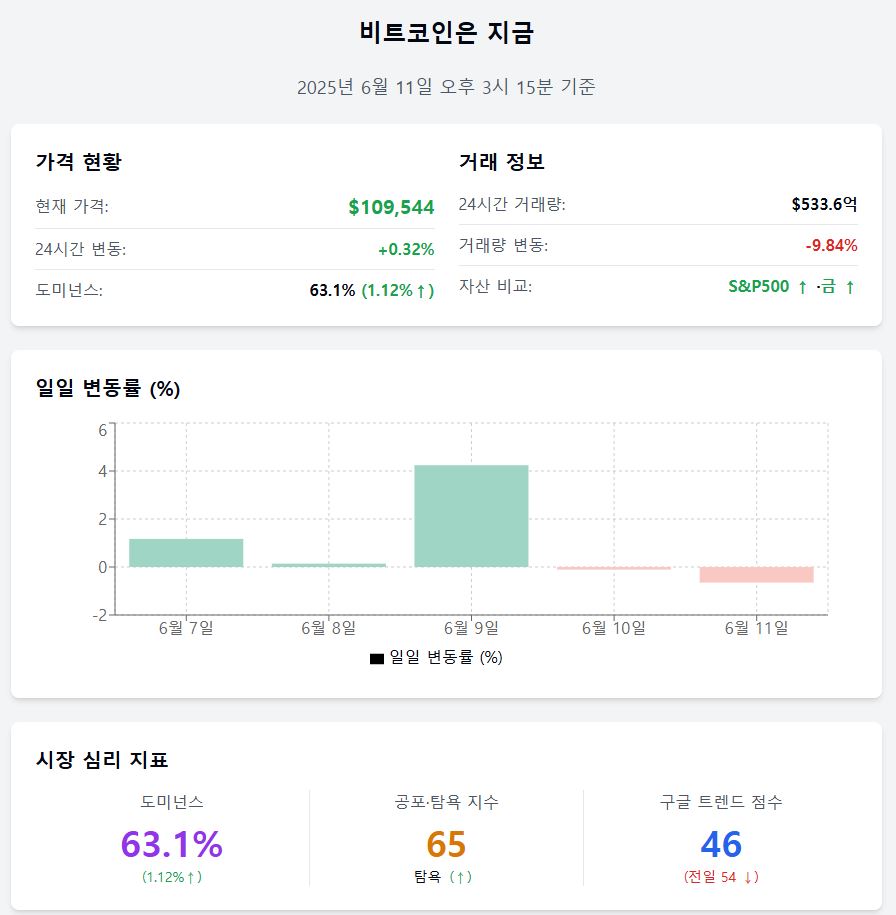

As of 3:15 PM on June 11, 2025

Bitcoin is experiencing fluctuations in the early $109,500 range, showing a limited trend after a short-term rise. While trading volume has decreased compared to the previous day, the number of active wallets has significantly increased, indicating a spreading on-chain participation trend.

📈 Price now

Price $109,543 (+0.32%) Bitcoin is trading at $109,543, up 0.32% from the previous day. Although the increase is not significant, it maintains a stable flow above the psychological support line, continuing to absorb selling pressure.

Trading volume $5.336 billion (–9.84%) Trading volume has decreased by 9.84% compared to the previous day. After a strong inflow yesterday, the trading volume has temporarily reduced, showing a somewhat slowed short-term buying momentum. Market liquidity may remain in an observational phase for the time being.

Daily fluctuation –0.65% Bitcoin has shown the following trend over the past 5 days: ▲June 7 +1.17% ▲June 8 +0.14% ▲June 9 +4.24% ▲June 10 –0.11% ▲June 11 –0.65%. After a sharp rise, profit-taking continues, repeating a limited adjustment range.

Asset comparison S&P500↑·Gold↑ The S&P500 index rose +0.55%, and gold prices increased by +0.50%, showing a stable risk preference trend along with traditional assets. Bitcoin is showing a similar directional movement.

MACD –70.98 The daily MACD is –70.98, still remaining in a weak zone but with a reduced decline compared to the previous day. In contrast, the weekly basis maintains a strong medium-term upward signal at +1463.52.

❤️ Investor sentiment now

Dominance 63.1% (+1.12%) Bitcoin dominance has risen to 63.1%, up 1.12% from the previous day. The flow of funds concentrating again on Bitcoin compared to major altcoins is strengthening.

Fear & Greed Index 65 (Greed) The Fear & Greed Index rose from 64 to 65, maintaining a 'greed' state. Compared to last week's 'neutral' (57), positive sentiment has clearly expanded.

Google Trend score 46 (–8) The Google search trend score dropped from 54 to 46. Interest has somewhat decreased after the recent surge, but still maintains a level above neutral.

🧭 Market now

SSR 18.4292 (+0.02) The Stablecoin Supply Ratio increased slightly to 18.4292. The purchasing power of stablecoins relative to Bitcoin remains low, and the supply recovery is not clear.

NUPL 0.5718 (–0.0010) NUPL has slightly decreased, showing some profit-taking. While there are still many investors in the profit zone, a somewhat more conservative movement is detected compared to before.

Exchange balance 2,503,500 BTC (+0.01%) The amount of Bitcoin held by exchanges increased slightly from the previous day. The structural outflow has temporarily stopped, reflecting some asset reallocation due to the spread of observational sentiment.

Exchange net inflow +51.78 BTC (–0.01%) The daily net inflow is about 51.78 BTC, with no significant movement, but showing a slight inflow conversion different from the previous day. This appears to reflect some profit-taking in the market.

Active wallet count 1,020,485 (+113,625) Increased by about 113,625 from the previous day, showing a trend of increasing user activity. This suggests an expanding on-chain participation, and it's worth noting the network activation rather than the price.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>