As the Bitcoin exchange reserve turns to net inflow on a daily basis, Binance's trading volume shows mixed trends across different time zones, indicating a divergence in short-term market sentiment.

According to CoinGlass as of the 11th, the total Bitcoin balance of major global exchanges is approximately 2,091,419.55 BTC.

A net inflow of 1,768.36 BTC occurred over the past day, while the past week saw a net outflow of -21,164.51 BTC, and the past month experienced a net outflow of -94,686.46 BTC.

Coinbase Pro holds 646,246 BTC, still maintaining the largest Bitcoin reserve. It saw a daily net inflow of +1,203.14 BTC, but continues the long-term outflow trend with a weekly -8,925.50 BTC and monthly -40,958.28 BTC net outflow.

Binance currently holds 549,692 BTC and experienced a daily net outflow of -1,074.42 BTC. While the weekly net outflow continued at -10,039.21 BTC, a monthly net inflow of +9,144.90 BTC was observed.

Bitfinex holds 376,435 BTC and saw a daily net inflow of +2,030.66 BTC. The weekly trend showed a net inflow of +7,127.08 BTC, but reversed to a monthly net outflow of -22,402.37 BTC.

Largest Daily Net Inflow ▲Bitfinex (+2,030 BTC) ▲Coinbase Pro (+1,203 BTC) ▲Gate (+723 BTC)

Largest Daily Net Outflow ▲Binance (-1,074 BTC) ▲Kraken (-860 BTC) ▲OKX (-343 BTC)

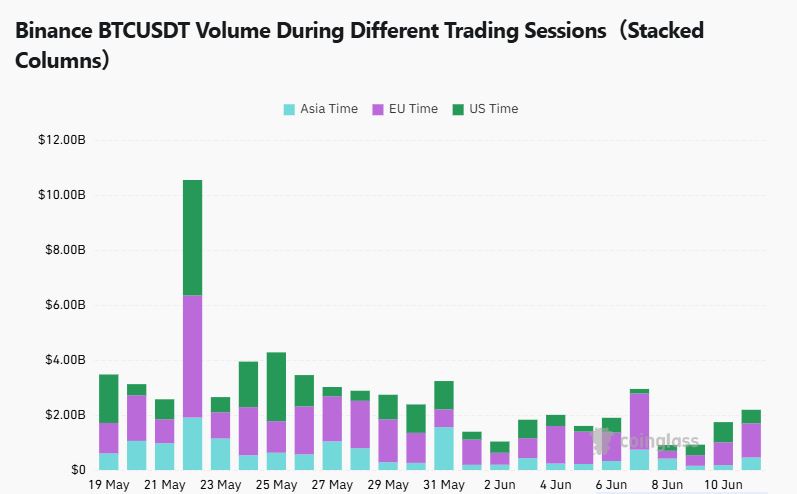

According to CoinGlass, Binance BTCUSDT trading volume on June 10th was $456.86 million in the Asian time zone, $1.24 billion in the European time zone, and $492.44 million in the US time zone.

Compared to the previous day (June 9th), Asian (+159.9%) and European (+48.9%) volumes increased significantly, while US volumes (-32.8%) sharply declined. The Asian market, in particular, led the short-term liquidity recovery with a nearly threefold rebound.

The European market continues to maintain an inflow trend, raising expectations for an upward shift. In contrast, the US time zone saw a significant reduction in trading, expanding a stance of profit-taking and wait-and-see.

Get news in real-time... Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>