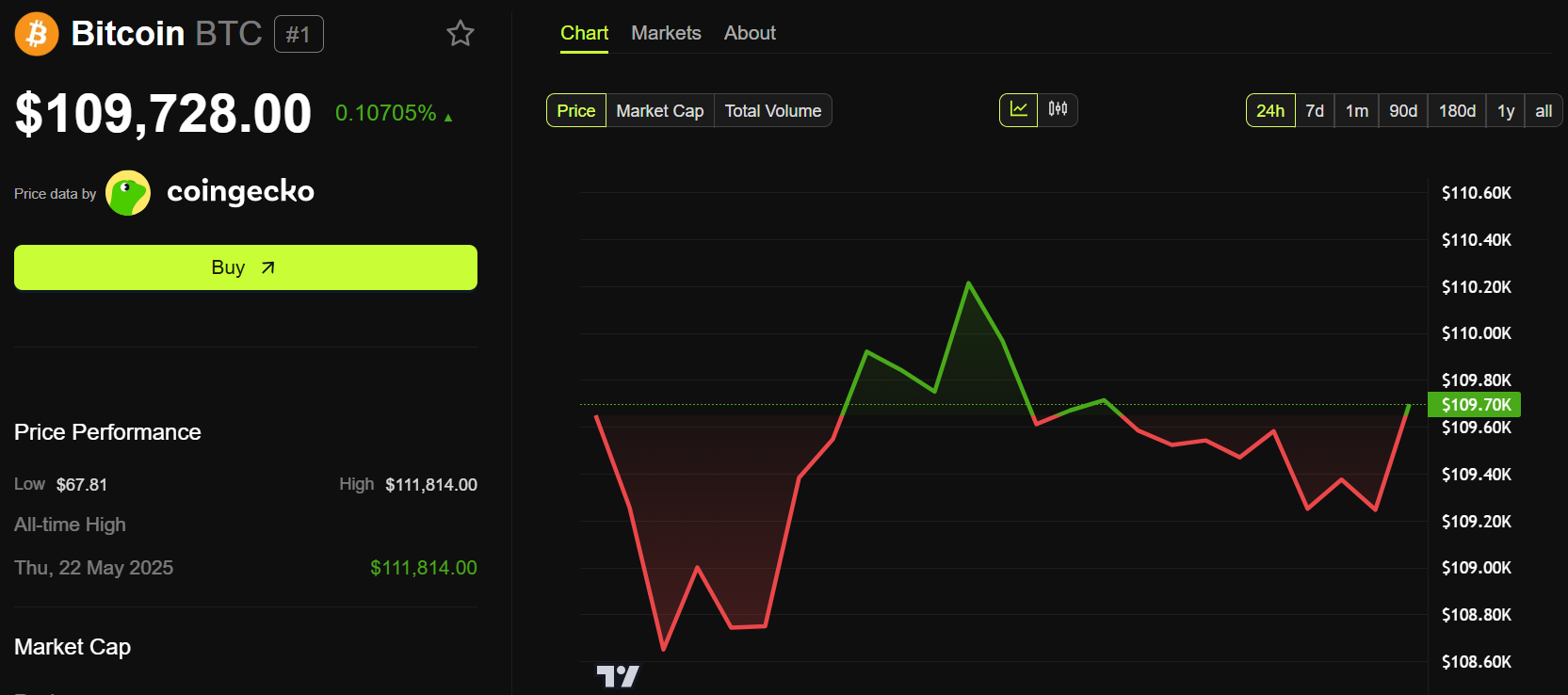

US Consumer Price Index (CPI) data has been released. Inflation in May increased, which is the first time since February. Bitcoin is approaching $110,000 in response to this news.

In addition to the CPI, traders and investors will be watching the US employment data and Producer Price Index (PPI) to be released on Thursday.

US CPI Data, May Inflation Rises 2.4%

The US Bureau of Labor Statistics (BLS) has released the Consumer Price Index (CPI). May inflation increased by 2.4% annually, rising for the first time since the annual 2.3% in April. This is the first time headline CPI inflation has shown an upward trend since January 2025.

