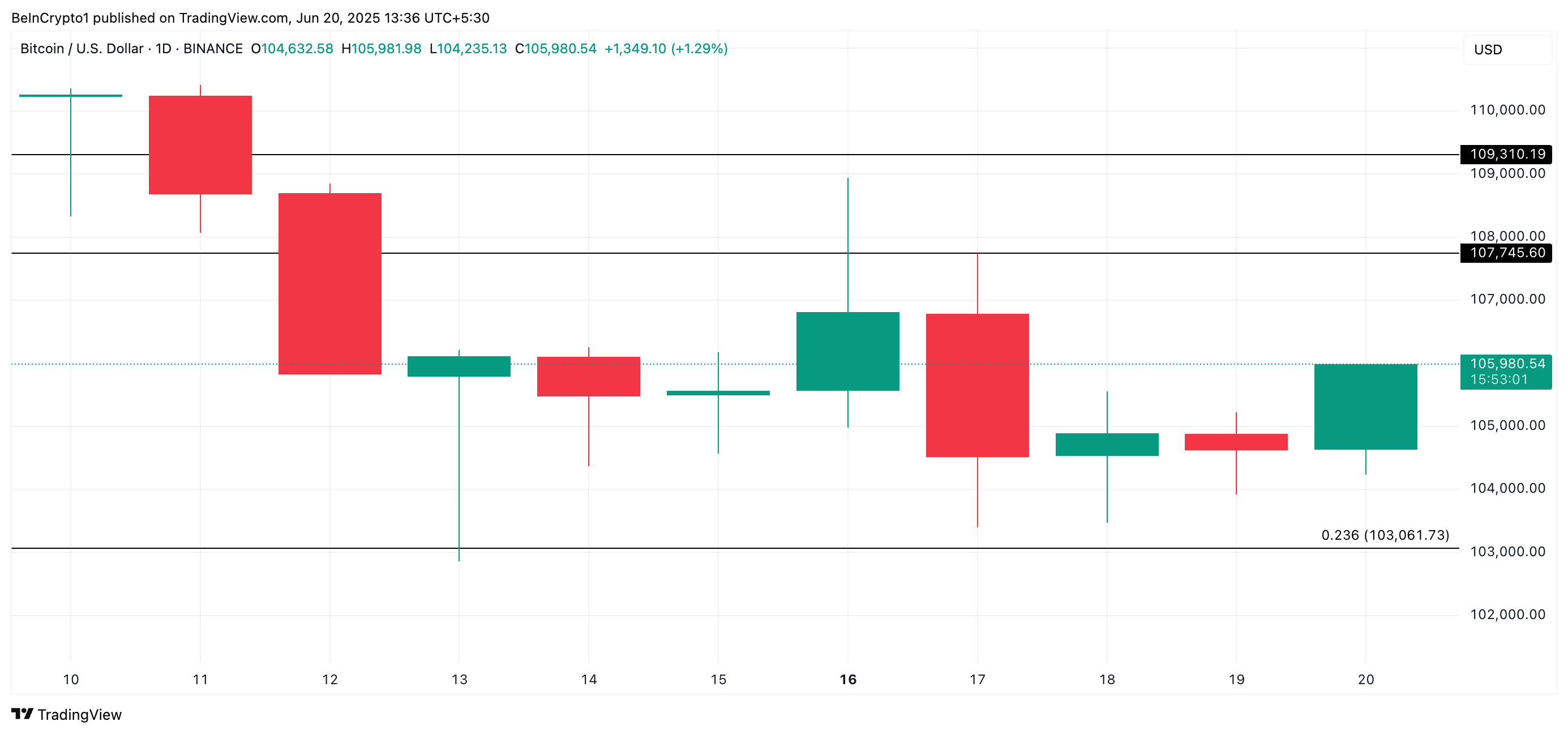

With uncertainty surging this week, BTC continues to fluctuate within a narrow range, facing resistance at $105,000 and support at $103,000. On Thursday, the coin recorded an intraday low of $103,929 before closing near $105,000.

Despite BTC's lackluster price movements, demand for spot Bitcoin ETF continues, with daily inflows varying. Continued interest suggests that price drops are increasingly seen as opportunities among institutional investors.

This demonstrates that long-term confidence persists amid ongoing short-term volatility.

Bitcoin Traders Maintain Bullish Stance Despite Price

While BTC's short-term price performance remains minimal, on-chain data indicates cautious optimism. For instance, the coin's funding rate across derivative platforms remains positive, suggesting traders are willing to pay costs to maintain long positions. At the time of writing, the coin's funding rate is 0.0066%.

