Discussing investor activities in on-chain and off-chain markets and analyzing changes in this cycle through network metrics.

Written by: UkuriaOC, CryptoVizArt, glassnode

Translated by: AididiaoJP, Foresight News

Abstract

- On-chain transaction count has decreased, but settlement volume has increased, indicating higher usage by large entities. Although transaction numbers have reduced, average transaction size has significantly grown, suggesting institutional or high-net-worth participants are dominating on-chain activities.

- Despite Bitcoin trading prices being close to historical highs, on-chain fees remain low, with minimal demand for block space. This differs significantly from previous cycles, where price increases typically accompanied congestion and network usage leading to fee spikes.

- Trading activities are increasingly moving off-chain, with centralized exchanges now capturing most trading volume, especially in futures markets. Notably, total spot, futures, and options trading volume is usually 7 to 16 times higher than on-chain settlement volume.

- Leverage continues to accumulate, with futures and options total open interest reaching $96.2 billion. Collateral structure has significantly improved, with stablecoin margin positions currently occupying most of the open interest.

On-Chain Ghost Town

Bitcoin currently remains stable above the critical psychological level of $100,000, just 6% away from its historical high of $117,000. One might expect Bitcoin network on-chain activity to be equally vibrant, yet the situation shows a clear divergence: spot prices remain high while network activity is unusually calm.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and technical terminology.]In the derivatives market, perpetual and calendar futures contracts have the largest trading volume, typically one order of magnitude higher than on-chain, spot, and options trading volumes.

Futures contract trading activity grew significantly during this cycle, with an average daily trading volume of $57 billion over the past year. Moreover, in November 2024, futures trading volume reached an astonishing peak of $122 billion per day. The scale of futures market trading volume highlights the dominance of these instruments for speculators, traders, and risk hedgers.

Additionally, options trading volume surged during this cycle, with an average daily trading volume of $2.4 billion over the past year, reaching up to $5 billion. This surge underscores the increasing use of options contracts by mature market participants, with investors increasingly utilizing options to implement advanced risk management strategies and fine-tune their market exposure.

The growth in spot and derivatives trading volume highlights a shift in trading activity, with increasing volumes moving from Bitcoin's underlying layer to off-chain trading platforms. When comparing off-chain trading volumes (spot, futures, and options) to network settlement values, we observe that off-chain trading volumes are typically 7 to 16 times higher than on-chain volumes.

This shift may significantly impact how we interpret network metrics, as traditional indicators may no longer comprehensively reflect market activity. However, the on-chain market remains the core of the Bitcoin economy and constitutes the foundational layer of the broader ecosystem's operation. Deposits and withdrawals are the primary link between off-chain platforms and the Bitcoin network, and on-chain activity will likely continue to play a crucial role in market structure and capital flow.

Leverage Accumulation

Having established the growing significance of derivatives in the Bitcoin ecosystem, we now turn our attention to the open interest in futures and options contracts to assess leverage accumulation.

Both markets experienced significant growth in open interest (OI), with futures open interest increasing from $7.7 billion to $52.8 billion, and options open interest rising from $3.2 billion to $43.4 billion. The total derivatives open interest peaked at $114 billion and currently remains high at around $96.2 billion. This continued expansion reflects a substantial increase in leverage within the Bitcoin economy, which may exacerbate price volatility risks.

When assessing the 30-day total open interest changes, we observe that volatility has been accelerating. Throughout 2023, open interest changes were relatively smooth, but these fluctuations began to intensify following the launch of the US spot ETF in January 2024.

The increasing volatility of open interest signals a broader market transformation, shifting from a market structure primarily driven by spot activity to one dominated by derivatives. This transition increases the risk of cascading liquidations and leads to a more unstable, reflexive market environment.