CPI 0.1% MoM, Exp. 0.2%

— zerohedge (@zerohedge) June 11, 2025

CPI Core 0.1% MoM, Exp. 0.3%

CPI 2.4% YoY, Exp. 2.4%

CPI Core 2.8% YoY, Exp. 2.9%

This CPI increase is the first in 3-4 months. Immediately after this news, Bitcoin slightly rose and is now approaching $110,000.

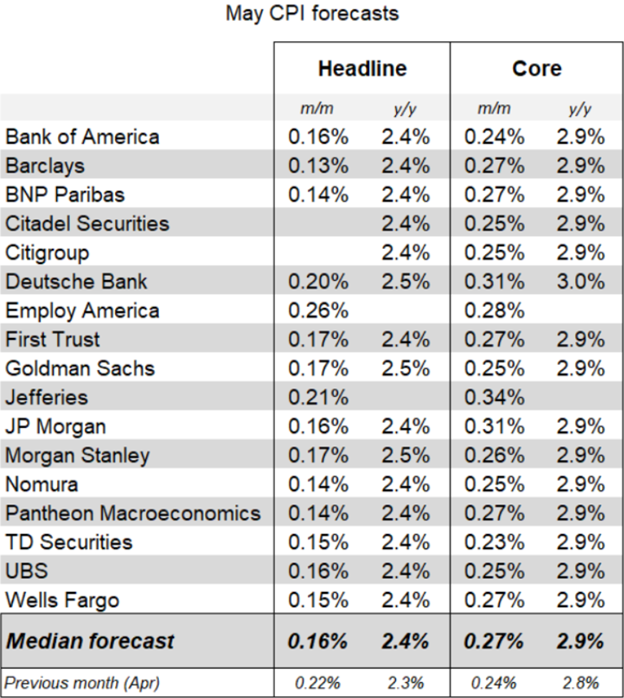

Before the US CPI data release, the consensus expected the headline figure to rise 0.2% month-on-month and accelerate to 2.5% annually.

Perhaps the expectation of inflation increase explains the slight rise in Bitcoin price, as it has already been factored in.

"If CPI exceeds 2.5%, the possibility of Fed rate cuts will decrease, and selling pressure is expected. If CPI is 2.5%, there will be selling pressure, but the decline will be a buying opportunity. If CPI is below 2.5%, a pump and dump is expected, but the market will close with an upward trend. Except for the first scenario, the market will show strength." – Analyst Cas Abbé

In particular, several banks expected May CPI to show moderate headline inflation and monthly core inflation close to the midpoint of the past 12 months.

Meanwhile, the cause of the May US CPI inflation increase can be easily identified. All signs point to Trump's tariffs, and the latest data indicates the first impact of trade policy in the US, particularly on goods inflation.

"A slight increase is expected compared to last month, which is likely due to the increase in OIL and some tariffs being passed on to consumers." – Analyst Daan Crypto Trades

As the CPI inflation data is priced in, attention is focused on additional US indicators this week. Particularly, the new unemployment claims and PPI to be released tomorrow are drawing attention. Additionally, interest is growing in the Federal Reserve's policy decision next week.

Next Wednesday, the Fed will announce the policy rate decision for the June 17/18 meeting, followed by a speech by Chairman Jerome Powell.

The US CPI is a lagging indicator, a major focus for inflation targets, and thus connected to the Federal Reserve's 2% target. Today's US CPI inflation data will influence the FOMC's rate decision next week.

According to the CME FedWatch, there is a 99.9% probability that the Fed will maintain rates at 4.25-4.50% at the next meeting. Currently, the possibility of a Fed rate cut is almost 0%.

"The possibility of a Fed rate cut next week has dropped to 0%." – The Kobeissi Letter

However, despite the impact of Trump's tariffs on US inflation, Chairman Powell claims that political pressure will not influence the Fed's policy decisions.

As inflation still exceeds the Fed's 2% target, policymakers may continue a cautious approach.

"The market generally expects the Federal Reserve to continue a wait-and-see approach. Market movements will still be driven by events, with key factors being rate cut expectations adjustment after the Fed meeting and statements from officials." – Bitunix Analyst, speaking to BeInCrypto

However, in addition to inflation, the labor market is also becoming an important macroeconomic catalyst for Bitcoin. The Fed can cut rates if there is a robust labor market and an economy that has not yet derailed.