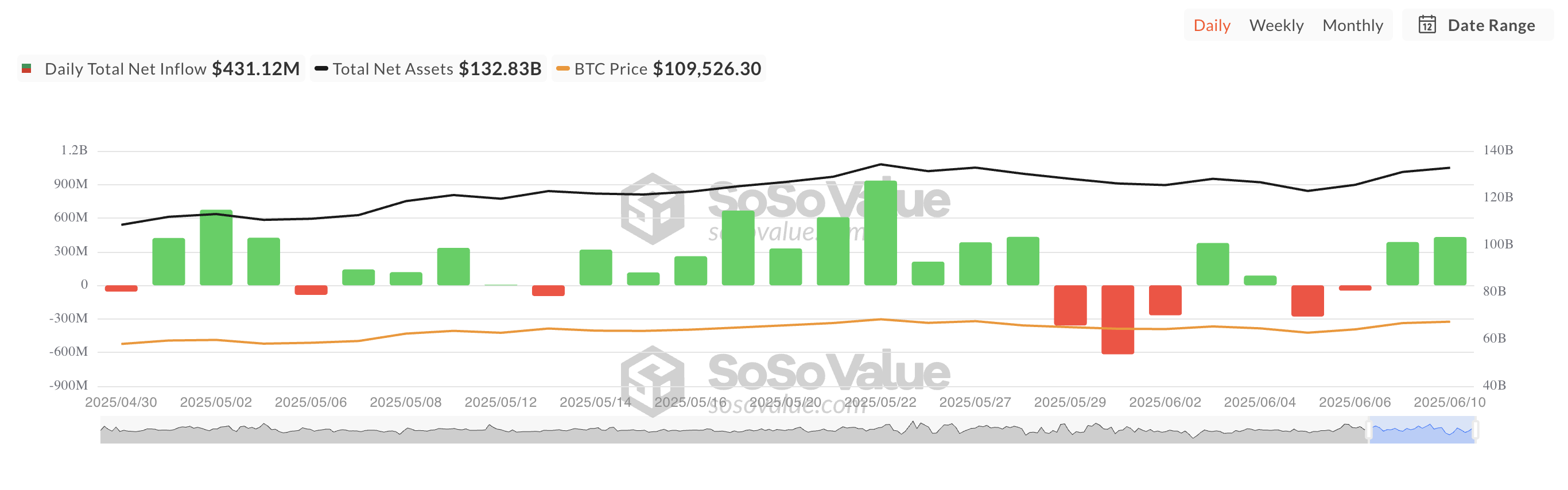

Bitcoin spot ETF recorded over $400 million in net inflows yesterday. This is the largest single-day net inflow since May 28.

This inflow emphasizes the restoration of confidence among institutional investors and reignited the upward trend across the cryptocurrency market.

Surge in Bitcoin ETF Demand

On Tuesday, demand for U.S.-listed spot Bitcoin ETF significantly increased. Net inflows rose to $431.12 million, a 12% increase from the previous day's $386 million.

Capital inflows into ETFs serve as a leading indicator of broad market demand, suggesting institutional investors are positioning themselves for further gains. The surge in ETF demand occurred amid growing optimism that BTC could soon recover to the $110,000 level. Some traders are expecting a return to all-time highs.

Yesterday, BlackRock's IBIT recorded the highest daily inflow of $337 million, bringing its total historical net inflows to $49.1 billion.

Fidelity's FBTC recorded the second-highest daily net inflow of $67.07 million, raising its total historical net inflows to $11.68 billion.

BTC Price Stability…Futures and Options Caution Signals

As profit-taking activities gradually intensify, the BTC spot price remained largely unchanged over the past 24 hours. At the time of writing, Bitcoin is trading at $109,601, recording a slight 0.11% increase.

