The cryptocurrency market is seeing increased participation from Japanese listed companies such as Metaplanet, ANAP, Remixpoint, and Gumi.

This movement appears to be a calculated response to Japan's unique economic challenges, including a weak yen, persistent low interest rates, and limited domestic investment opportunities.

Japan's Bitcoin Boom... Listed Companies Entering Crypto

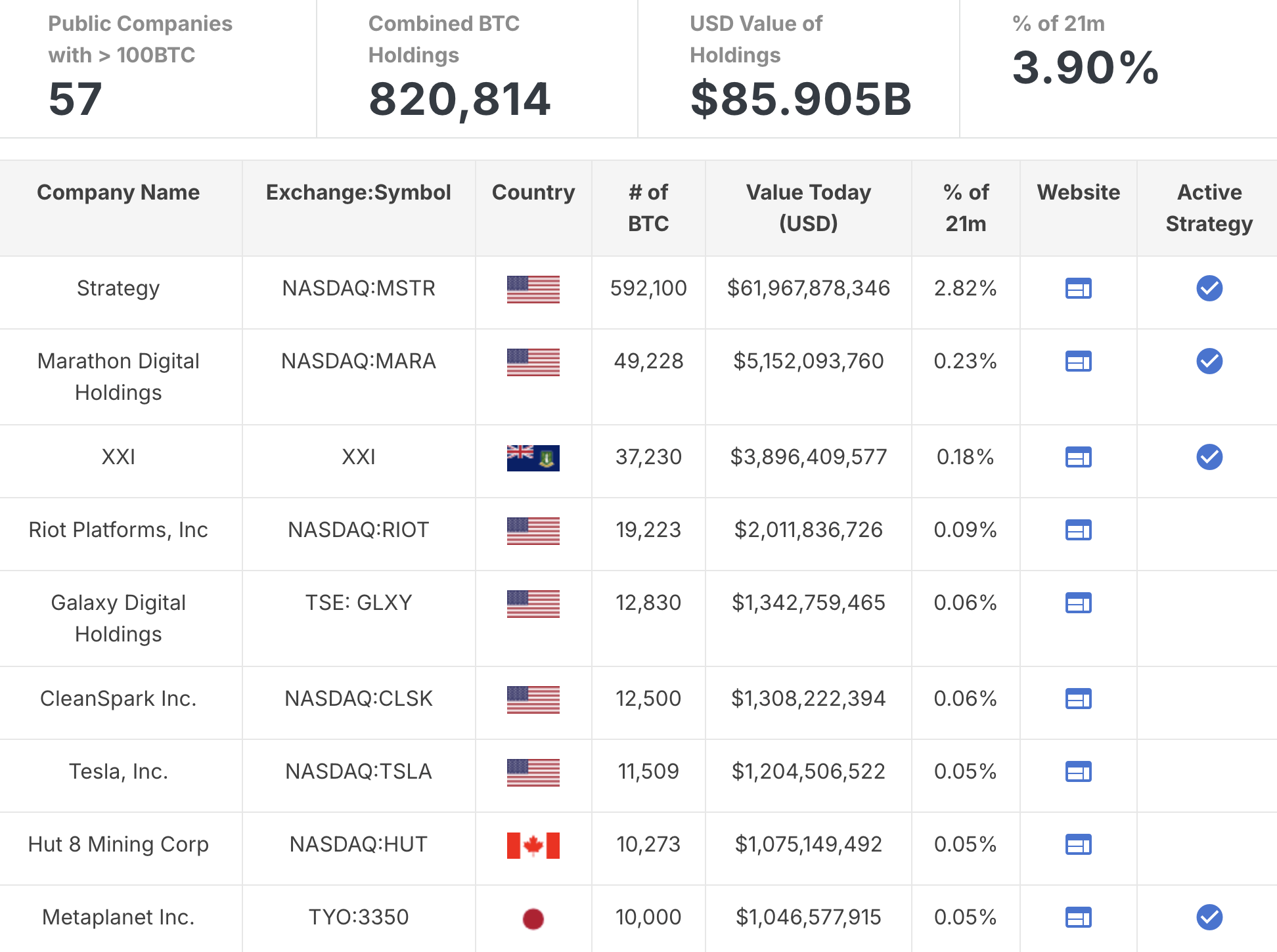

According to Bitcoin Magazine's data, listed companies' Bitcoin (BTC) holdings have exceeded 820,000 BTC, surpassing $85 billion. MicroStrategy continues to lead, holding over 592,000 BTC.

Metaplanet has emerged as MicroStrategy's biggest competitor in the Asian cryptocurrency market. The company's stock price showed positive signals after entering this market. Following Metaplanet's lead, new players have recently appeared in this region.

Japanese listed companies have multiple reasons for participating in the cryptocurrency market. The primary factor is the significant depreciation of the Japanese yen. According to Trading Economics data, the yen has lost substantial value in recent years. This decline is partially attributed to the Bank of Japan's (BOJ) long-term negative interest rate policy.

According to a 2025 BOJ research report, this policy intended to stimulate the economy but weakened the domestic currency. This prompted companies to seek alternative assets to preserve value. Bitcoin became an attractive option for Japanese companies due to its inflation-resistant characteristics.

Secondly, the lack of profitability in domestic assets plays a crucial role. Long-term negative interest rates have resulted in low or even negative returns on government bonds and traditional assets, placing Japanese companies in a challenging situation.

As a result, many companies have chosen Bitcoin holdings as a long-term corporate investment strategy. This is similar to the MicroStrategy model in the United States. The stock price surge of Japanese listed companies like Metaplanet demonstrates investor confidence in this Bitcoin strategy.

Additionally, Japan's progressive cryptocurrency legal framework is an important facilitating factor. The Financial Services Agency (FSA) has established clear regulations, including KYC and AML requirements. While recognizing cryptocurrency's purchasing power, it is not recognized as legal tender. This provides a safe environment for companies to participate, unlike many countries with stricter limitations.

However, risks cannot be overlooked. Bitcoin's price volatility and dependence on global monetary policies can put pressure on these companies, presenting challenges to their long-term strategy. Moreover, the BOJ's recent decision to end its negative interest rate policy could change economic dynamics and potentially impact future accumulation decisions.