Recently, Bitcoin's price has shown notable volatility due to various factors, ranging from the US Consumer Price Index (CPI) data release to the escalating conflict between Israel and Iran.

While these global events added uncertainty to the cryptocurrency market, Bitcoin's resilient performance suggests that it will continue to receive support.

Bitcoin is Gaining Investor Support

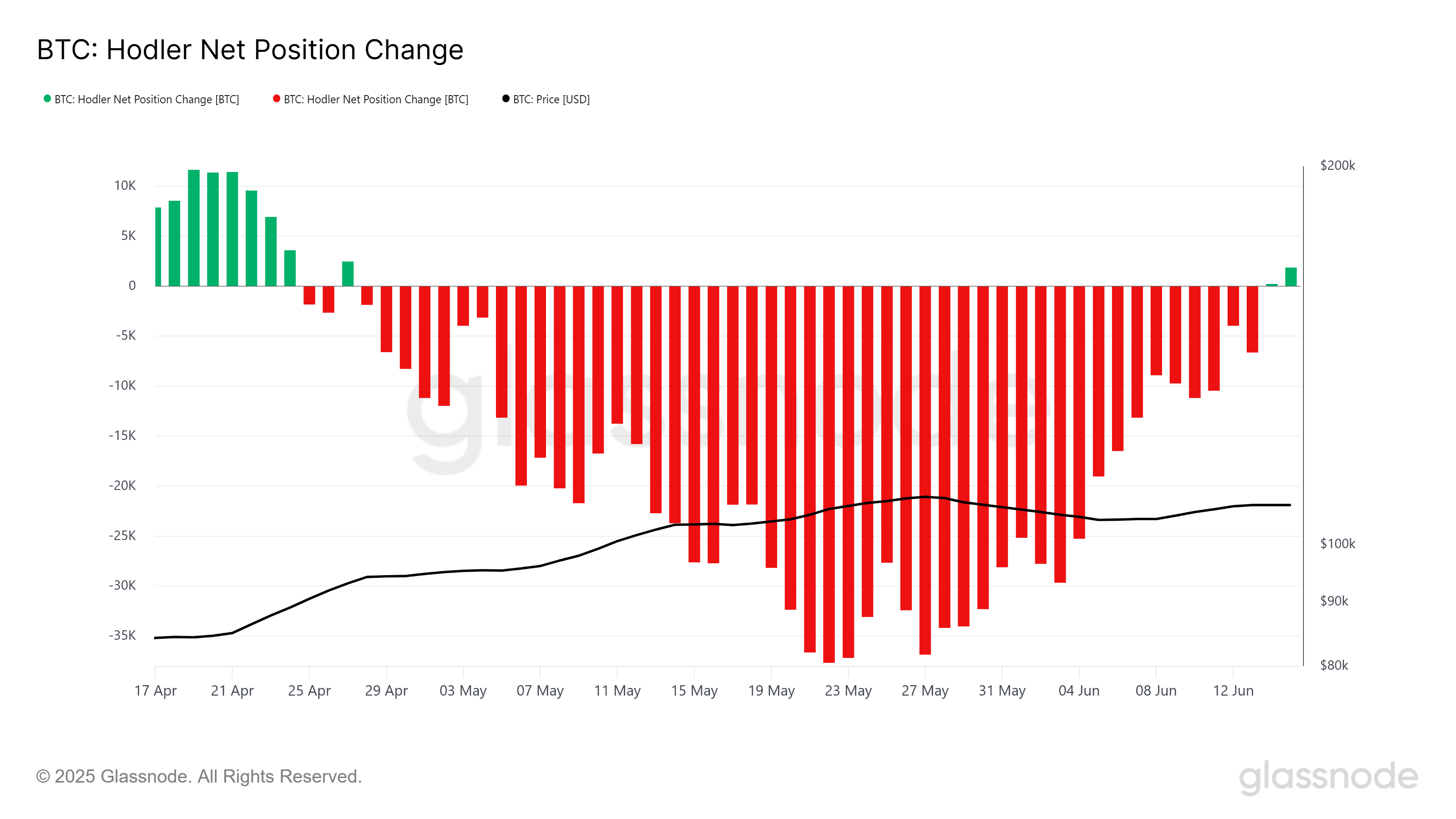

After nearly two months of limited movement, the stance of Bitcoin long-term holders (LTH) has begun to change. Recent hodler net position change data indicates a decrease in fund outflows, suggesting that LTHs have stopped taking profits. This change signals increasing investor confidence;

A small inflow of funds was observed in the past 24 hours, implying that LTHs are beginning to re-enter the market. As these inflows increase, Bitcoin's price could gain momentum and recover, reflecting new investor optimism.

The reversal of LTH selling is an encouraging sign. If this trend continues, it could support further price increases for Bitcoin.

From a macroeconomic perspective, Bitcoin ETFs have played a crucial role in recent market developments. Last Friday, amid the Israel-Iran conflict, Bitcoin ETFs saw an inflow of $311.7 million. This was the second-highest inflow this week, with consistent daily inflows. The fact that institutional investors remained unshaken by geopolitical tensions suggests a strong outlook for this market segment.

However, this positive momentum may depend on how institutions respond going forward. If institutional fund inflows continue, <2>Bitcoin can maintain its price uptrend with additional support. Conversely, if institutional sentiment turns negative or inflows slow down, Bitcoin's price could experience a reversal. Monitoring ETF inflows next week will be crucial in gauging the market's direction.

Bitcoin Price Must Break Key Barriers

Bitcoin's price has been trading slightly below $107,000 after rebounding from the support level of $105,572, having maintained levels above $105,000 in recent days. This indicates that Bitcoin has found a solid support base, with traders targeting the next resistance level at $108,000.

Breaking this level will be crucial for the cryptocurrency to achieve further gains. If Bitcoin successfully breaks through the $108,000 barrier, it can move towards the next major resistance level.

Overcoming the psychological resistance of $108,000 could open the door for Bitcoin to challenge $109,476 and potentially reach $110,000. If Bitcoin can reclaim this as a support level, the path to its all-time high of $111,980 (ATH) would become even closer.

However, if Bitcoin fails to break the resistance at $108,000 and investor sentiment contracts, the cryptocurrency could fall back to the support level of $105,572. Dropping below this support would signal a bearish reversal, potentially pushing Bitcoin below $105,000.