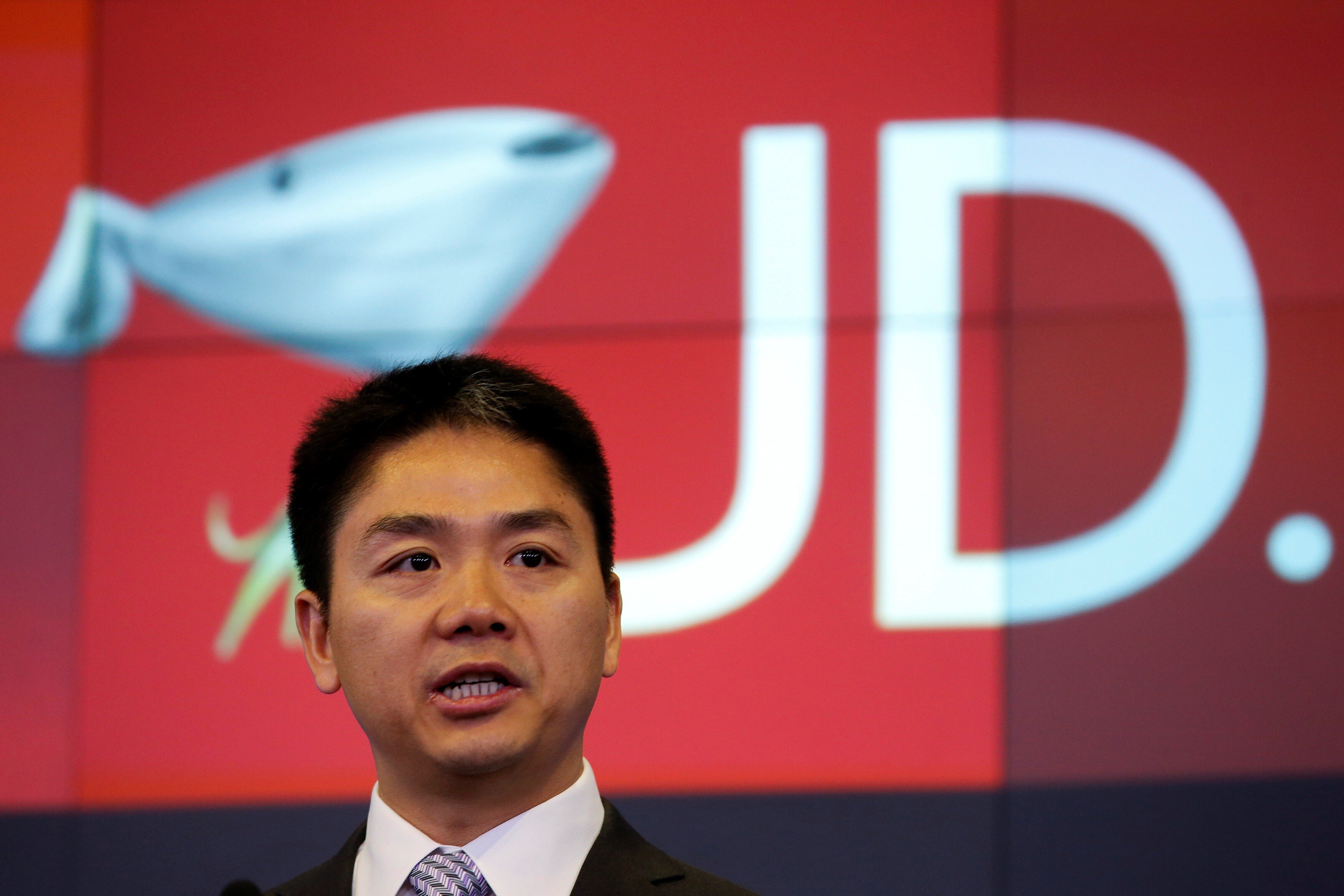

When Liu Qiangdong, the chairman of the JD Group, announced plans to apply for stablecoin licenses globally, with the intention of reducing cross-border payment costs by 90% and improving efficiency to within 10 seconds, many people's first reaction was that this business giant was about to create waves in the financial technology field. However, viewing this merely as the birth of another payment tool would greatly underestimate Liu Qiangdong's true ambition.

This is not a simple "cross-border" move, but a long-planned "reshaping". Liu Qiangdong's goal far exceeds creating a JD version of "Alipay" or "WeChat Pay". What he is truly doing is building a self-controlled, ultra-high-efficiency global "capital high-speed rail" for his vast business empire, ultimately permeating into everyone's cross-border life. His declaration hints at an exciting possibility: in the future, when you shop overseas or when your enterprise trades with global partners, the settlement might no longer use traditional banking networks, but a digital currency called "JD Coin".

