The Pi Network token has risen by 2% in the last 24 hours, riding the overall upward trend of the cryptocurrency market. Currently, this altcoin is trading at $0.63.

However, despite this upward movement, key technical indicators are showing a bearish divergence with price, raising questions about the sustainability of the recent uptrend.

Lack of Confidence in PI Token Rally

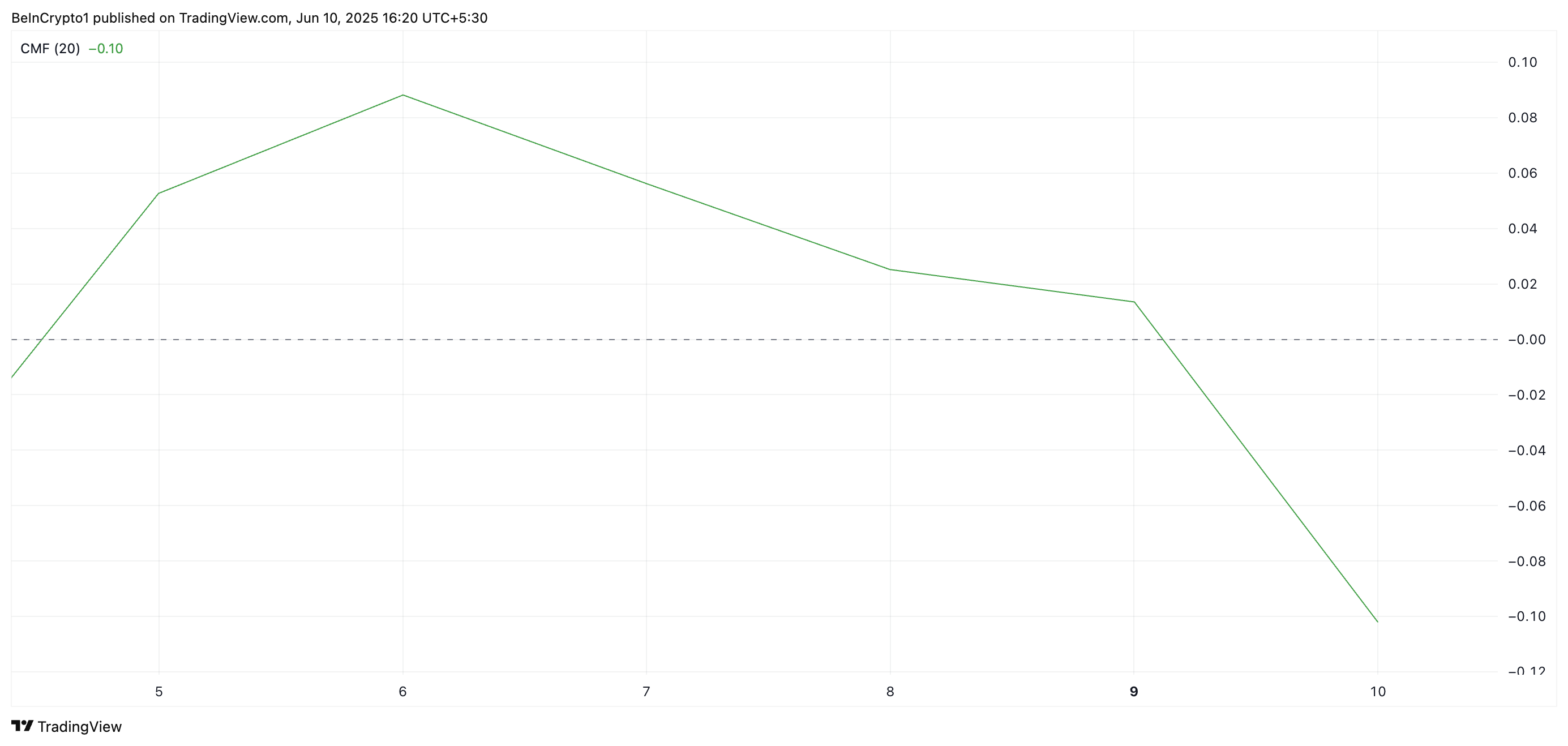

The readings on the PI/USD daily chart show that the token's Chaikin Money Flow (CMF) is below the zero line and showing a downward trend. It is forming a bearish divergence. At the time of writing, this indicator is -0.10.

