Original Author: Rob Hadick, Dragonfly Partner

Original Translation: AididiaoJP, Foresight News

Stablecoins are not meant to improve existing payment networks, but to completely disrupt traditional payment networks. Stablecoins enable businesses to completely bypass traditional payment channels, in other words, these traditional payment channels may be entirely replaced in the future.

When payment networks are based on stablecoins, all transactions are just numerical changes on the ledger, and many emerging companies have already begun to promote the restructuring of fund flows.

Recently, many people have been discussing how stablecoins can become Banking as a Service (BaaS) network platforms, connecting existing payment channels from issuing banks to merchant acceptance and everything in between. Although I agree with these views, when I think about how enterprises and protocols will create and accumulate value in the new paradigm, viewing stablecoins merely as a platform connecting existing payment channels actually underestimates its true potential. Stablecoin payments represent a gradual improvement and the possibility of reimagining payment channels from the ground up.

[The rest of the translation follows the same professional and accurate approach, maintaining the original meaning while translating into clear English.]This sounds like science fiction. Are there many issues related to fraud, compliance, stablecoin availability, liquidity/cost, etc. in reality? Will there be incremental steps between today and this potential future? Technologies like real-time payments (RTPs) also have flaws, and the programmability and interoperability of cross-border remittances are problems that RTPs cannot solve.

Anyway, the future is gradually approaching, and some companies are preparing for it. Top issuers like Circle, Paxos, and withausd are expanding their products, and blockchain platforms focused on payments such as Codex, Sphere, and PlasmaFDN are also moving closer to end consumers and businesses. Future payment networks will significantly reduce intermediaries and increase autonomy, transparency, interoperability, and bring more value to customers.

Cross-border Payments

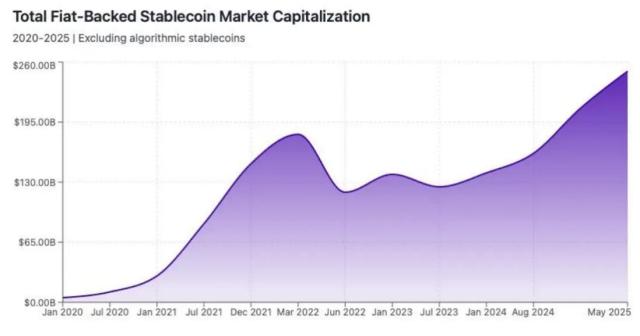

B2B cross-border payments are one of the areas where stablecoin applications are growing significantly.

Matt Brown wrote an article about cross-border payments last year, from which we can see:

In many cases, multiple banks are involved in cross-border transactions, all using SWIFT to transmit information. While SWIFT itself is not problematic, communication between banks creates additional time costs and often involves other clearing counterparties. In fact, the clearing process typically takes 7-14 days, which undoubtedly brings huge risks and costs, and the process is extremely opaque. For example, it is not uncommon for JPMorgan to "lose" millions of dollars for extended periods when transferring funds from the US parent company to foreign subsidiaries. Moreover, foreign exchange risks among multiple transaction counterparties lead to an average transaction cost increase of 6.6%. Additionally, when corporate funds flow across borders, they can hardly earn interest.

Therefore, it is not surprising that Stripe recently announced the launch of a stablecoin-based financial account. This allows businesses to access USD financial accounts backed by stablecoins, directly minting/redeeming stablecoins through Bridge, and transferring funds to other wallet addresses via the Stripe dashboard. Using the Bridge API for fiat deposits and withdrawals, issuing payment cards supported by stablecoin balances (depending on the region, currently using Lead Bank), exchanging other currencies, and ultimately directly converting to interest-bearing products for fund management. Although many functions currently still depend on traditional systems as temporary solutions, sending, receiving, issuing, and exchanging stablecoins and tokenized assets do not rely on traditional systems. The fiat deposit and withdrawal solution is similar to the current alternative payment methods (APMs), such as Wise and Airwallex, which essentially create their own banking networks, can deposit funds in different countries, and settle net amounts at the end of a day. Airwallex co-founder Jack Zhang correctly pointed this out last week, but he did not consider how the world would change if fiat deposits and withdrawals were no longer needed.

If you simply purchase tokenized assets through stablecoins without needing to convert to fiat currency, you essentially completely bypass the traditional correspondent banking model. This will significantly reduce users' dependence on third parties actually holding and sending assets, thereby allowing customers to capture more value and reduce payment costs for everyone. Startups like Squads protocol, Rain cards, and Stablesea are all working to enable the possibility of directly buying and selling tokenized assets through stablecoins, and all companies operating in this field will ultimately expand across the entire network.

But if you want to exchange stablecoins for fiat currency, Conduit Pay can directly collaborate with the largest foreign exchange banks in local markets, achieving seamless, cheap, and almost instant on-chain cross-border transactions. Wallets become accounts, tokenized assets become products, and blockchain becomes the network, thereby significantly improving user experience, with even lower costs if fiat deposits and withdrawals are not needed. All of this can be achieved through better technology and can provide simpler reconciliation, more autonomy, higher transparency, faster speed, stronger interoperability, and even lower costs.

So what does all this mean?

It means a native payment world existing on-chain and based on stablecoins (digital changes on the ledger) is coming. It will not only connect current payment modes but gradually replace them. This is why we will see the first trillion-dollar stablecoin-based fintech company emerging soon.

I know this article will provoke many reasonable criticisms, such as not considering certain issues. But please understand that I and many entrepreneurs in this field are aware of these problems and are working to solve them. Innovation is like this; progressive building on old systems will never truly bring a completely new system because vested interests will always obstruct everything.

Closed loop + trusted intermediary → Open loop + trusted intermediary → Open loop + partial personal autonomy → Truly open digital native system where everyone can compete in the entire payment network and customers exercise autonomy through an open network.

This article represents only the author's subjective views and does not necessarily represent the views of Dragonfly or its affiliated companies. Dragonfly may have invested in some of the protocols or cryptocurrencies mentioned in this article.