Bitcoin spot ETFs in the US market continue to record steady inflows for two consecutive weeks, despite heightened geopolitical tensions in the Middle East and ongoing pressure on BTC spot prices.

Although daily inflows are temporarily decreasing, the overall trend suggests a stronger indication that institutional investors are confident that BTC and related products serve as reliable hedging instruments in a highly volatile market environment.

Bitcoin ETF, $390 Million Inflow on the 18th

On Wednesday, BTC ETFs recorded approximately $390 million in net inflows, continuing a positive net movement for the asset class for eight consecutive days. This figure represents an 80% increase from the previous day's $216 million, demonstrating a renewed interest from institutional investors.

Bitcoin price briefly exceeded the critical resistance level of $105,000 yesterday, thanks to the increase in net inflows. BTC subsequently slightly declined, down about 0.44% at the time of reporting, but still maintains relative strength within this price range.

BlackRock's spot BTC ETF, IBIT, recorded the highest net inflows among all BTC ETFs yesterday, with $279 million flowing into the fund. At the time of writing, IBIT's total historical net inflows stand at $51 billion.

Traders Shift to Bitcoin Bullish Sentiment

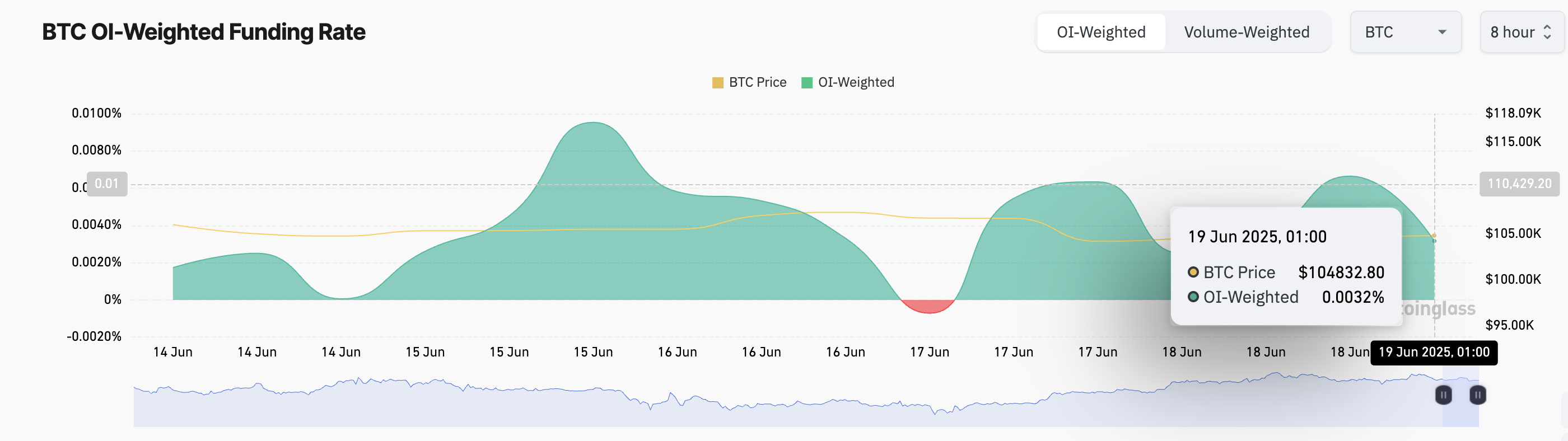

As BTC stabilizes around the $105,000 price range today, derivatives data presents a cautiously optimistic outlook. For instance, the coin's perpetual futures funding rate is positive, indicating an upward sentiment among traders. Currently, this rate is 0.0032%.

The funding rate represents a type of fee rate between traders in perpetual futures contracts. When more traders bet on an increase, long position buyers pay a certain fee to short position buyers, helping to align contract prices with spot prices.