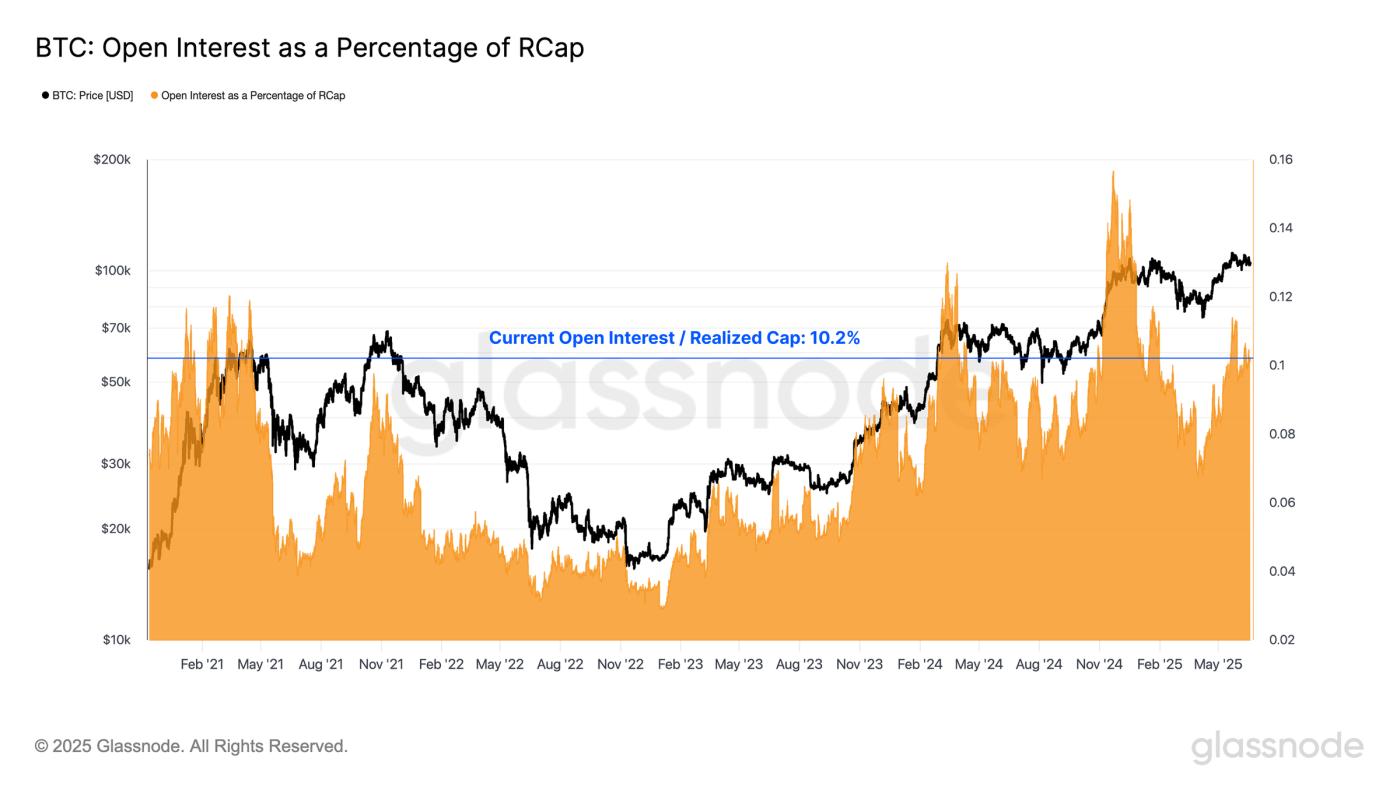

To quantify leverage accumulation, we calculated the realized market value leverage ratio, which compares total open interest to Bitcoin's realized market cap (the total dollar value stored on the network). A significantly positive deviation in this ratio indicates enhanced speculative activity in the derivatives market relative to the underlying asset's size, suggesting increased leverage and potential market structure fragility. Conversely, a contraction in the ratio indicates a deleveraging phase.

The current leverage ratio remains high at 10.2%, with only 182 trading days (10.8%) historically exceeding this level across 1,679 trading days. This highlights the substantial increase in market leverage and further reinforces the growing dominance of derivatives in shaping the current market landscape.

However, the collateral structure of open interest is not uniform, as traders can choose between stablecoin and cryptocurrency margins. Stablecoin margin positions are more conservative, with collateral pegged to the US dollar, while cryptocurrency margin positions introduce additional volatility, as the underlying collateral's value fluctuates with market movements.

To assess the overall health of the derivatives market's collateral structure, we calculated the realized market value leverage ratio for stablecoin and cryptocurrency margin open interest. During the 2018-2021 cycle, cryptocurrency margin collateral was investors' preferred choice. Combined with the widespread use of 100x leverage, this structurally weaker collateral base exacerbated the market downturn in May 2021.

Since the high-profile collapse of FTX, stablecoin margin collateral has become the primary margin form, currently representing the vast majority of open interest collateral. This shift highlights the maturing derivatives ecosystem around digital assets and the progression of risk management practices towards more stability.

Conclusion

Despite Bitcoin's price increase, there is a notable divergence between market valuation and network activity, with transaction counts remaining unusually low, primarily due to a sharp decline in non-token transactions. The decrease in throughput has led to a significant drop in miner fee income, contrasting with previous bull market cycles where price increases typically resulted in network congestion and fee spikes.

Nevertheless, the network's settlement volume remains substantial, with an average daily settlement amount of $7.5 billion. Lower transaction counts and higher transaction throughput indicate that large entities are increasingly dominating on-chain activity. Additionally, off-chain trading platforms have seen strong growth, with total spot, futures, and options trading volumes typically 7 to 16 times higher than on-chain settlement volumes.

Leverage in the derivatives market continues to rise, with total futures and options open interest remaining at a historical high of $96.2 billion. However, the underlying collateral structure has significantly improved, with stablecoin margin positions now representing the majority of open interest. This shift underscores the maturing derivatives ecosystem around digital assets and the progression of risk management practices towards greater robustness.