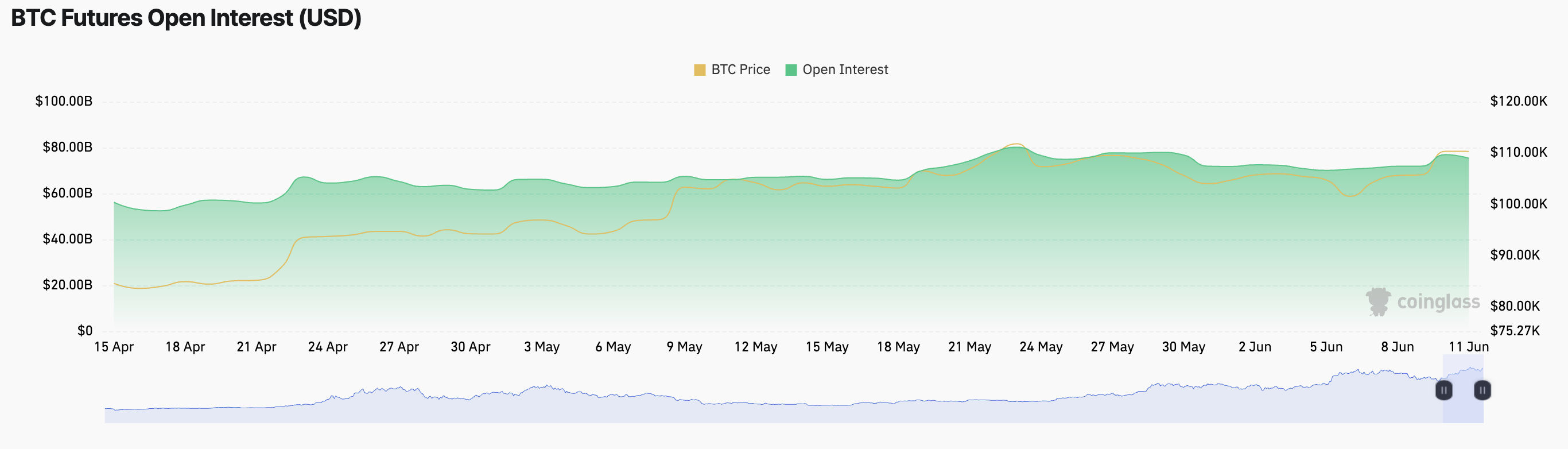

Meanwhile, the coin's futures open interest has decreased, indicating reduced trading activity. At the time of reporting, it stands at $75.33 billion, a 1% drop from the previous day.

Open interest represents the total number of unsettled derivative contracts, such as futures or options. A decrease in open interest indicates reduced trading activity or profit-taking, suggesting traders are closing existing positions.

For BTC, the slight decline in futures open interest indicates initial profit-taking among traders who held long positions during the recent rally. If this trend continues, downward pressure on the coin could intensify.

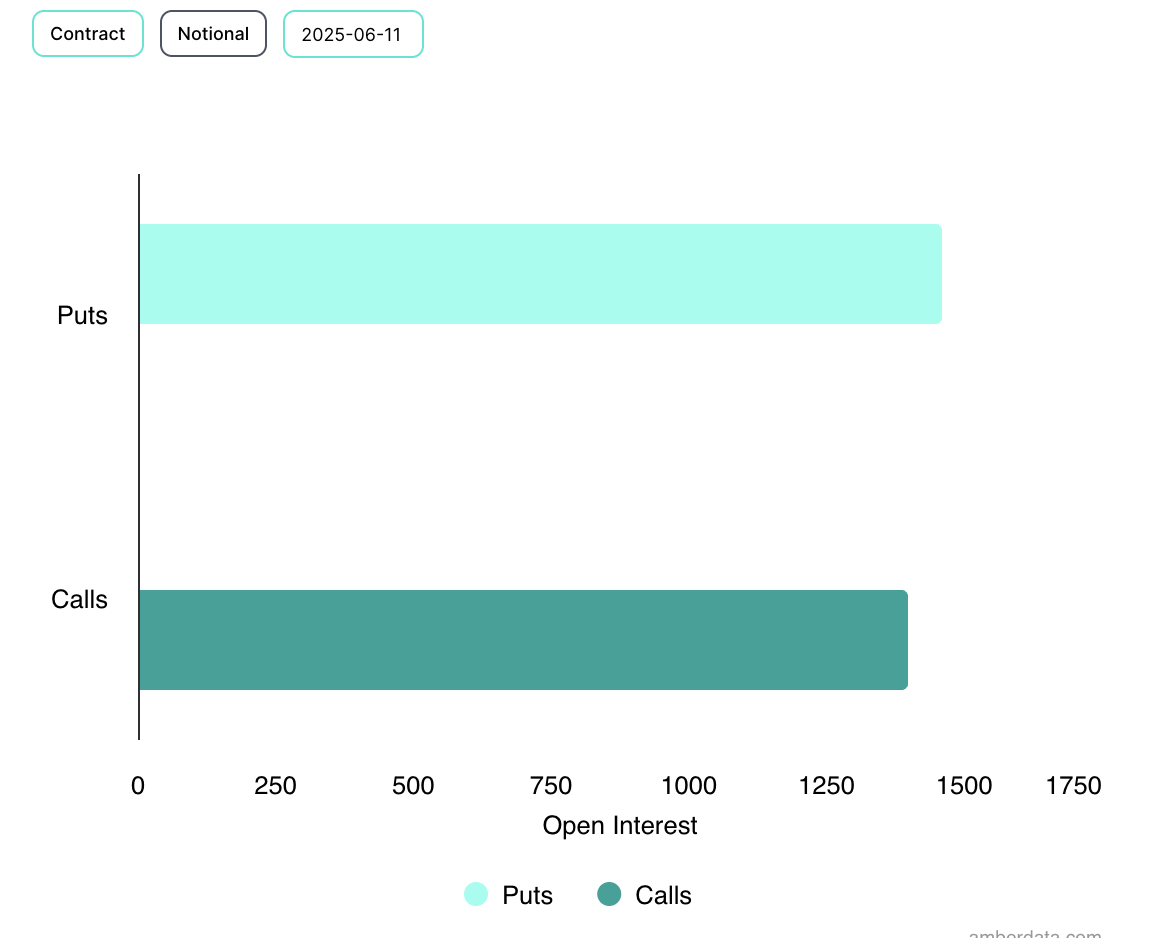

Additionally, a cautious atmosphere is detected in the options market, with increased demand for put options subtly reviving bearish expectations.

Therefore, while ETF inflows paint a positive macroeconomic picture, short-term price movements and derivative positioning suggest a potential correction period as investors realize profits.