The funding rate represents recurring fees between traders in perpetual futures markets, used to align contract prices with spot prices. A positive rate means long sellers pay short traders, indicating bullish sentiment and traders' expectations of price increases.

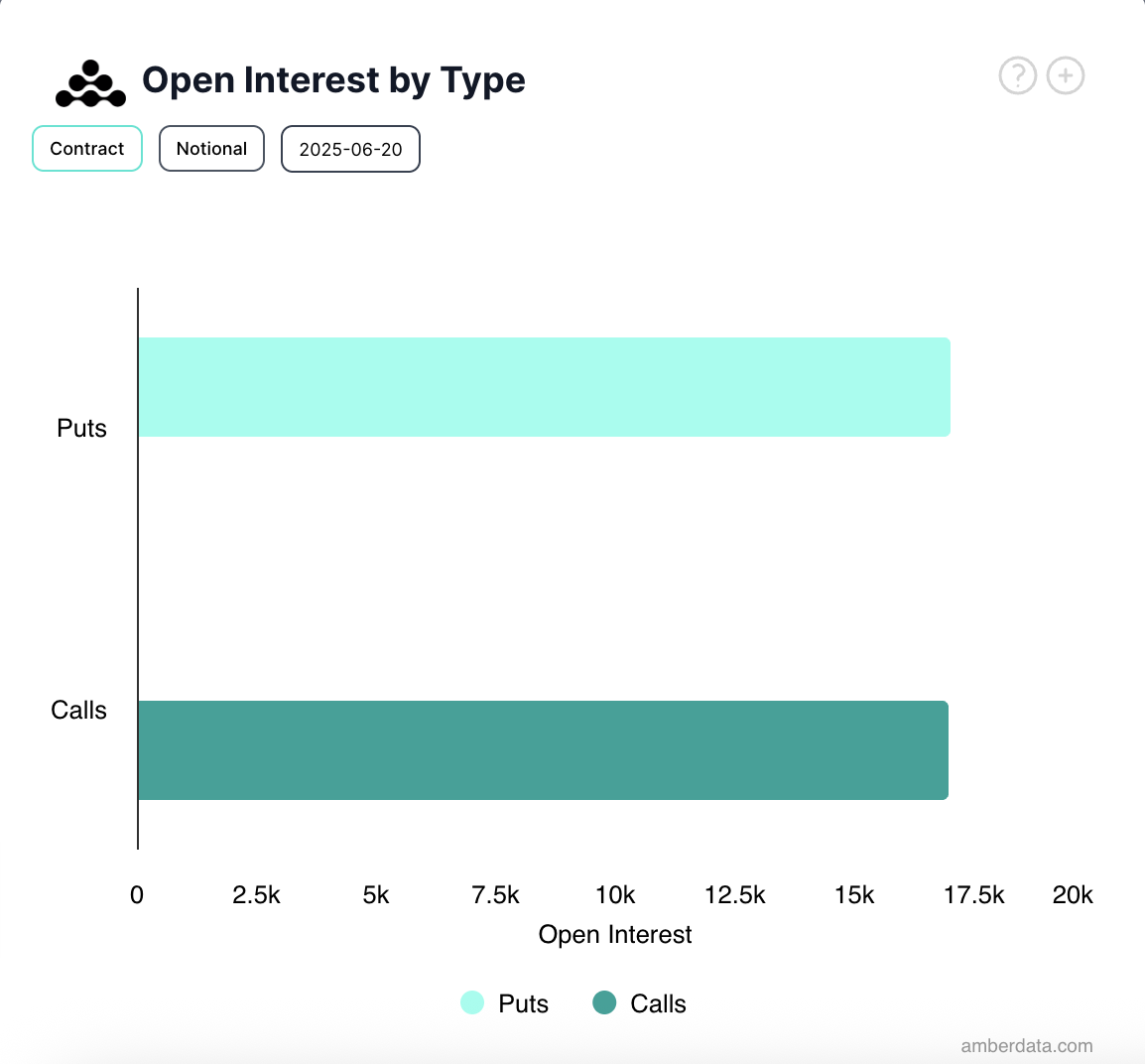

Additionally, call option demand in the options market is outpacing put options, suggesting market participants see a higher probability of short-term rebounds.

BTC Bulls and Bears Clash Over Next Move

Despite price stagnation, continued demand for spot BTC ETF indicates institutional investors view current levels as buying opportunities. However, the sustainability of this trend remains uncertain, with escalating Middle Eastern geopolitical tensions adding new volatility and risk to the market environment.

At the time of reporting, the coin is trading at $105,980. If bullish bias increases, the coin's price could rise to reach $107,745.

However, if demand decreases and bearish sentiment strengthens, BTC's price could drop to $103,061.