Bitcoin's price has been experiencing significant difficulties around $105,000 in recent weeks. Despite attempts to push it to higher prices, this cryptocurrency is struggling to break through this level.

Nevertheless, investors still maintain hope for recovery. However, the escalating conflict between Israel and Iran has introduced additional uncertainty to the market.

Bitcoin Holders Worry More About Trade War Than War

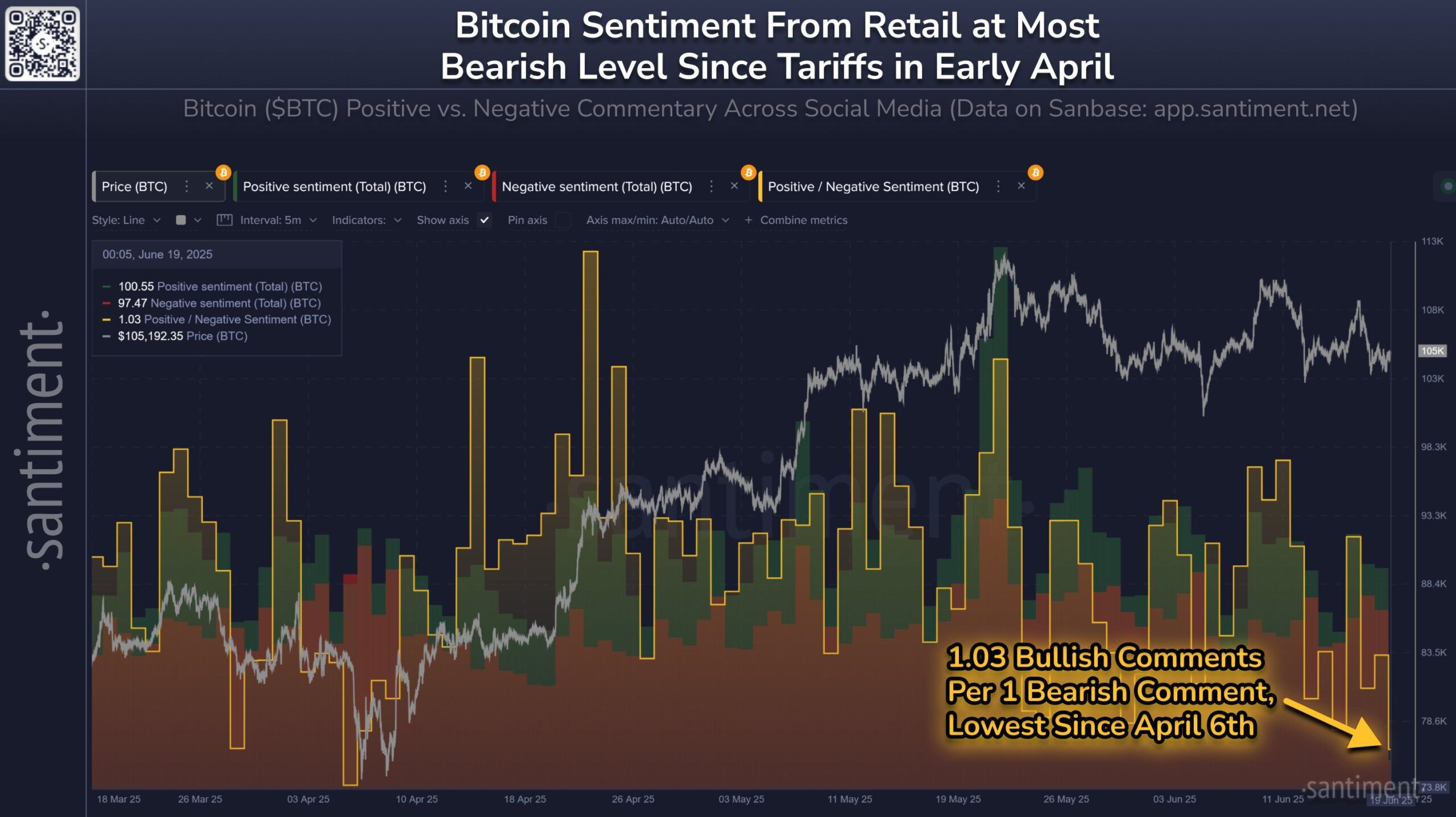

Bitcoin investor sentiment has been steadily declining as geopolitical concerns grow. BTC holders remain optimistic about their asset's long-term prospects, but their enthusiasm has diminished in recent weeks.

The ongoing tension between Israel and Iran has caused a psychological shift, dropping to its lowest level in two months. This stands in stark contrast to the situation in April, when sentiment was significantly impacted by the broad economic effects of the trade war initiated by former US President Donald Trump.

Despite the decline in investment sentiment, the current environment is not as severe as in April or earlier. At that time, Bitcoin's price fell below $80,000 due to the widespread global uncertainty triggered by Trump's trade war. In comparison, the geopolitical tension caused by the Israel-Iran conflict may have an impact, but might not lead to such a severe decline.

