Analysts point out that Ethereum (ETH) has gathered several key factors. This is the catalyst that investors have long been waiting for to trigger a strong new upward movement.

In June, these signals become more distinct, forming a solid foundation for short-term price expectations. So what are these factors? Let's explore in detail.

ETH, About to Break All-Time High?

Axel Bitblaze, a famous analyst on Platform X, believes ETH is facing a potential all-time breakthrough. According to him, four major catalysts are laying the groundwork for ETH's strong growth.

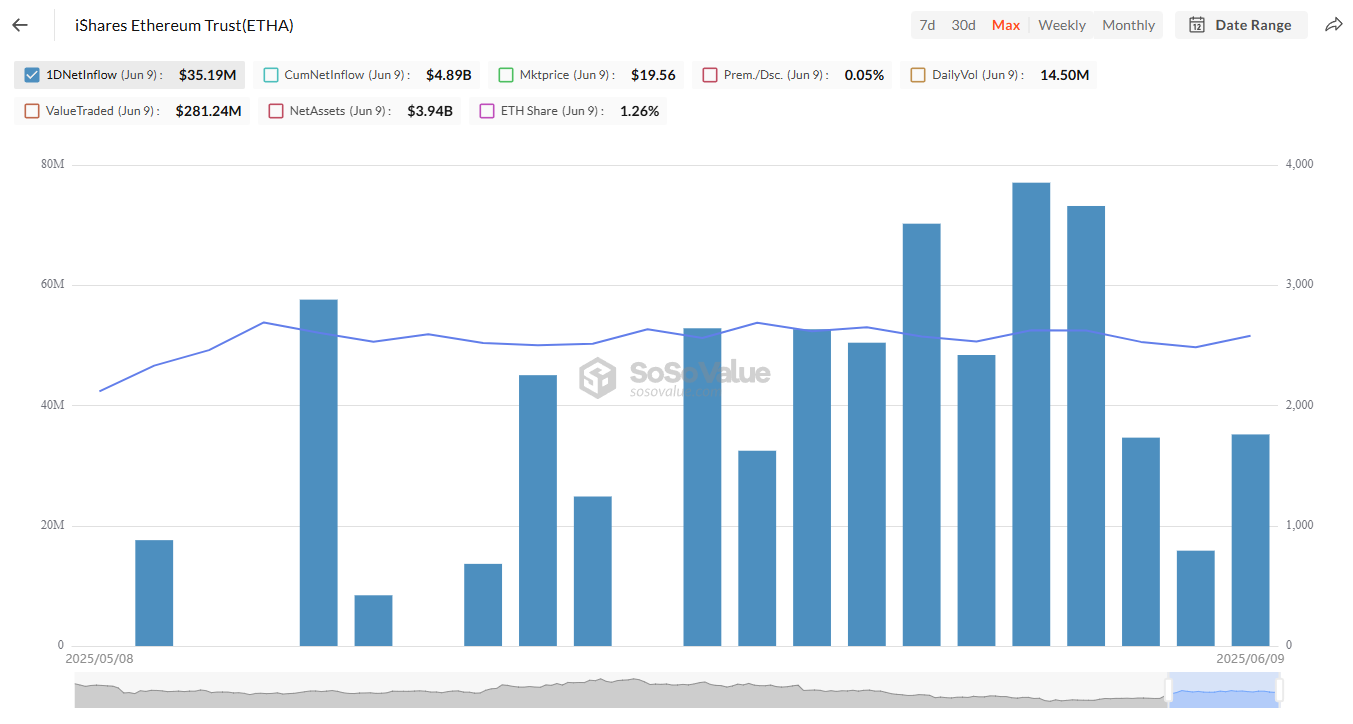

One of Axel Bitblaze's key reasons for being optimistic about ETH is BlackRock's aggressive accumulation. From May 9, 2025, BlackRock has purchased 269,000 ETH, amounting to approximately $673.4 million. This indicates a long-term investment strategy for ETH.

Previously, BlackRock contributed to pushing Bitcoin (BTC) prices from $76,000 to $112,000, driven by massive inflows. Now, a similar movement is occurring with ETH. Many analysts believe this is a strong signal that ETH could break through soon.

Additionally, according to BeInCrypto's latest report, ETH has set its strongest inflow record since the US election.

