Over the past 24 hours, approximately $403 million (about 588 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently compiled data, short positions accounted for $330 million, representing 82% of the total liquidations, while long positions were $73 million, accounting for 18%.

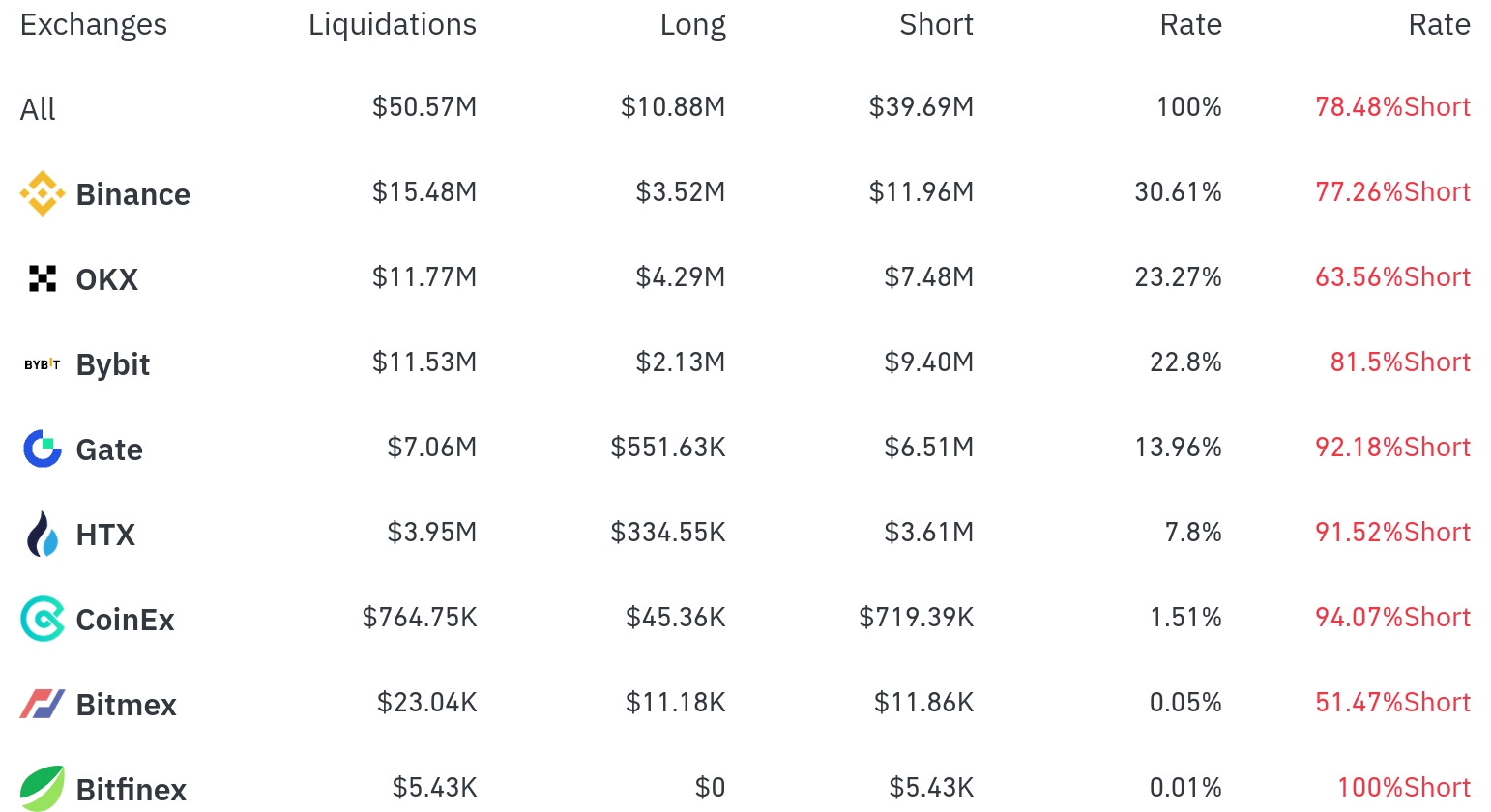

Binance experienced the most position liquidations over the past 4 hours, with a total of $15.48 million (30.5%) liquidated. Among these, short positions accounted for $11.96 million, or 77.26%.

OKX was the second-highest exchange with $11.77 million (23.2%) of positions liquidated, with short positions making up $7.48 million (63.56%).

Bybit saw approximately $11.53 million (22.7%) in liquidations, with short positions at 81.5%.

Notably, Gate.io showed an extremely high short position liquidation rate of 92.18%, while HTX and CoinEx also had overwhelmingly high short position liquidations at 91.52% and 94.07%, respectively.

Bitcoin (BTC) and Ethereum (ETH) positions were the most liquidated. Over 24 hours, approximately $175.68 million in Bitcoin positions were liquidated, with up to $13.51 million in short positions liquidated within 4 hours.

Ethereum (ETH) saw about $173.68 million in positions liquidated over 24 hours, with up to $11.83 million in short positions liquidated within 4 hours. Notably, Ethereum's 7.22% price increase triggered massive short liquidations.

Solana (SOL) had approximately $19.32 million liquidated over 24 hours, with a 5.72% price increase and $4.92 million in short positions liquidated within 4 hours.

Doge experienced about $9.73 million in liquidations over 24 hours, accompanied by a 4.54% price drop.

UNI Token was particularly noteworthy, recording a significant 25.71% price increase over 24 hours and triggering substantial short position liquidations ($2.45 million). Additionally, AAVE (+14.08%), HYPE (+10.06%), and ENA (+10.87%) saw large short liquidations alongside double-digit price increases.

FARTCO, one of the cryptocurrencies with the highest price increase, saw a 12.64% rise and $4.50 million in short position liquidations over 24 hours.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leverage position when a trader fails to meet margin requirements. This large-scale short position liquidation indicates that the recent cryptocurrency market's upward trend has exceeded many short sellers' expectations.

Get real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>