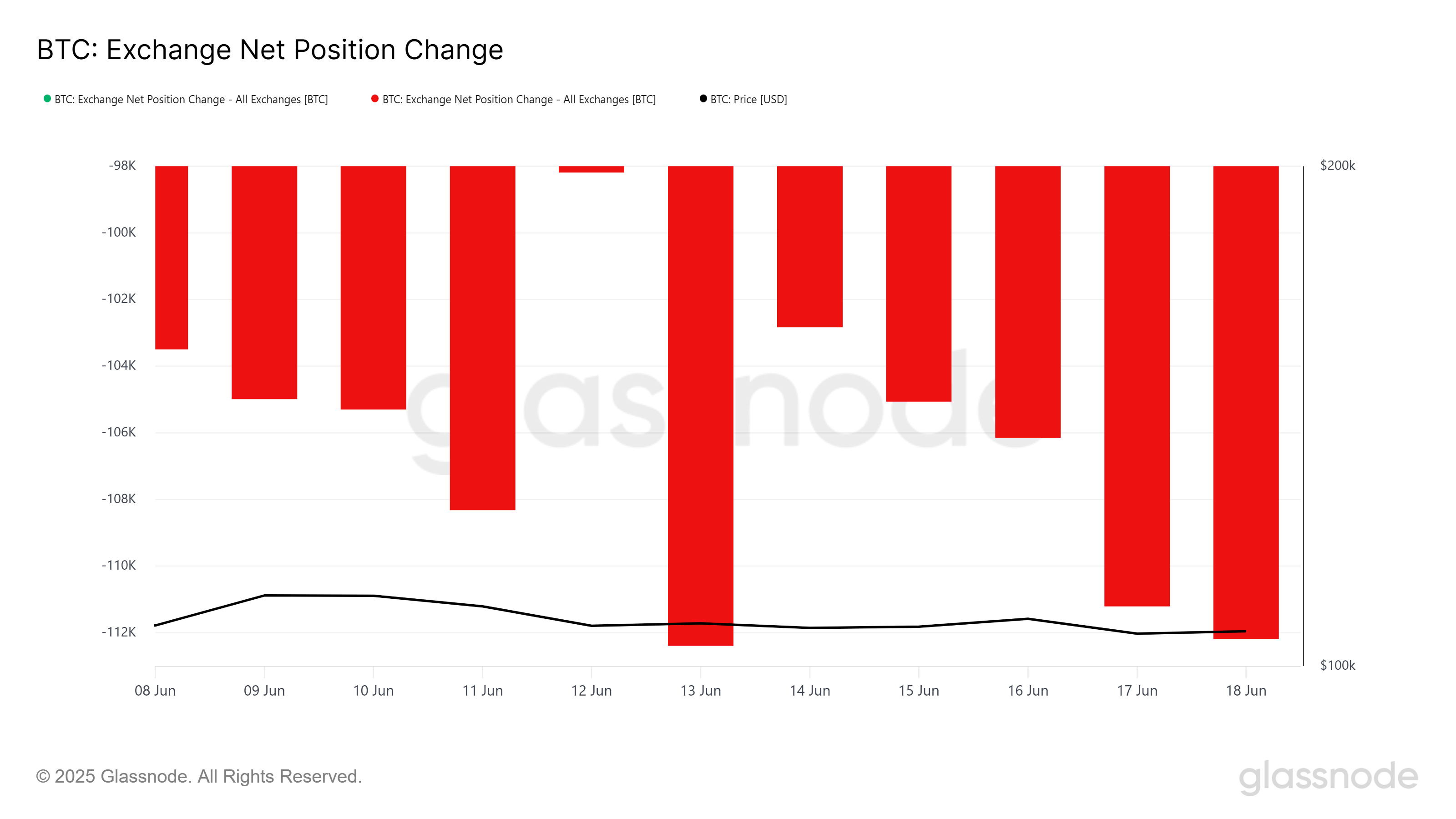

Bitcoin's recent price movements are supported by a slight upward trend in exchange net positions. Over the past week, 14,004 BTC, worth over $1.4 billion, was purchased by investors.

This demonstrates strong investor confidence in Bitcoin's long-term recovery despite broad market volatility. As long as this accumulation continues, Bitcoin is more likely to weather the storm and recover when market conditions improve.

BTC Price Struggling

Bitcoin's price is currently at $105,000, attempting to transform this level into a support line and pave the way for an increase to $108,000. If BTC successfully maintains above $105,000, it could trigger an ascent to the next major price point, suggesting potential recovery.

If Bitcoin breaks through the $108,000 resistance, it will target the next major level of $110,000. Surpassing the $109,476 resistance could push prices higher and restore some optimism among BTC investors. Consistently rising at these levels could strengthen investor confidence and reinforce a positive outlook for the cryptocurrency.

However, if investor sentiment continues to deteriorate due to geopolitical tensions, Bitcoin's price could experience a sharp decline. In such a case, it might drop to the support level of $102,734 or even $101,503. Falling below these levels would erase the current positive sentiment and signal further Bitcoin correction.