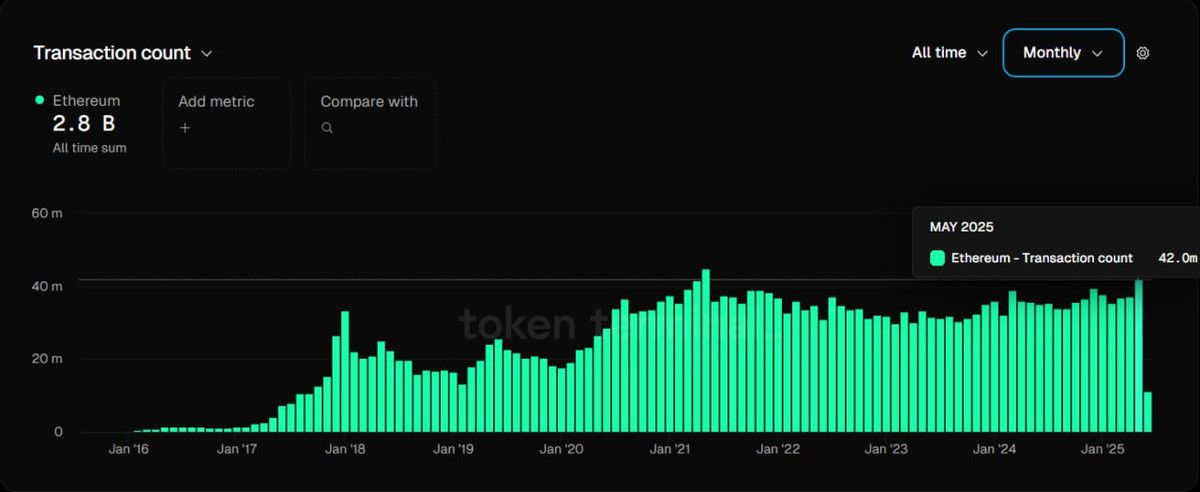

The second factor Axel Bitblaze emphasizes is the surge in Ethereum network activity. Last month, Ethereum network transactions reached 42 million, the highest since May 2021. Simultaneously, daily active addresses increased to 440,000, the highest in the past six months.

This reflects increased network usage, especially in areas like decentralized finance (DeFi) and stablecoin transactions.

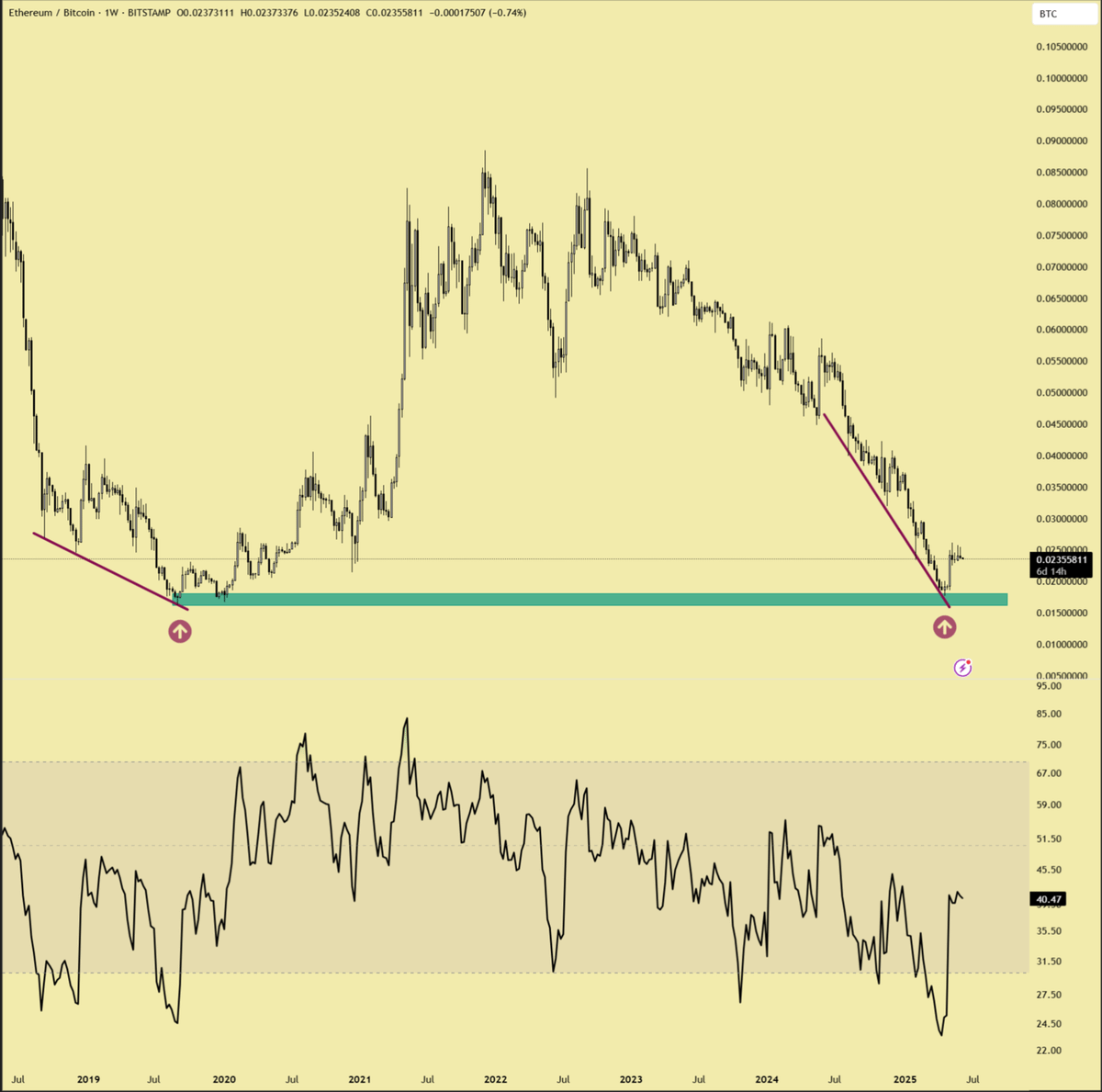

The third factor Axel pointed out is that the ETH/BTC ratio has dropped to its lowest level in six years. The weekly RSI has also hit an all-time low, suggesting ETH is currently oversold, which often indicates a potential trend reversal.

