Last week, venture capital of $1.77 billion flowed into the cryptocurrency industry.

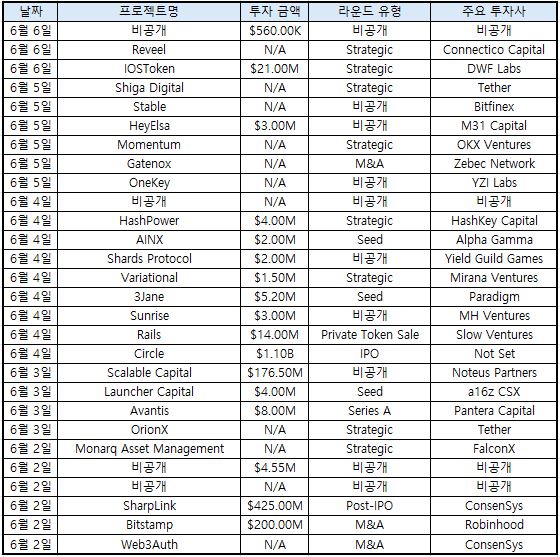

According to CryptoRank, a total of 27 investment rounds brought $1.77 billion (approximately 2.4257 trillion won) of venture capital into the cryptocurrency industry last week (June 2-8).

While the number of investments decreased slightly compared to the previous week (33 deals), the investment scale significantly increased from $1.1 billion, continuing the investment recovery trend. Particularly, the inclusion of multiple large investment rounds suggests active institutional fund inflows. From early June, global capital flows are showing signs of refocusing on the cryptocurrency ecosystem.

The most notable investment was Circle's $1.1 billion IPO, which drew significant industry-wide attention to the stablecoin issuer's public listing. Following this, 'Scalable Capital' raised a large investment of $176.5 million.

At the intersection of traditional finance and crypto, 'SharpLink' completed a post-IPO round of $425 million, with Consensys participating as a major investor. Additionally, the $200 million M&A deal of 'Bitstamp', where Robinhood acted as the acquirer, demonstrated the acceleration of traditional financial institutions' entry into crypto.

In the blockchain infrastructure sector, 'IOSToken (IOST)' secured a strategic investment of $21 million from DWF Labs, and 'Rails' successfully completed a private token sale of $14 million.

Seed-stage projects also showed active movements. '3Jane' raised $5.2 million in a round led by Paradigm, and 'Avantis' secured $8 million in a Series A round with Pantera Capital's participation.

Additionally, projects in various fields such as ▲'Sunrise' ($3 million, MH Ventures) ▲'HeyElsa' ($3 million, M31 Capital) ▲'AINX' ($2 million, Alpha Gamma) contributed to ecosystem expansion by attracting investments from Tier 1 VCs.

Moreover, Tether expanded its ecosystem by making strategic investments in 'Shiga Digital' and 'OrionX'.

The cryptocurrency industry has raised a total of $1.92 billion through 42 investment rounds so far this month. In March, it raised $5.08 billion through 140 investments, in April $2.38 billion through 94 deals, and in May $1.92 billion through 124 rounds. As of mid-June, the investment scale has reached a level similar to the entire month of May, and the number of deals continues to increase steadily.

The investment activity index over the past 30 days increased by 2% compared to the 12-month average, recovering to a 'Normal' level. The previous week showed 2% less than the average.

A total of 139 investment rounds were counted over 30 days, a 36.3% increase from the previous month. The total investment raised was $4 billion, a 37.6% decrease from the previous month, with the average round size maintained at around $3-10 million. The most active investment stage was the 'Strategic' stage.

In terms of investment focus areas, Artificial Intelligence (AI) accounted for the highest proportion at 30.97%. This was followed by payments at 20.74%, developer tools at 19.89%, decentralized exchanges (DEX) at 15.06%, and Non-Fungible Token (NFT) elements at 13.35%.

The top investment firms most actively investing over the past six months were ▲Coinbase Ventures with 34 deals ▲Animoca Brands with 25 deals ▲a16z CSX with 21 deals ▲Amber Group with 21 deals ▲OKX Ventures with 19 deals ▲Cellini Capital with 19 deals ▲MH Ventures with 18 deals.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>