Welcome to the US Cryptocurrency Morning News Briefing. Here's a brief summary of today's key cryptocurrency developments.

Prepare your coffee to gain insights into the BTC price outlook. The pioneering cryptocurrency is steadily approaching its all-time high (ATH) recorded on May 22, 2025. Will Bitcoin soon set a new ATH? Continue reading for more insights.

Today's Cryptocurrency News... US Investors Towards New BTC ATH

Bitcoin price is attempting to retest the ATH of $111,980. BeInCrypto reported that BTC's recent surge stems from US-China trade negotiations and reconciliation between Donald Trump and Elon Musk.

"BTC led a pleasant overnight surge, rising from 107,000 to over 110,000 dollars. This began with the resumption of US-China trade negotiations in London. Initially driven by optimism from headlines of progress, the market's enthusiasm quickly cooled." – Written by QCP analysts.

Against this backdrop, investor sentiment has shifted from fear to greed. Traders are interpreting two developments as stabilizing factors within broader volatility.

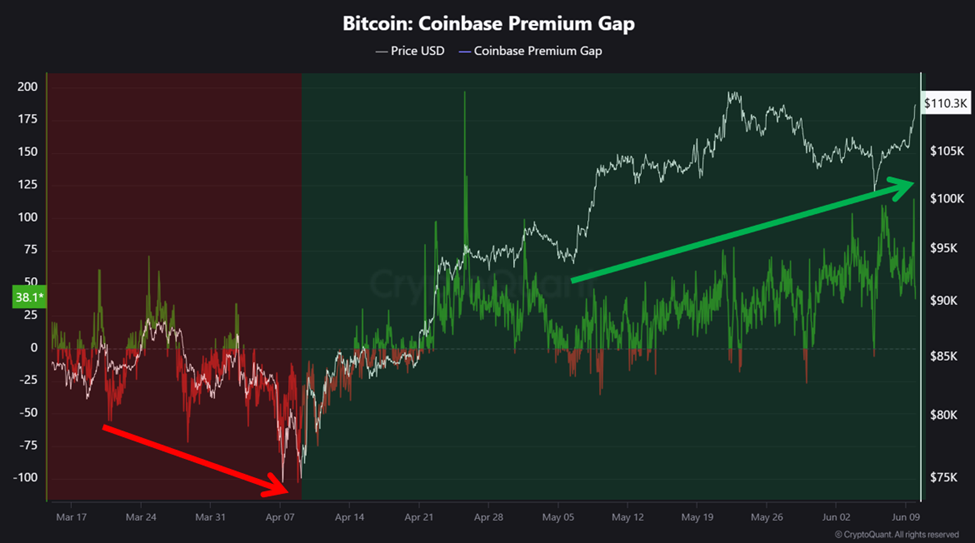

However, amid increasing greed and optimism, on-chain analyst and Cryptoquant Korea Community Manager Crypto Dan emphasizes the role of US investors driving Bitcoin price increases.

Specifically, Crypto Dan notes that the Coinbase premium is rising and whale buying activity is gradually being observed.

"Particularly, the Coinbase premium is gradually increasing, indicating US investors' buying pressure supporting the trend. Additionally, whale buying activity is being gradually observed. Positive movements without overheating signs are typical patterns in upward cycles after corrections, suggesting an optimistic cryptocurrency market movement in the second half of 2025." – Written by the analyst.

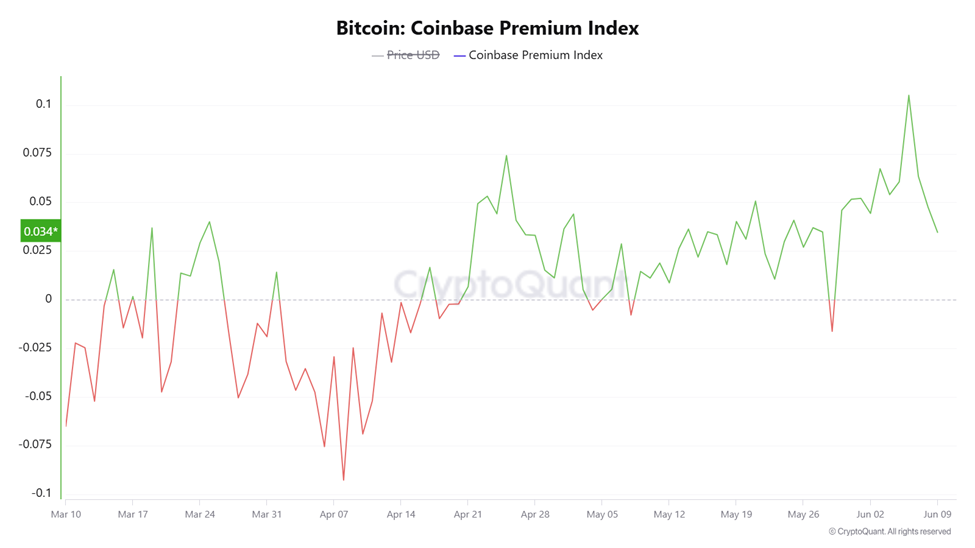

The Bitcoin Coinbase premium index measures the price difference of coins between Coinbase and Binance. When its value increases above 0, it suggests significant buying activity from US-based investors on Coinbase.