The core of this transformation is Stablecoin - a digital asset pegged 1:1 with legal currencies like the US dollar or Euro. It possesses the 24/7 global instant transfer efficiency of cryptocurrencies while maintaining the value stability of legal tender. Liu Qiangdong sees the revolutionary potential of this tool, attempting to thoroughly solve a decades-long global trade challenge: high-cost, inefficient cross-border payments. This is no longer a distant concept, but a commercial reality being forcefully advanced by JD.

The Birth of "JD Coin": An Evolution Story Inherent to a Business Empire

To understand why "JD Coin" might succeed, one must first comprehend that it is not created out of thin air, but the inevitable self-evolution of JD's massive commercial "organism". Its birth is to heal the deepest pain point in JD's global expansion, which precisely constitutes its most solid foundation.

JD's core identity is a technology and service enterprise based on supply chain, with its business empire's cornerstone being the ultimate control of "business flow, logistics, capital flow, and information flow". Over the years, JD has firmly controlled commodity movement (logistics) and transaction occurrence (business flow) through its self-built warehousing and distribution system. However, in the "nervous system" of this empire - capital flow, especially in complex cross-border settlements, it has always been constrained by external traditional financial systems.

Imagine a European brand selling products to China through JD, or a Chinese factory supplying to Southeast Asia via JD. In this process, settling a payment typically takes 2-4 days, with high costs through multiple intermediary banks. For JD, which pursues extreme efficiency and calculates inventory turnover in "days" or even "hours", this is an intolerable bottleneck.

Therefore, "JD Coin" is first a "specific medicine" born to heal this internal wound. Its primary service targets are the tens of thousands of suppliers, brands, and partners within JD's global supply chain ecosystem. When JD can provide near-zero-cost, 10-second settlement services for all participants in this massive "economic body", an unprecedented, almost friction-free global trade closed loop is formed. This is not just cost savings, but a generational business model revolution.

This "self-contained scenario, serving internally" strategy is JD's wise move after learning from Meta's (formerly Facebook) failed Libra project. Libra attempted to create a "supranational currency" for global consumers, directly challenging national financial sovereignty, thus inviting collective suppression from global regulators. JD pragmatically positions stablecoin as a B2B efficiency tool, first landing in a relatively closed and politically less sensitive business scenario. This "B-end first, C-end later" penetration path allows JD's ambition to be wrapped in a highly convincing business case, thus gaining valuable growth time under the regulatory radar.

Giants on the Track: How JD Coin Challenges Tether and USDC

The emergence of "JD Coin" means it will enter a global stablecoin track already dominated by giants, with white-hot competition. In this market worth hundreds of billions of dollars, it faces not only regulatory challenges but also massive pressure from pioneers like Tether (USDT) and Circle (USDC). However, JD Coin's unique genes determine it will compete in a completely different way.

Tether's USDT is the current "traffic king", occupying half the stablecoin market through its first-mover advantage and deep binding in cryptocurrency trading markets. However, it has long been controversial due to its opaque reserve funds and unclear corporate governance, viewed by many mainstream financial institutions and regulators as a potential systemic risk source.

Circle's USDC represents another path - the "compliance route". From its inception, it has prioritized transparency and compliance, with reserve funds managed by top financial institutions like New York Mellon Bank, and regularly publishing audit reports from top accounting firms. This makes USDC a more favored choice for mainstream financial institutions and enterprises, seen as a compliant bridge connecting traditional and digital asset worlds.

Facing these two giants, "JD Coin's" differentiation advantage lies not in financial innovation, but in its unparalleled "real economy foundation". USDT and USDC's value is mainly reflected in financial transactions and digital world payment scenarios. In contrast, "JD Coin's" value is directly anchored to the trillions of dollars of real commodity trade flowing through JD's global network.

This is a fundamental difference. Behind each "JD Coin" transaction might be a batch of real mobile phones, a box of European cosmetics, or a shipment of furniture to the US. This deep binding with the real economy naturally provides risk resistance and value support. Its demand doesn't come from speculation or financial arbitrage, but from enterprises' most genuine trade settlement needs. JD doesn't even need to spend massive resources "convincing" users like other stablecoins, but can directly "guide" tens of thousands of companies in its ecosystem to adopt it through platform rules, payment term benefits, and supply chain financial services.

Therefore, "JD Coin's" entry is no longer homogeneous competition within the stablecoin market, but a "dimensional attack" from the real industry. It will open a brand new market segment - Trade Finance Stablecoin (TradeFi Stablecoin). In this market, competition's core is no longer who designs financial products more cleverly, but who can better serve global commodity trade's real needs. This might force existing players like USDT and USDC to rethink how to more closely integrate their products with the real economy.

