In the cryptocurrency options market, Ethereum, Solana, and XRP all show a predominance of call options, with rising expectations reflected in top trading volume options.

As of 8:50 AM on the 20th, according to the largest cryptocurrency options exchange Deribit, the outstanding open interest for options expiring on this day is ▲Ethereum 224,733 contracts (567.43 million dollars) ▲Solana 9,950 contracts (14.64 million dollars) ▲XRP 1,798 contracts (3.89 million dollars).

The Put/Call Ratio of outstanding open interest is ▲Ethereum 0.69 ▲Solana 0.6 ▲XRP 0.87, showing a trend of call option dominance across all cryptocurrencies.

The trading volume Put/Call Ratio is also ▲Ethereum 0.97 ▲Solana 0.73 ▲XRP 0.59, highlighting a bullish sentiment. This ratio is typically interpreted as optimistic (bullish) when below 0.7-0.8, and cautious or bearish when above 1.

Ethereum is in a bullish range with call options predominant, with an outstanding open interest ratio of 0.69 and a trading volume ratio of 0.97. Solana shows a clear bullish sentiment with an outstanding open interest ratio of 0.6 and a trading volume ratio of 0.73. XRP has relatively low put option demand with an outstanding open interest of 0.87 and trading volume of 0.59, maintaining a call option-centered bullish outlook. Overall, all three cryptocurrencies show a short-term upward expectation.

Maximum Open Interest Options (as of today)

- Ethereum $2,800 call option, $3,000 call option, $2,600 call option

- Solana $148 call option, $170 call option, $140 put option

- XRP $2.15 put option, $2.2 call option, $2.3 call option

Looking at the top open interest options, Ethereum is concentrated on $2,800, $3,000, and $2,600 call options, strongly reflecting medium to long-term bullish expectations. Solana has a mix of $148 and $170 call options and a $140 put option, but call options clearly dominate. XRP has a $2.15 put option and $2.2 and $2.3 call options in the top positions, showing demand aimed at breaking through the upper end of the box range at nearby price levels.

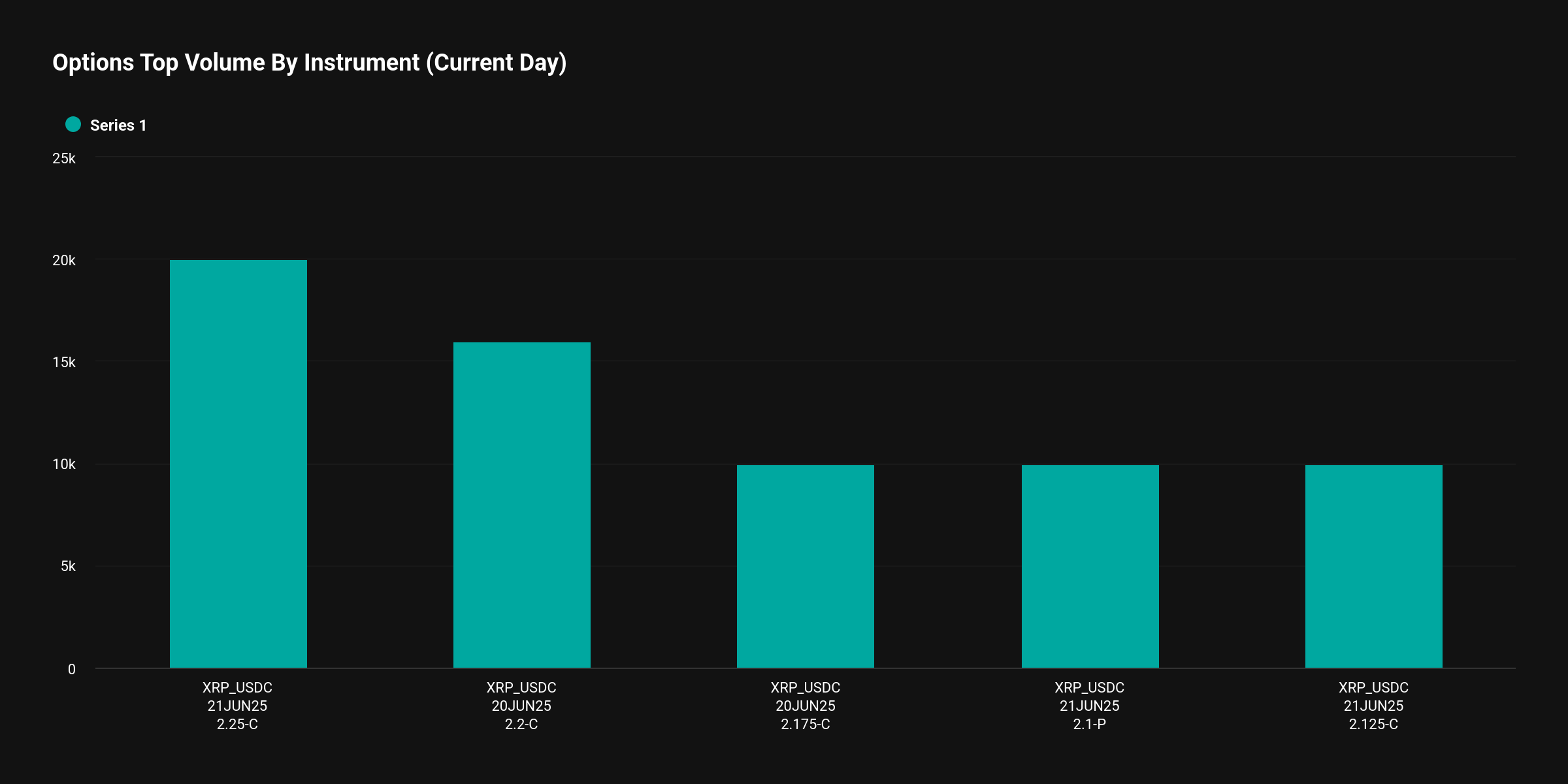

Maximum Trading Volume Options

- Ethereum $2,000 put option (9/26), $2,700 call option (6/27), $2,600 call option (6/27)

- Solana $148 call option (6/20), $145 put option (6/27), $140 put option (6/27)

- XRP $2.25 call option (6/21), $2.2 call option (6/20), $2.175 call option (6/20)

Looking at the current top trading volume options, Ethereum shows mixed put and call demand with a $2,000 put option (9/26) and $2,700 and $2,600 call options (6/27), but with a short-term trend of attempting a high point. Solana has trading concentrated on the $148 call option (6/20) and $145 and $140 put options (6/27), indicating a strong risk management character within the box range. XRP has $2.25, $2.2, and $2.175 call options in the top positions, showing a relatively prominent short-term bullish expectation.

The Maximum Pain Price at the expiration point, where option buyers are likely to incur the most losses, is ▲Ethereum $2,600 ▲Solana $148 ▲XRP $2.2.

The Maximum Pain Price suggests that the market may converge around this price point, which could be the most advantageous point for option sellers and potentially serve as the central axis of price movement before expiration.

According to TokenPost Market, as of 8:50 AM on the 20th, Ethereum is trading at $2,522, up 0.05% from the previous day. XRP is down 0.44% at $2.16, and Solana is down 0.20% at $146.80.

Get news in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>