Moreover, the ETH/BTC pair has already recovered by 30% in the past month. This serves as an initial confirmation of a possible reversal.

Lastly, he highlighted institutional demand for ETH by noting that Sharplink Gaming recently raised nearly $500 million to purchase ETH.

Based on these developments, Axel Bitblaze predicts ETH could reach $9,000 by early 2026.

"ETH could trade between $6,000 and $6,500 by December 2025. The final surge will occur in Q1 2026, and ETH is likely to trade above $9,000 before the blow-off top." – Axel Bitblaze said.

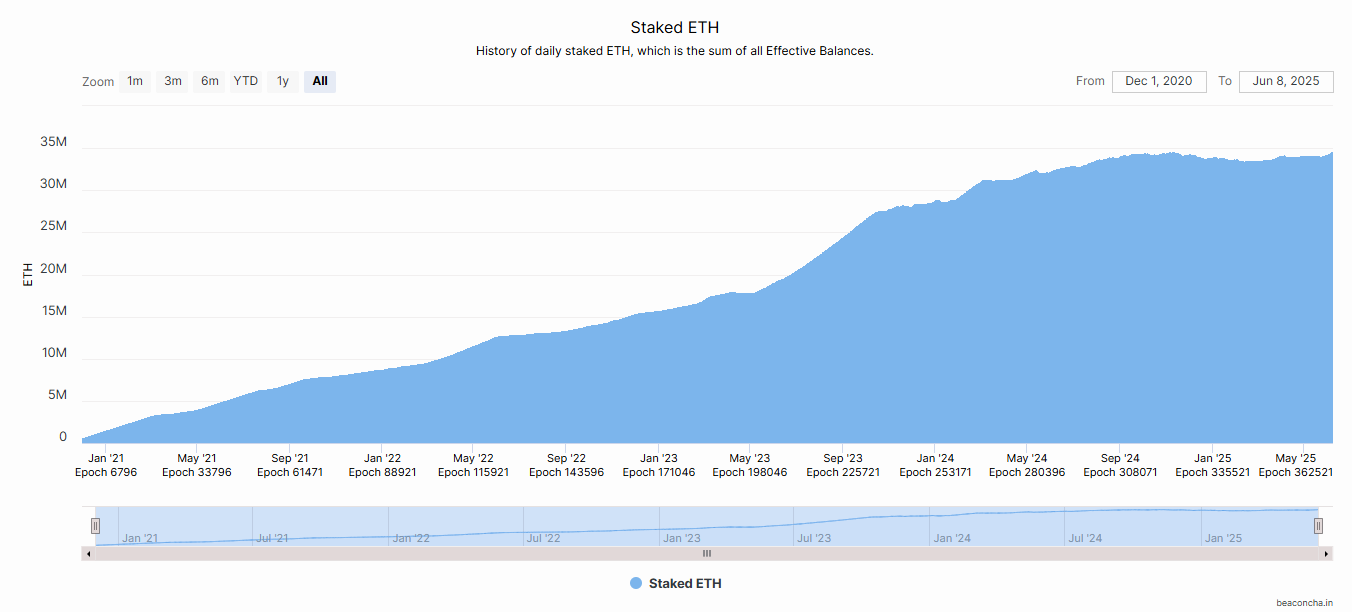

In addition to the catalysts Axel emphasized, the amount of staked ETH reached a new high in June. Currently, 4.65 million ETH is locked, representing almost 30% of the current circulating supply.

This increase in staked ETH has pushed exchange available supply to a new low in June. As supply decreases and institutional demand increases, price upward pressure is growing.

Ethereum, A Rally Like 2017?

Adding to Axel Bitblaze's analysis, veteran trader Merlijn The Trader compared Ethereum's (ETH) current price cycle to the 2017 bull market. He believes ETH is now structurally positioned for a stronger breakthrough.

"ETH is following 2017 exactly... bar by bar

2017: Recovered and broke through 50-day moving average (MA)

2025: Same setup. Same level. Same tension.The only difference?

2025 has a bigger engine, more fuel... and no brakes." – Merlijn The Trader said.

At the time of writing, ETH is trading above $2,600, having recovered more than 50% since early May. However, according to BeInCrypto's recent analysis, profit-taking has begun. This could act as a short-term resistance to ETH breaking above the weekly 50-day moving average (MA) as Merlijn predicted.