On the 20th, Bitcoin options contracts worth $3.6 billion will expire.

According to Deribit, the largest cryptocurrency options exchange, the outstanding Bitcoin options contracts expiring on the 20th total 34,058 contracts, worth approximately $356.561 million.

On this day, the outstanding call option contracts are 16,977, and put option contracts are 17,082. The Put/Call Ratio is 1.01, indicating a slightly higher number of put option contracts compared to call option contracts.

Typically, a ratio below 0.7-0.8 is considered optimistic (bullish), while a ratio above 1 is interpreted as cautious or bearish. The current ratio is close to neutral, reflecting a somewhat cautious wait-and-see sentiment.

The Max Pain Price at the expiration point is $105,000, where most option buyers are likely to incur the greatest losses. This suggests that many market participants may be liquidated around this price, potentially causing short-term price movements to converge in this range.

As of this date, the option contract with the most concentrated outstanding contracts is the put option with a strike price of $100,000, with 2,654 outstanding contracts. Following this are the call option with a strike price of $110,000 (2,380 contracts) and the put option with a strike price of $102,000 (1,989 contracts).

Currently, the options market suggests a defensive position is still valid, with a mixed flow of downside support and upper resistance around $100,000, rather than a strong upward possibility beyond the peak.

In terms of overall expiration, the call option with a strike price of $140,000 has the most concentrated outstanding contracts at 16,405. Following this are the call options with strike prices of $115,000 (15,477 contracts) and $110,000 (15,159 contracts). This indicates that long-term upward expectations are still maintained to some extent.

In the past 24 hours, call option trading volume was 14,368 contracts, while put option trading volume was 11,187 contracts, with call options being more actively traded. The Put/Call ratio based on 24-hour trading volume is 0.78, suggesting a short-term market expectation of an upward trend.

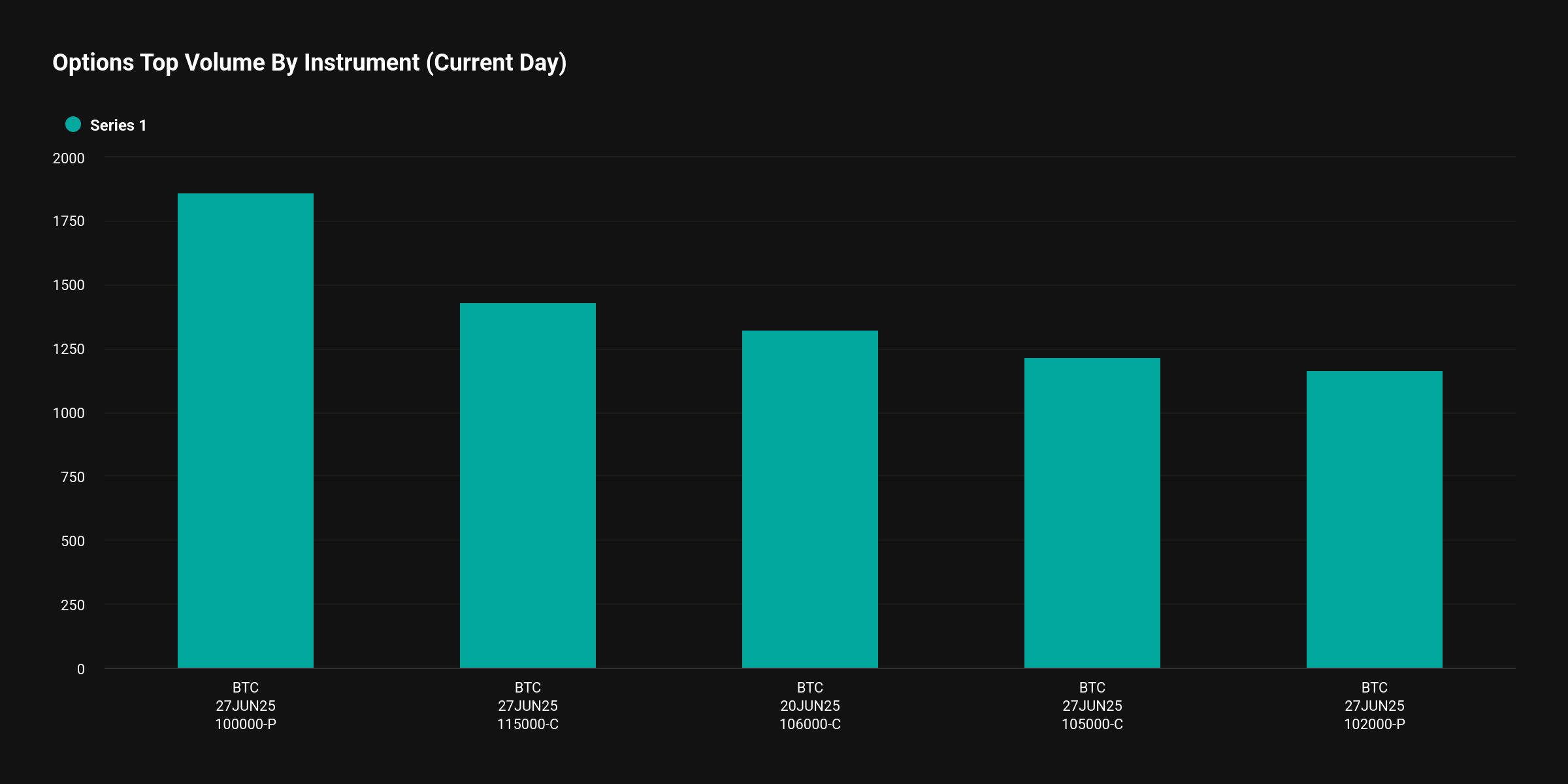

The most actively traded option contract in a day was the put option with a strike price of $100,000 expiring on June 27, with 1,861 contracts traded. This was followed by the call option with a strike price of $115,000 expiring on June 27 (1,432 contracts), the call option with a strike price of $106,000 expiring on June 20 (1,324 contracts), the call option with a strike price of $105,000 expiring on June 27 (1,216 contracts), and the put option with a strike price of $102,000 expiring on June 27 (1,167 contracts).

Currently, option trading is concentrated in the $100,000 to $115,000 range, with a prevailing sentiment of trading strategies and risk management near the current price levels, rather than breaking through the peak.

In terms of outstanding contract concentration by expiration date, June 27 has the most outstanding contracts at approximately 133,630, with call options accounting for 59%. This is followed by September 26 with 60,714 contracts (73% call options) and July 25 with 49,702 contracts (59% call options).

In the past 24 hours, the expiration date with the most trading volume was June 27, with a total of 9,430 contracts traded. This was followed by the June 20 expiration (5,942 contracts) and the July 11 expiration (2,369 contracts).

According to CoinMarketCap, Bitcoin was trading at $104,671 at 8:39 AM on the 20th, down 0.12%.

Options are derivatives that investors can use to leverage bet on underlying asset price movements or hedge risks of existing positions. There are 'call options' (bullish bets) that give the right to purchase the underlying asset at a predetermined price at a specific future point, and 'put options' (bearish expectations) that give the right to sell. Outstanding contracts represent the total volume of option contracts currently in the market.

[This article does not provide financial advice, and the investment results are the sole responsibility of the investor.]

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>