The CMF indicator measures the inflow and outflow of funds for an asset to assess buying and selling pressure. When this value is negative while the asset's price is rising, a bearish divergence appears.

This trend indicates that the price increase is not supported by strong buying pressure. This suggests a lack of confidence in the PI token rally and implies a potential correction.

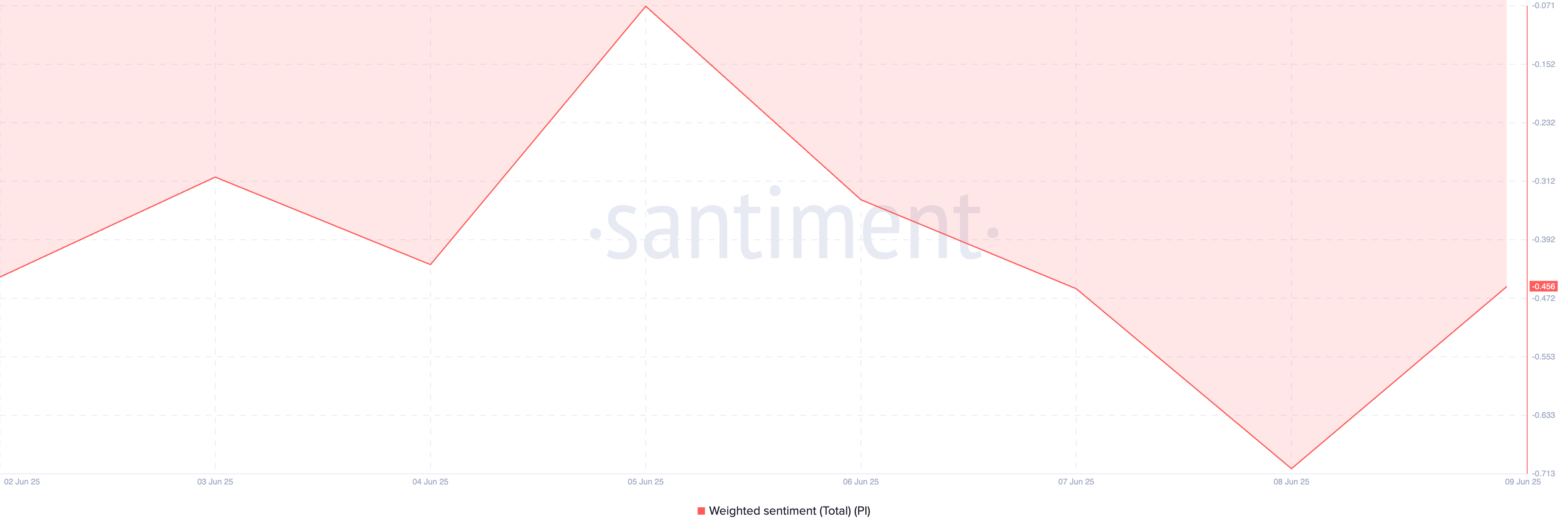

Moreover, on-chain data shows that PI continues to be constrained by negative sentiment, which further exacerbates downward pressure on the price. According to sentiment, this indicator is currently -0.45, reflecting a decrease in investor sentiment.

The weighted sentiment indicator analyzes social media and online platforms to assess the overall tone (positive or negative) about the cryptocurrency.

When the value of this indicator is negative, it indicates that the overall market sentiment for the asset is declining, with negative discussions and outlooks prevailing over positive ones.

This highlights PI's continued challenges and shows that the lack of investor optimism continues to delay meaningful upward movement.

PI Approaching Key Resistance at $0.65

PI is currently trading at $0.63 and approaching resistance formed at $0.65. If demand begins to decrease, this uptrend could reverse and potentially cause a price drop to $0.57.

However, if new demand enters the market and the current PI rally receives support, it could break through the $0.65 resistance and rise to $0.72.