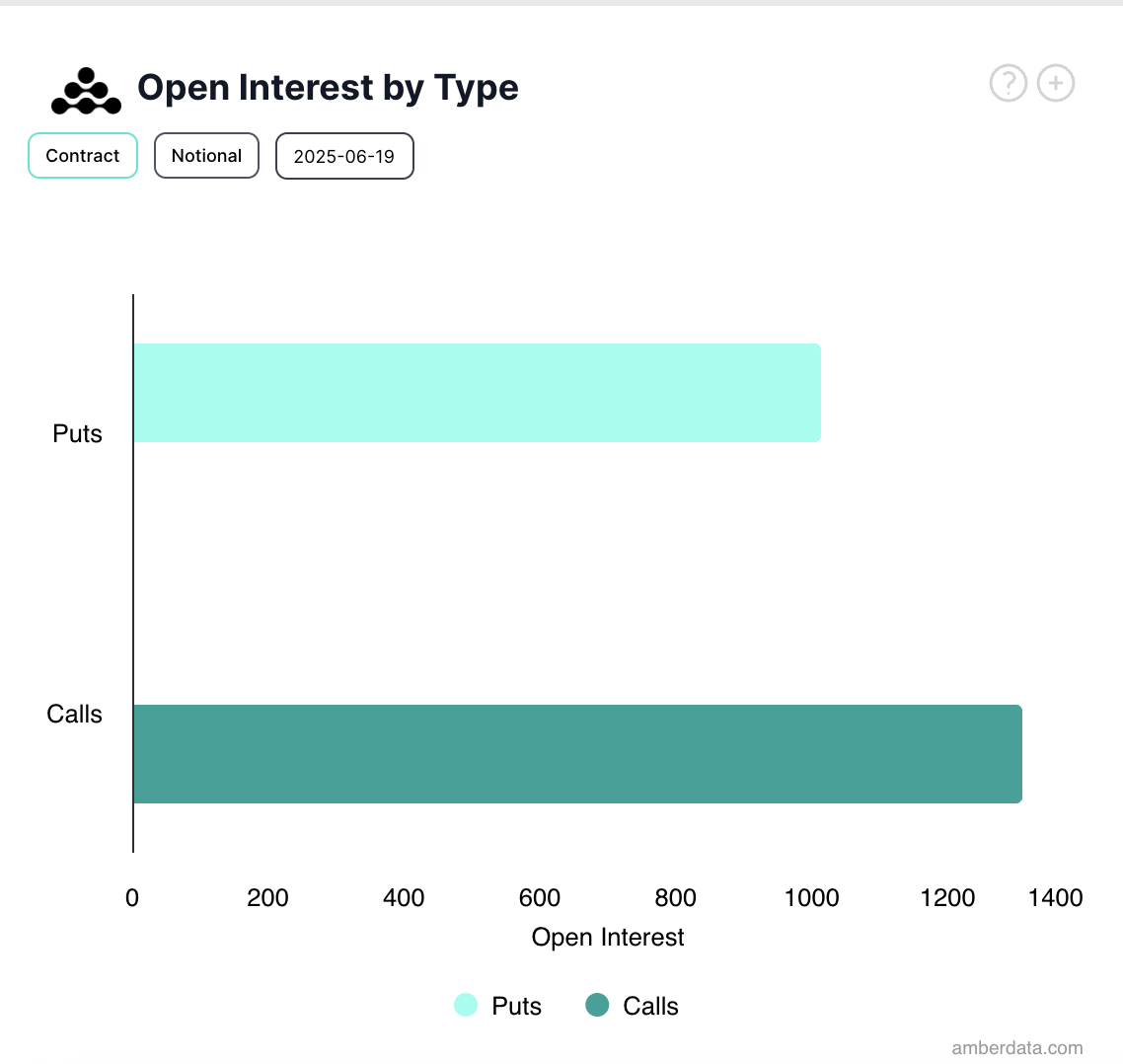

Moreover, options market activity shows a notable surge in call option demand today, a trend associated with rising expectations. This suggests growing sentiment about the potential for a short-term reversal in BTC price.

As global uncertainty persists, the continued momentum of Bitcoin ETF flows serves as a strong indicator of the asset's value storage capabilities.