Bitcoin spot ETF showed strong demand yesterday, with total net inflows exceeding $350 million. This occurred after BTC broke through the $105,000 resistance level and closed above $110,000.

With strong upward pressure, major coins are ready to continue their rally, which further stimulates demand for ETF products.

BTC ETF, $386 million inflow…Investor confidence restored

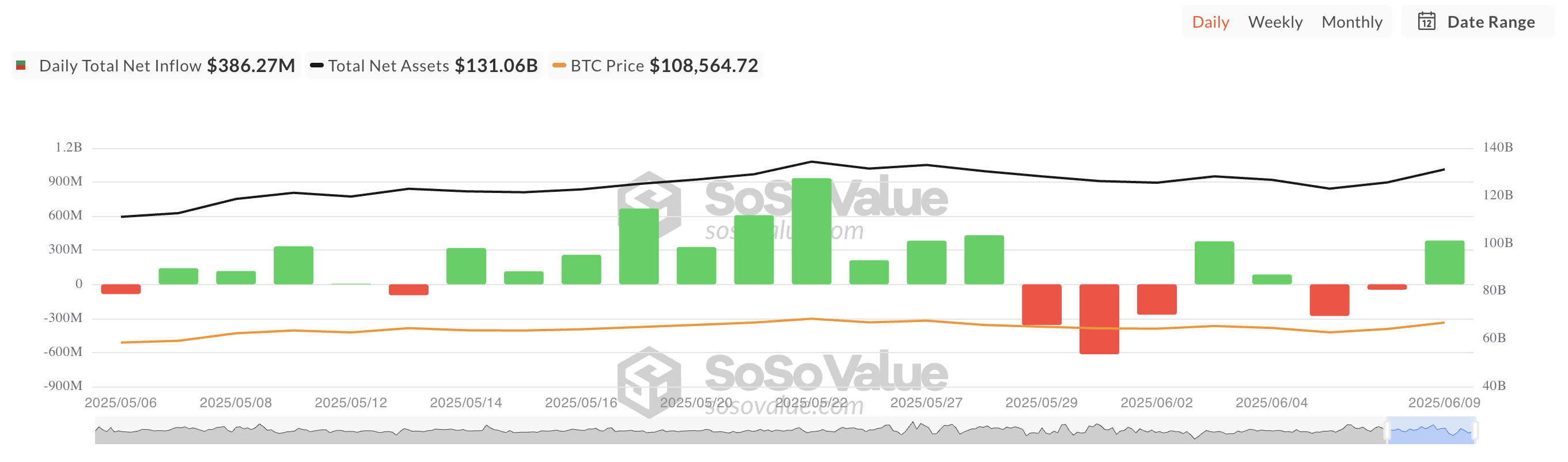

On Monday, the BTC spot ETF recorded net inflows of $386.27 million. This capital inflow indicated a significant change in market sentiment following last week's decline.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

These inflows reversed the previous week's net outflow trend. BTC's poor performance and decreased investor confidence had previously dampened demand. This surge occurred after BTC broke through the $105,000 resistance level, with the asset closing at $110,263 in yesterday's trading session.

As a result, new optimism spread across the market, driving active trading in ETF transactions. On Monday, Fidelity's CBOE-listed FBTC fund recorded the largest single-day net inflow among all US BTC ETF issuers.

BTC futures options strong…Price exceeds $109,000

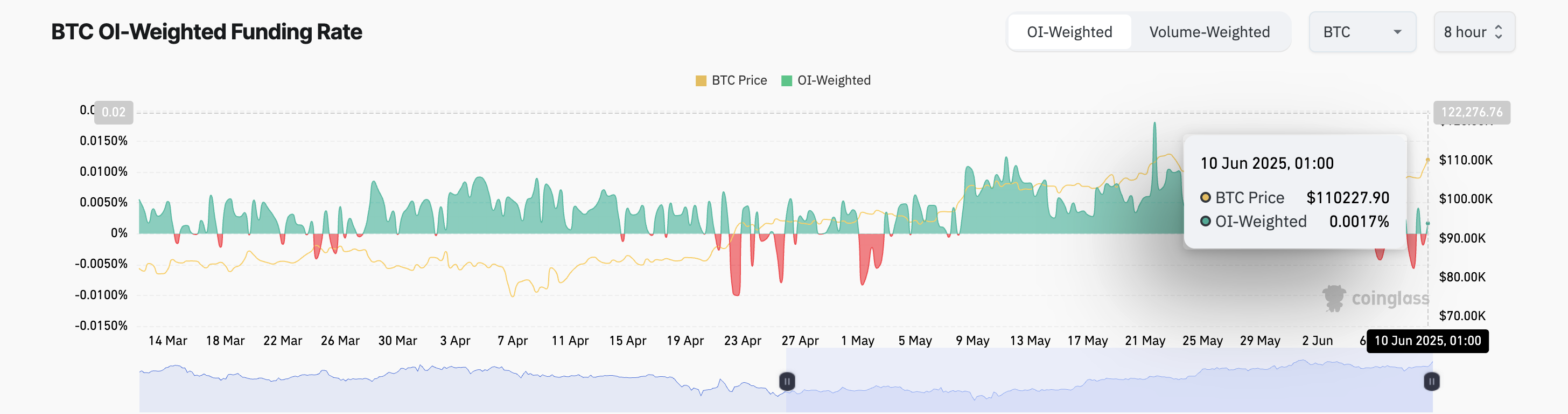

BTC is currently trading at $110,227, having risen 4% over the past day. The coin's funding rate has returned to a positive area in the derivatives market, indicating a shift to bullish market positioning. It is currently 0.0017%.

