On Tuesday, over $200 million flowed into the Bitcoin spot ETF. This is the net inflow to the fund, but it is a significantly decreased amount compared to the previous day's $421 million.

As BTC dropped to an intraday low of $103,371, investor caution increased, and investment sentiment cooled. If the downward trend continues, institutional sentiment may continue to be impacted, potentially further weakening ETF inflows.

BTC ETF, Sharp Decline in Daily Inflows

On Tuesday, the US-listed Bitcoin spot ETF recorded a net inflow of $216.48 million, indicating continued investor interest. However, this represents a 47% drop from the previous day's $412 million, suggesting a slowdown in momentum.

The decrease in inflows coincided with BTC's price drop during the trading session. Weak demand led to a decline to an intraday low of $103,371. This downward trend appears to have burdened market sentiment and prevented new funds from flowing into BTC-related ETFs.

Yesterday, BlackRock's IBIT led with its highest daily net inflow of $639.19 million, and the total cumulative net inflow reached $50.67 billion.

In contrast, Fidelity's FBTC experienced the largest net outflow among these ETFs, with $288.46 million withdrawn.

BTC Facing New Pressure

Today, BTC continued its downward trend, dropping an additional 2%, and the cryptocurrency market faced new selling pressure. The price decline was accompanied by a drop in the coin's futures open interest (OI), suggesting a slowdown in leveraged trading activity.

At the time of reporting, it was $70.24 billion, a 3% decline over the past day. This downward trend signals that traders may be reducing exposure and liquidating positions, reflecting growing market caution.

Open interest represents the total number of outstanding futures contracts not yet settled. A decline during a price drop like now indicates that traders are liquidating positions rather than opening new ones. This suggests weakening trader conviction and decreasing speculative tendencies in Bitcoin futures.

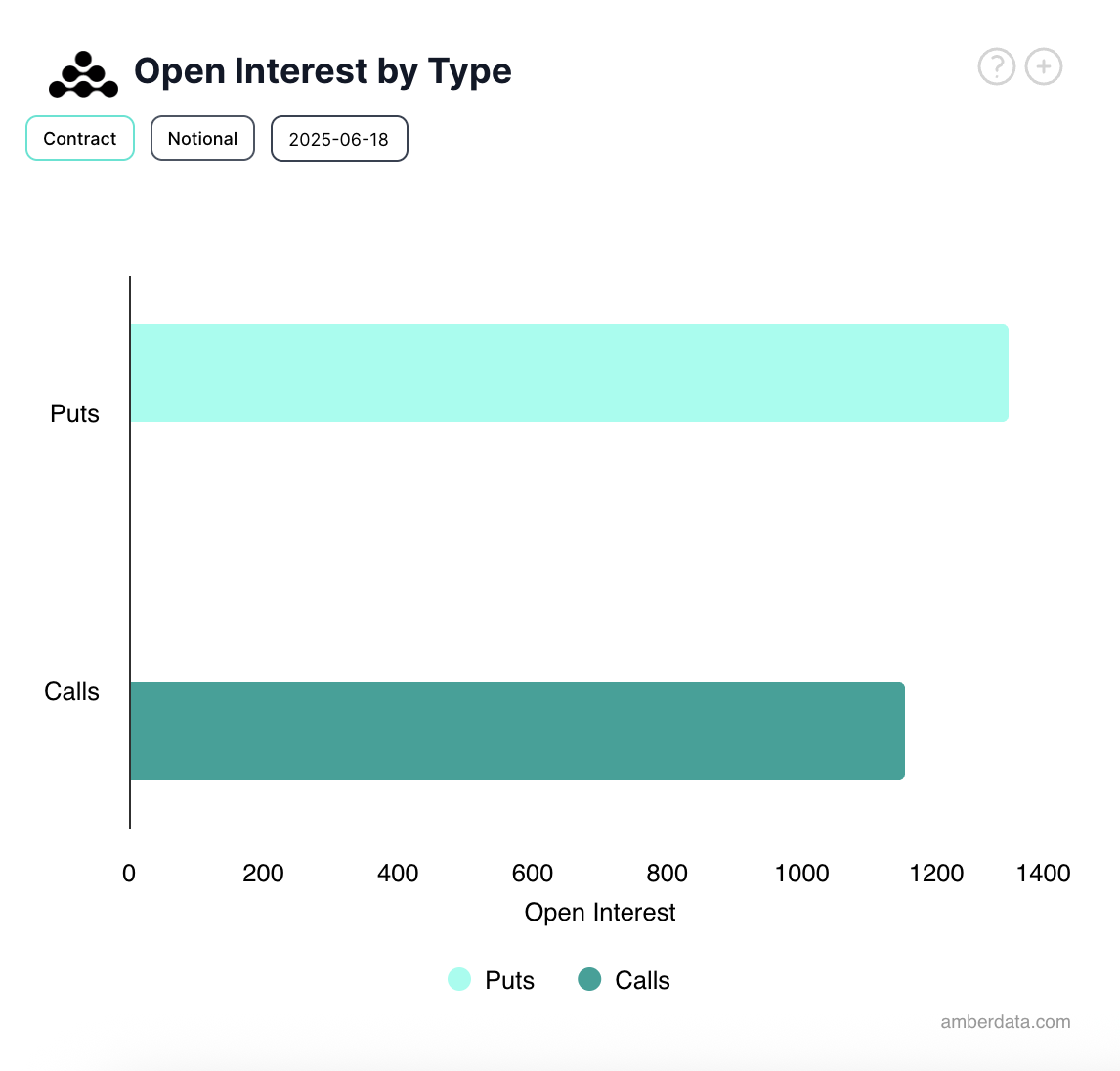

Additionally, according to Deribit, the options market continues to be dominated by bearish sentiment, with higher demand for put contracts compared to calls. This imbalance suggests that increasingly more traders are taking positions to profit from further Bitcoin price declines.

The combination of reduced ETF inflows, decreased open interest, and bearish options market tilt suggests that while institutional interest hasn't disappeared, the reduction in capital flow and trading activity indicates that many investors are preparing for further declines or at least waiting for clearer signals before re-entering the market.