Conversely, if the value decreases and falls into negative territory, it indicates reduced trading activity on the US-based exchange.

Notably, a positive Coinbase premium index is a bullish signal for BTC price, meaning US-based investors' demand is strong, causing higher trading prices on Coinbase.

This increased buying pressure from US institutions and retail traders often drives BTC price upward and pushes the market higher.

Bitcoin Quietly Building Strength Near ATH... Upside Potential

Positive developments in US-China trade negotiations and Musk-Trump reconciliation appear to have reignited buying pressure among US investors, who have quickly resumed Bitcoin accumulation.

"Bitcoin is quietly building strength near its ATH. More upside potential is visible. Bitcoin price continues its steady trend. Currently, Bitcoin price is approaching its all-time high, and it would not be surprising if it sets a new high at any moment." – Another analyst, pseudonymous Cryptoquant analyst Avocado_Onchain posted on X.

The analyst notes that this upward trend is unfolding in a relatively calm market atmosphere compared to previous new high breakthroughs.

Besides the continuous increase in Coinbase premium, the Kimchi premium (Korean premium index) remains low. This suggests more room for growth as the market is not "overheated".

Crypto Dan and Avocado's analysis aligns with BeInCrypto's recent US cryptocurrency news. BeInCrypto cited Marcus Tillen in their latest 10X research, emphasizing that a Bitcoin price breakout may be imminent.

However, according to BeInCrypto, the upside potential depends on BTC overcoming the supply zone between $109,242 and $111,774.

Traders looking to take a long position on the leading cryptocurrency should consider waiting for a candlestick close above $110,478, the midline of the supply block.

If this supply zone remains a resistance order block, Bitcoin could decline. However, the bullish logic is only invalidated in a downward direction when the candlestick closes below $102,239.

Breaking this support level would indicate a lower BTC low, suggesting a trend reversal.

Today's Chart

This chart shows that the Bitcoin Coinbase Premium Index is currently located at 0.034.

Today's Key News

Summary of today's notable US cryptocurrency news:

- Bitcoin rose nearly 4% to reach $109,275 due to easing tensions in US-China trade negotiations and between Trump and Musk.

- Plasma's ICO raised $500 million from 1,111 participants, but some whales dominated the allocation, raising fairness concerns.

- SEC reviews DeFi rules to encourage innovation and investor protection. The guidance clarifies mining and staking activities under securities law, but legal cases impact regulatory clarity for decentralized finance.

- Bitcoin ETFs recorded $386 million in inflows as BTC surpasses $105,000, closing at $110,263.

- FARTCOIN price led today's cryptocurrency rally, rising nearly 20% amid high interest in Coinbase listing.

- Public companies like Oblong and Synaptogenix are investing millions in Bittensor (TAO), citing fixed supply and AI utility.

- Polkadot's native token DOT is seeing increased demand as the ETF decision approaches on June 11, generating optimism among traders.

- Bitcoin is approaching the $110,000 resistance, but rising CPI and "greed" zone market sentiment could trigger a price correction.

- Bitcoin Core v30 will increase the OP_RETURN limit from 80 bytes to 4MB, sparking debate about Bitcoin's scalability and decentralization.

- An analyst highlights four reasons why Ethereum is on the verge of a breakout. One is that BlackRock has purchased over $600 million in ETH with no sales, indicating a long-term bullish intent similar to BTC's historical rally.

Pre-Market Stock Overview

| Company | Closing on June 9 | Pre-Market Overview |

| Strategy (MSTR) | $392.12 | $395.39 (+0.83%) |

| Coinbase Global (COIN) | $256.63 | $259.47 (+1.11%) |

| Galaxy Digital Holdings (GLXY.TO) | $20.93 | $21.25 (+1.53%) |

| MARA Holdings (MARA) | $16.27 | $16.26 (-0.069%) |

| Riot Platforms (RIOT) | $10.12 | $10.23 (+1.09%) |

| Core Scientific (CORZ) | $12.71 | $13.15 (+3.46%) |