The funding rate is a periodic payment exchanged between traders in perpetual futures contracts, used to align the price with the spot market.

When the value is positive, it indicates bullish sentiment and high demand for long positions. This means traders holding long BTC positions are paying those with short positions, which can increase the coin's value in the short term.

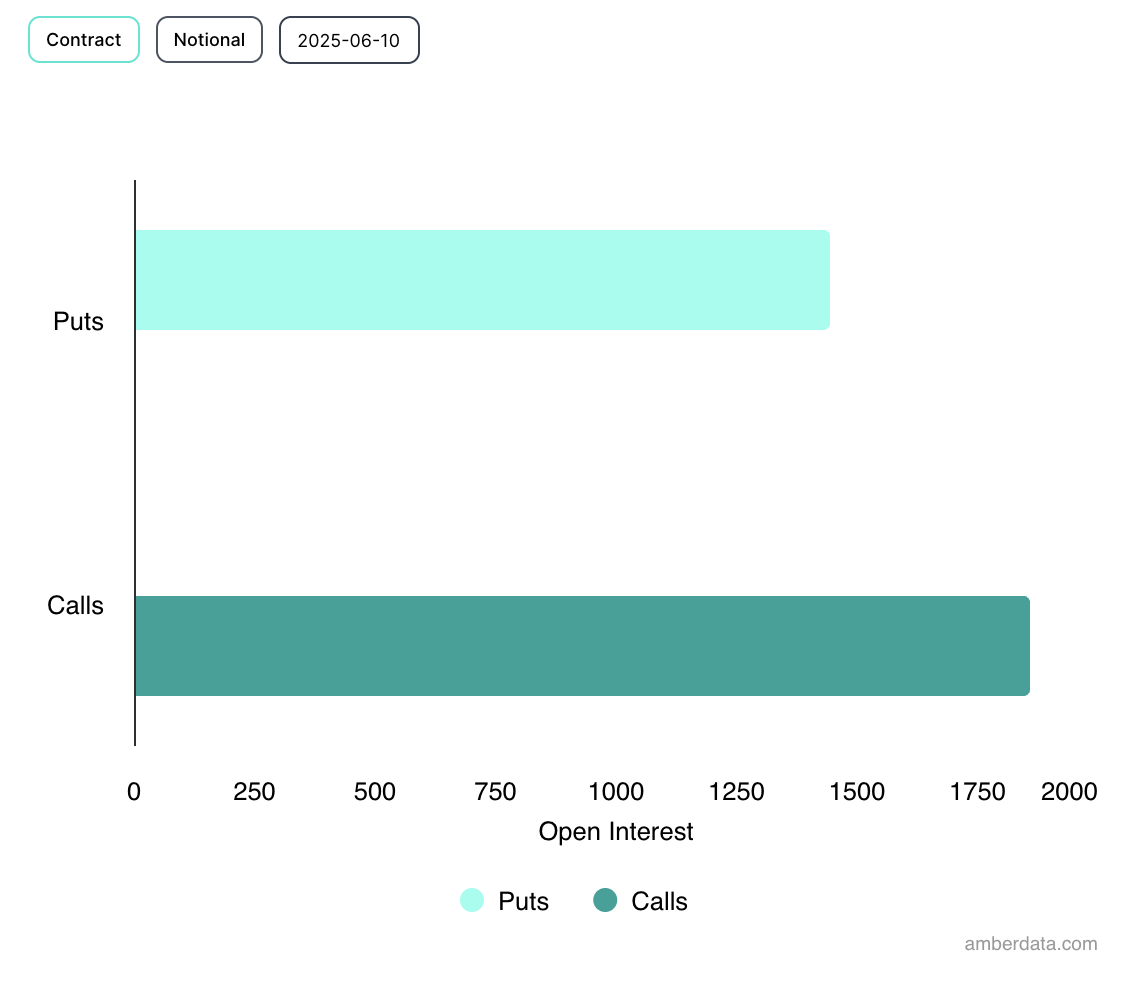

Additionally, traders are buying BTC call options today, indicating bullish sentiment about the asset's future price.

Therefore, the combination of institutional inflows, price momentum, and positive sentiment recovery in derivatives suggests the market may be entering a new accumulation phase.