The US national debt has exceeded 37 trillion dollars, significantly increasing from 18 trillion dollars 10 years ago. During the same period, Bitcoin's value surged from less than 500 dollars to over 10 dollars, highlighting its potential as a store of value.

As the pressure of rapidly increasing debt continues, cryptocurrency supporters are once again focusing on Bitcoin as a potential solution. While support for Bitcoin is not new, what is noteworthy now is the new idea that stablecoins could help reduce national debt.

US Debt Increase... Bitcoin as an Economic Protection Measure?

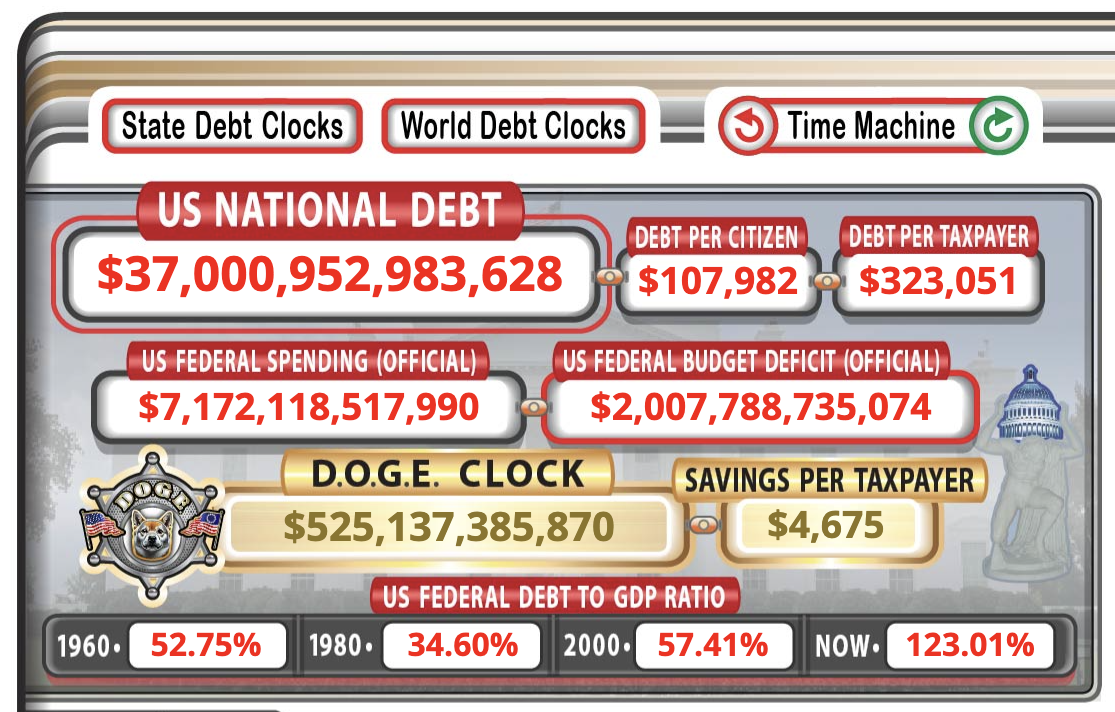

According to the latest data from the US debt clock, each US citizen carries a debt burden of $107,982. Additionally, the debt per taxpayer is $323,051.

Federal spending amounts to approximately 7.1 trillion dollars, with a federal budget deficit of 2 trillion dollars.

An analyst pointed out, "We are using 25% of all US government revenues to pay interest on national debt."

The surge in debt, reflected in a 123% debt-to-GDP ratio, has sparked demand for alternative financial strategies. Analysts are increasingly advocating Bitcoin as a viable option for value preservation.

A user said, "If you haven't owned Bitcoin yet, now is a good time to start."

Moreover, Real Vision's founder Raoul Pal described Bitcoin as a "lifeboat" against economic challenges like debt and currency value decline. He explained that when central banks print more money to manage debt, this dilutes fiat currency's value, making scarce assets like Bitcoin more valuable.

He also emphasized that Bitcoin not only helps defend against an 8% annual fiat currency value decline but also increases in value as adoption grows. This makes Bitcoin an attractive option during periods of economic uncertainty.

Stablecoins, Helping to Reduce National Debt?

As demand for the largest cryptocurrencies increases, stablecoins are emerging as a potential solution to the debt crisis. In a recent X (formerly Twitter) post, US Treasury Secretary Scott Bessent highlighted the potential of stablecoins to reduce national debt.

He explained that as the stablecoin ecosystem continues to grow, private sector demand for US Treasuries used as reserves to back stablecoins could significantly increase. A surge in Treasury demand would help manage and potentially reduce government borrowing costs.

Bessent also noted that stablecoins could serve as a gateway for millions of people worldwide to enter the dollar-based digital asset economy.

"This is a win-win-win for everyone involved: private sector, Treasury, consumers," he said.

Bessent also referenced a recent report suggesting the stablecoin market could grow to 3.7 trillion dollars by the end of the decade. According to him, this becomes increasingly likely with the passage of the GENIUS Act.

BeInCrypto reported that the US Senate passed this bill earlier this week. It now moves to the House, and if passed, will go to the President's desk.

President Trump has already expressed willingness to sign the bill. He also believes the act can strengthen the nation's leadership in the digital asset space.

"Digital assets are the future, and we will own them. We're talking about massive investment and big innovation. I hope the House moves quickly to pass the 'clean' GENIUS Act. Bring it to my desk, immediately, without additions. This is American talent at its finest, and we will show the world how to win with digital assets!" he wrote.

However, not everyone believes in the value proposition of dollar-based stablecoins. Economist Peter Schiff recently expressed criticism in a social media post.

"I understand Bitcoin, but I don't understand US dollar stablecoins. If you're going to introduce a third-party custodian, why settle for tokens backed by a flawed fiat currency like the dollar when you could own something backed by gold? You can get the same liquidity, but also get a true store of value," he mentioned.

As US national debt increases, it becomes urgent to explore various financial options. While Bitcoin is widely recognized as a hedge, the role of stablecoins remains controversial. Ultimately, whether these dollar-based assets can contribute to debt reduction will only be known with time.