The decentralized finance token Uniswap is today's top-performing digital asset, recording over 10% growth in the past 24 hours and ignoring the market's downward trend.

While most major cryptocurrencies are consolidating, UNI has extended its recent rally, reaching a new four-month high and reigniting its upward momentum.

UNI Rises 40%... Four-Month High

Evaluating the UNI/dollar daily chart, this altcoin surged 40% on June 10th, closing at a four-month high of $8.66. After a slight adjustment to $8.38, UNI still rose 17% over the past day and continues to build upward momentum.

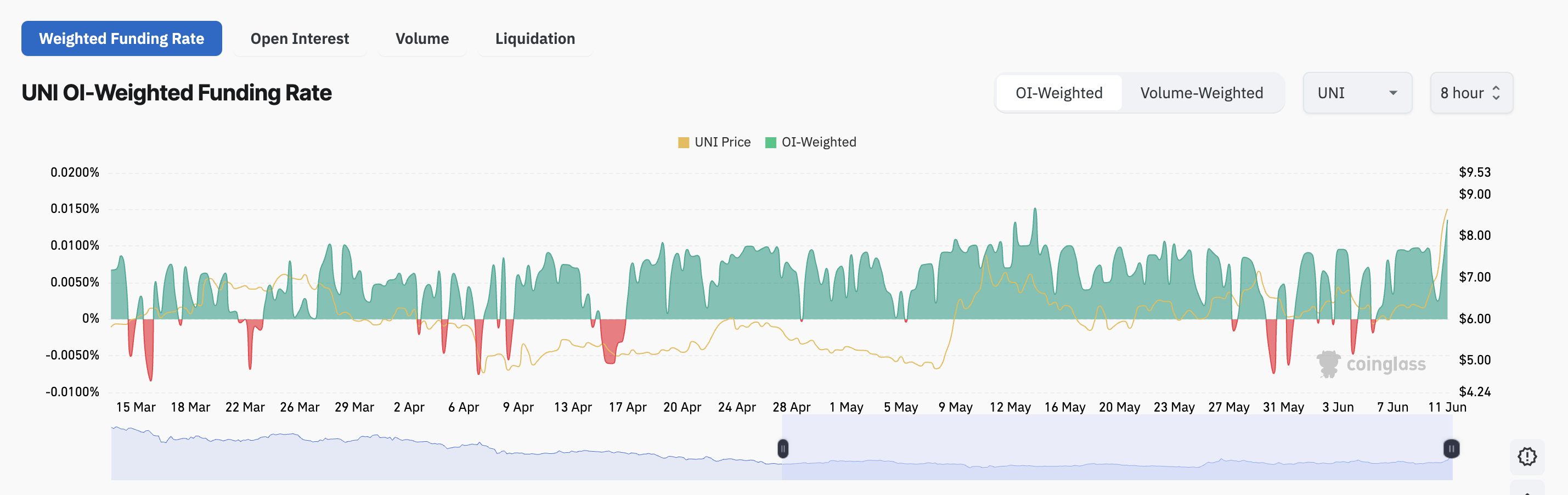

The token's funding rate surge supports this upward trend. According to Coinglass, this indicator has reached its monthly high of 0.013%, indicating increased demand for long positions in the token's perpetual futures market.

The funding rate is a periodic fee between traders in the perpetual futures market, used to align contract prices with the spot market. When an asset's funding rate is positive, long position holders pay short position holders, indicating bullish sentiment and high demand for leveraged long trades.

Moreover, UNI's Elder-Ray index supports this upward outlook. On the daily chart, the momentum indicator records its highest green histogram bar in a month, reflecting a surge in buying pressure. Currently, UNI's Elder-Ray index is 3.01.

This indicator measures the strength of buyers and sellers in the market. When green histogram bars are displayed, it indicates strong buyer dominance and upward momentum. This suggests the potential continuation of UNI's short-term rally.

Increasing UNI Bullish Sentiment

As buying pressure increases, UNI could rally to the $9.46 resistance level and potentially convert it to a support level. If this upward breakout succeeds, it could pave the way for a move to $10.25, last seen on February 17th.

However, a resumption of profit-taking could invalidate this outlook. If selling pressure resumes, UNI could drop back to $8.07, potentially erasing much of its recent gains.

If this support does not hold, the altcoin could experience a further decline to the $7.08 area.