Global Compliance Maze: JD Coin's Necessary Path to Reality

Despite its powerful business vision and ecosystem advantages, for "JD Coin" to transform from blueprint to reality, it must successfully navigate a "regulatory maze" composed of complex, fragmented global regulations. This is both its greatest challenge and the key to its success.

JD's choice of Hong Kong as the starting point for its stablecoin plan is a well-considered strategic decision. As an international financial center, Hong Kong has adopted an proactive and pragmatic attitude towards virtual asset regulation in recent years. Its "Stablecoin Issuer Sandbox" mechanism provides JD a valuable testing ground to communicate with top regulators and jointly explore compliance pathways. JD's "JD Coin Technology" successfully being selected for the first batch of sandboxes means it has obtained a precious "admission ticket".

However, Hong Kong is just the starting point. To build a truly global payment network, JD must overcome regulatory barriers in major global economies one by one. In Europe, it must fully comply with the strict requirements of the Markets in Crypto-Assets Regulation (MiCA), which sets bank-like provisions for stablecoins' reserves, capital adequacy, and information disclosure. In the United States, it needs to navigate the continuously evolving federal regulatory bills and find a way forward in complex political negotiations.

This means that the future "JD Coin" is likely not a single global currency, but an alliance of multiple "local stablecoins" independently registered, holding reserves, and complying with local laws in different jurisdictions, such as "JD USD Coin", "JD Euro Coin", and "JD Hong Kong Coin". They are interconnected in brand and technology, but legally and financially isolated. The legal, compliance, and corporate governance costs behind this will be astronomical.

A more subtle challenge is that as a tech giant from China, JD must prove to Beijing's regulators that its project is a strategic tool serving "Chinese enterprise globalization", rather than a potential loophole threatening national financial security or circumventing capital controls. It needs to establish an impeccable "firewall" with legally flawless entities, fund custody, and anti-money laundering processes. The communication and negotiation behind the scenes are as difficult and crucial as any competition in the open market.

More Than Speed: When Your Payment Becomes "Smart"

If "JD Coin" only brings faster payments and lower costs, its revolutionary potential would be far from fully realized. Its true disruptive power lies in its "programmability" - upgrading money from a simple value symbol to a smart tool that can embed business logic. This signals a complete reshaping of the global trade and financial paradigm that has lasted for hundreds of years.

Imagine a future trade scenario: A Chinese factory ships goods to JD's European overseas warehouse. A smart contract is preset with the execution condition of "when JD's logistics system data confirms that the goods have been safely stored". Once the condition is met, the contract will automatically trigger, and the corresponding "JD Euro Coin" payment will be instantly released from JD's digital wallet to the Chinese factory.

The entire process requires no human intervention, no lengthy review of letters of credit, invoices, and bills of lading. Logistics, information flow, and capital flow achieve an unprecedented real-time synchronization. In this shared ledger system, all parties to the transaction - suppliers, platforms, logistics companies, and even customs - can see the same real, unalterable transaction record in real-time. This will fundamentally eliminate the backend costs of reconciliation, accounting, and dispute resolution caused by information asymmetry in traditional trade.

This is not an optimization of existing processes, but a rewriting of the global trade "operating system". When payments become smart, data becomes the new "oil". By operating this closed-loop platform, JD will gain unparalleled insights into global supply chain dynamics. It will know earlier than anyone which region's demand for a certain commodity is surging, or where a bottleneck is occurring on a route. The data precipitated from real transactions constitutes the most core strategic asset, which can be used for more precise inventory management, supply chain finance, and market forecasting.

Conclusion: Will Your Wallet Make Room for "JD Coin"?

Liu Qiangdong's few words about stablecoins are like a stone thrown into a calm lake, with ripples far deeper than what appears on the surface. It reveals the arrival of an era where tech giants reshape global commercial infrastructure using stablecoins.

The core of this transformation is no longer a direct confrontation between tech companies and sovereign states, but a business race around "efficiency" and "scenarios". JD's ultimate ambition is to use its unparalleled real-world trade ecosystem to create a global payment layer more efficient, smarter, and closer to real business needs than any existing financial network.

Its success will depend on navigating the complex global regulatory maze and maximizing its "real economy" advantages in competition with financial giants like Tether and USDC. For ordinary people, this means the emergence of a new choice. Perhaps in the near future, when making the next cross-border payment, we'll find an option called "JD Coin" alongside traditional bank transfers and credit cards. And this is the future Liu Qiangdong hopes to see.